As an investor or cryptocurrency enthusiast, you might often ask, “What is the current market price of Bitcoin?” Understanding Bitcoin’s price is crucial for making informed decisions and grasping market trends. Bitcoin, the pioneering cryptocurrency, plays a significant role in the digital financial ecosystem and often influences other assets and markets.

What is the current market price of Bitcoin?

As of August 20, 2024, at 8:35 p.m., the price of Bitcoin (BTC) stands at $61,102.09. The cryptocurrency has experienced a 4.36% increase in the past 24 hours, with a trading volume of $27.17 billion during this period. Bitcoin currently has a circulating supply of 19.74 million and a market capitalization of $1.21 trillion.

Bitcoin is the world’s first decentralized cryptocurrency, utilizing public-key cryptography to record, sign, and transmit transactions over its blockchain, all without the oversight of a central authority.

Launched in January 2009 by an anonymous individual or group under the pseudonym “Satoshi Nakamoto,” the Bitcoin network operates as a peer-to-peer electronic payment system. It uses the cryptocurrency bitcoin (with a lowercase “b”) to transfer value online or as a store of value, akin to gold and silver.

Bitcoin’s Price Journey and Milestones

Bitcoin’s price is infamous for its volatility, yet it has outperformed every other asset class—including stocks, commodities, and bonds—over the past decade, with an extraordinary rise of 9,000,000% from 2010 to 2020.

When Bitcoin was introduced in early 2009, Satoshi Nakamoto mined the first block, known as the genesis block, which released 50 BTC into circulation at a price of $0.00. Initially, 50 BTC were issued every block (created approximately every 10 minutes) until the first halving event in November 2012. This halving mechanism, programmed into Bitcoin’s code by Nakamoto, reduces the issuance of new BTC by 50% every 210,000 blocks.

In February 2011, Bitcoin’s price matched the U.S. dollar for the first time, sparking interest from new investors and causing the price to peak above $30 within four months. By early 2013, Bitcoin briefly surged above $1,000 but faced setbacks due to events like the Mt. Gox hack and China’s first crypto ban. It took another four years for Bitcoin to surpass $1,000 consistently. The cryptocurrency then experienced a meteoric rise throughout 2017, reaching a previous all-time high of $19,850.

In 2018, Bitcoin and the broader crypto market entered a prolonged bear phase, termed the “crypto winter.” It wasn’t until December 2020 that Bitcoin retested and exceeded its previous all-time high, eventually climbing an additional 239% over the next 119 days to reach a new peak of $64,799.

Who Created Bitcoin?

Bitcoin was introduced by an enigmatic figure known as “Satoshi Nakamoto.” In 2008, Nakamoto published a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” which laid the groundwork for this groundbreaking digital currency. Satoshi envisioned Bitcoin as a decentralized, peer-to-peer network designed to enable transactions without relying on central authorities like banks or governments. The key innovation was a proof-of-work consensus mechanism integrated into a blockchain structure, addressing the double-spending problem and ensuring transaction security.

In January 2009, Nakamoto activated the Bitcoin network by mining the first block, known as the “genesis block.” Despite the profound impact of Bitcoin on the financial world, the true identity of Satoshi Nakamoto remains unknown, embodying the privacy and decentralization principles at the core of the cryptocurrency movement.

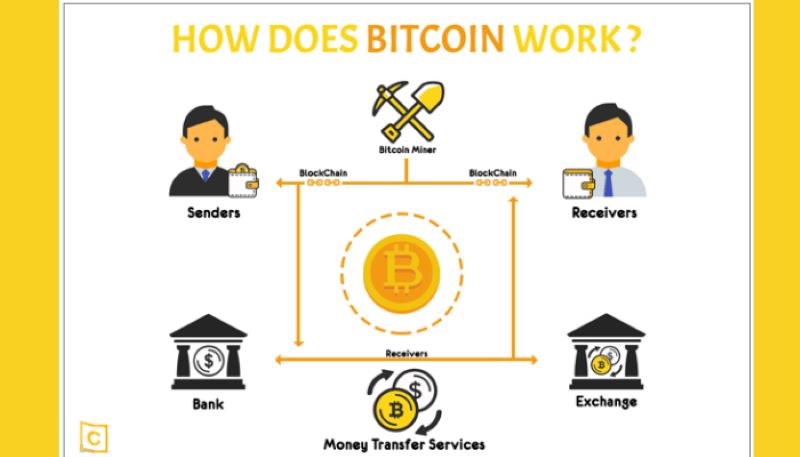

How Does Bitcoin Work?

Bitcoin operates in a way that’s comparable to how email functions for communication—it’s a digital currency without a physical form, and transactions are conducted directly between users without needing traditional banks. Instead, everything happens on a transparent and unchangeable ledger called the blockchain.

1. Transactions and Fees

- Bitcoin transactions are verified by a network of users called miners.

- To encourage miners to validate transactions, each transaction includes a fee. This fee is given to the miner who successfully adds the transaction to a new block on the blockchain.

- Transactions with higher fees are prioritized, as miners are more likely to process them first.

2. Mining and Block Rewards

- Every Bitcoin transaction must be permanently recorded on the blockchain through a process called “mining.”

- Mining involves solving complex mathematical problems with specialized equipment called ASIC (Application-Specific Integrated Circuit) chips.

- This process is known as the proof-of-work system. It ensures that miners use significant computational power and energy to maintain network security and prevent malicious attacks.

3. Earning Bitcoin

- The miner who solves the problem and unlocks a new block is rewarded with a set amount of Bitcoin, known as “block rewards.” They also earn any transaction fees included in that block.

- A new block is added approximately every 10 minutes.

4. Halving and Supply Control

- Bitcoin’s block rewards decrease over time through a process called “halving.” Every 210,000 blocks, or roughly every four years, the reward for mining a new block is halved.

- As of 2021, miners receive 6.25 bitcoins per block. The next halving, expected in 2024, will reduce this reward to 3.125 bitcoins per block.

- This reduction in new Bitcoin supply makes each Bitcoin more valuable over time, especially if demand remains high.

Assessing Bitcoin’s Energy Usage

Bitcoin’s energy consumption is a critical aspect of its operation, reflecting the network’s need for security through computational power. As of 2021, the Bitcoin network uses approximately 93 terawatt-hours (TWh) of electricity annually, comparable to the energy usage of the 34th-largest country globally.

This significant electricity demand has attracted criticism from high-profile figures like Tesla CEO Elon Musk and government entities, including China’s State Council and the U.S. Senate, who are concerned about Bitcoin’s environmental impact. Despite these concerns, Bitcoin mining represents only about 1.29% of a single country’s total energy consumption.

Furthermore, Bitcoin’s energy footprint is more transparent compared to the traditional financial system, which is harder to measure due to its reliance on a variety of physical infrastructure like ATMs, bank branches, and security systems.

Efforts to mitigate Bitcoin’s environmental impact include initiatives like the Crypto Climate Accord and the Bitcoin Mining Council, which promote the use of renewable energy sources among miners. These initiatives aim to reduce Bitcoin’s carbon footprint while maintaining its security and functionality.

The current market price of Bitcoin offers a snapshot of its dynamic value. To stay ahead of market trends and make informed decisions, visit Crypto Currency Bitcoin Price for real-time updates and expert analyses.