Stacking in crypto isn’t just a buzzword, it’s your ticket to earning money while you sleep. Think of it like planting a money seed and watching it grow without lifting a finger. You’re here because you’ve heard the whisper of crypto wealth, and now you want in on the secret. Our journey together will start at the very beginning, peeling back the layers of what is stacking in crypto. From getting to grips with the tech behind it to crafting a strategy that fits your goals, I’ll give you the insider tips to make your crypto work for you. So, buckle up! It’s time to turn those digital coins into a steady stream of income.

Understanding the Fundamentals of Crypto Staking

What is Proof of Stake?

Proof of Stake, or PoS, is a way blockchain networks stay safe. It’s different from Proof of Work (PoW), which Bitcoin uses. In PoS, you can get rewards for holding coins and supporting the network. It’s like earning interest in a bank.

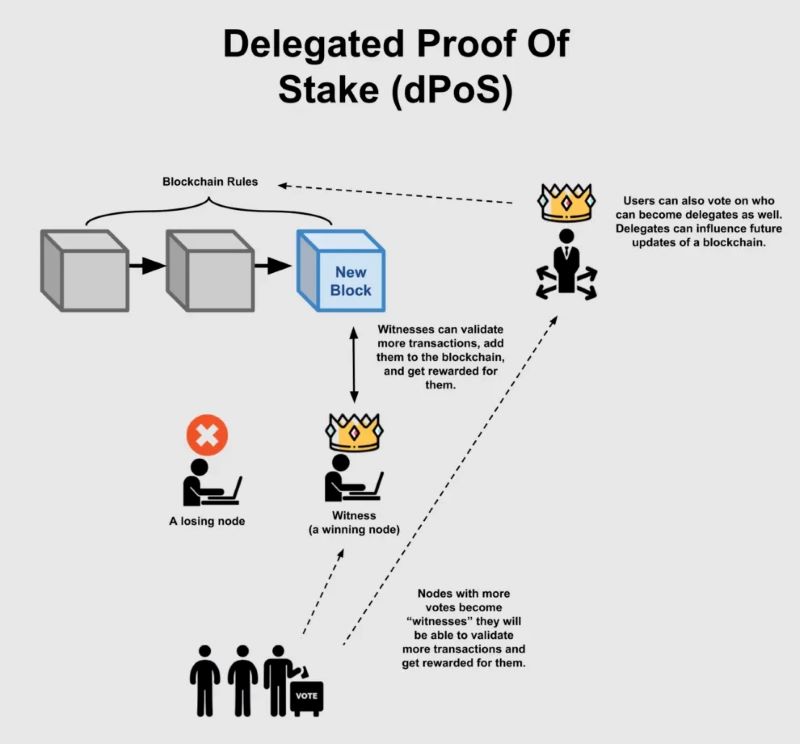

Validators are chosen to create new blocks and validate transactions. They’re picked based on the amount of coins they hold and are willing to “stake” or lock up as security. They get staking rewards in return. This method uses less energy than PoW and offers staking benefits like rewards just for holding your coins.

The Role of Validator Nodes and Staking Process

Validator nodes are key to cryptocurrency staking. They are like the guardians of the blockchain. To be a validator, you must hold a certain amount of coins. This is your stake in the game. You put these coins into a staking wallet to show you’re serious. If you act badly, like approving bad transactions, you could lose some of your stake. This is called slashing.

The staking process starts when you join a staking pool or offer your coins directly to the blockchain. Staking pools are groups where coin holders combine their stakes. This increases their chances to be chosen as validators and earn rewards. It’s a bit like joining a lottery pool to improve the chance of winning.

When staking, you must know the staking requirements. These include how many coins you need and how long you must lock them up. The locking period can vary, but it means you can’t sell your coins during that time. After the time is up, you get back your stake plus any rewards you earned. The rewards can be more coins or a cut of network fees.

Staking in blockchain offers passive income through crypto. Passive income is money you make without working for it every day. Staking rewards are like getting a paycheck just for being part of the process. But remember, there are staking risks, too. Coin values can change fast, and there’s the risk of slashing.

To sum it up, staking in crypto is a way to earn by participating. You pledge coins to help keep the network secure. You become part of the team that checks and approves transactions. If you do your part well, you earn rewards. Always think carefully about where and how much you want to stake. Whether you are using staking pools or going alone, knowing the rules and risks is key.

Stay tuned for tips on optimizing your staking, understanding technical details, and advanced strategies as we dive deeper into the world of crypto staking in further sections.

Optimizing Your Staking Strategy for Maximum Returns

Selecting the Right Staking Pools and Platforms

Let’s dive right in! In crypto, think of staking like the way you earn interest in a bank, but it’s more cool. Here’s the deal: you lock up your coins, and in return, you get more coins back as rewards. The place where you do this? That’s a staking pool.

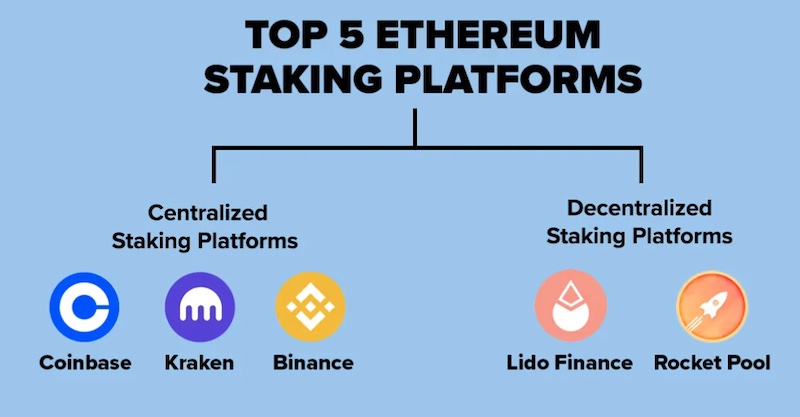

Choosing the right pool matters a lot. Look for a platform with a strong track record and good security. This means less chance of your coins being lost or stolen. More people in a pool can mean smaller rewards for you, because you have to share with everyone. Yet, if only a few people are in the pool, this might feel risky. A bigger pool has more power on the network and can be more reliable.

You want a platform that’s easy to use. Nothing is a buzzkill like a hard-to-use website when you’re trying to stake your coins. It should show you everything. Like, what rewards you can expect and how long you need to lock up your coins.

Balancing Risks and Rewards in Staking

Now, let’s talk about balancing risks and rewards. Blew too much on a fancy dinner last night? We’ve all been there. With staking, you don’t want to take risks like that. Not all coins are good for staking. Some might go down in value or have big problems. You want to pick coins that have a good shot at staying strong.

The next thing is the amount you stake. Don’t put all your money in one place. Spread it out. This means if one staking option goes bad, you’re not losing everything.

Then, you need to think about how long you can go without that money. Some staking options ask you to lock up your coins for a while. This can be days, months, or longer. Can you do without it for that long? Make sure before you lock it away.

What about the APY? That’s how much you earn in a year from staking. Higher APY might mean higher risk. Don’t just jump at the biggest number. Take the time to understand why the APY is what it is.

One last tip: always keep up with changes. In crypto, things move fast. A great staking option today might not be so great tomorrow. So, keep your eyes open and don’t be afraid to move your stake if you need to.

There you have it. Pick the right staking pool, don’t risk too much, and stay sharp about changes. Do this, and you could be well on your way to making your coins work for you. Staking in crypto is real, and done right, it’s a powerful way to grow your crypto pile, right from your couch.

Navigating the Technical Aspects of Staking

The Impact of Staking Duration and Locking Periods

Let me take you into the nuts and bolts of staking. At the heart of it lies the staking duration. This is simply how long your coins must be staked to earn rewards. Think of it like planting a seed. You plant it, and with time, it grows into a fruit-bearing tree. In crypto staking, the longer you “plant” your coins, the bigger the “fruit” you may get. This is often called “compound interest” in the crypto world.

One key term you must know is locking periods. Locking periods are times when your staked coins are held tight. You can’t move them or sell them. It’s a bit like having your money in a time-locked safe. These periods can be a few days to several years. Shorter periods mean you can get your coins back faster. But longer periods could make for bigger rewards. It’s a trade-off, something like choosing between getting a small toy today or a bike next month.

Now, about choosing how long to stake. Short-term staking is good if you want to get your coins back quick. Long-term staking is like a “set it and forget it” cooker. You set your coins to stake and come back later, maybe to a nice reward. But here’s the catch: crypto markets can be wild. Prices swing up and down. A long lock-up might mean missing out on a chance to sell high.

Validator Responsibilities and Slashing Consequences

As a staker, you can join forces in what we call a validator node. That’s like being part of a team where your coins help make big decisions on the network. Your coins give the node power – power to vote on important things like which transactions are good and should be added to the blockchain.

But there’s a weight on these validator shoulders. They must be online and working right. If they fail, miss a vote, or act shady, they get punished. This punishment is called slashing. Think of slashing like being fined for showing up late to a game. In crypto, this means losing some of your staked coins. It’s not fun.

So if you’re helping out a validator, pick a reliable one. A good validator is up and running well, with a clear record, kind of like a star player in sports. A bad one could lose you coins, like an unreliable friend who loses your favorite toys.

It’s all about balance. Weigh how long to lock up coins against the chance to use them. Decide if helping a validator is worth the risk of being slashed. Know these things, and you’ll navigate the staking seas like a pro. Staking has its twists and turns, like a game board with rewards and pitfalls. Play it smart, and you might just sail to victory – or at least snag a little extra crypto cash.

Advanced Staking Techniques for Seasoned Investors

Yield Generation and Annual Percentage Yield (APY) Insights

Ever wondered how some folks seem to make money while they sleep? It’s all about making smart moves with your digital coins, and one trick is cryptocurrency staking. It’s a bit like earning interest from a bank but way cooler and often with higher returns. You lock up your coins, help out the network, and boom, you earn more coins as a thank you, known as staking rewards. It’s that thing they call passive income through crypto, and who doesn’t like earning without the grind?

In proof of stake, the more you stake, the more you might earn. Annual Percentage Yield, or APY, shows how much you can make in a year. Looking for a steady income from your crypto? High APYs could be your best friend. But remember, high rewards often mean high risk. You should always weigh staking risks and not jump in just for flashy APY numbers. Smart, right?

Delegation Services and Secure Crypto Staking Practices

Now, let’s get down to brass tacks. Not everyone has the time or tech to run a validator node. That’s where delegation services come in. You lend your coins to someone who can do the heavy lifting. They keep the blockchain safe and sound, and you share in the staking returns. Win-win!

But here’s the catch: you need to pick someone reliable to hold your precious coins. Secure staking practices are no joke. You’re trusting someone with your cash, so make sure they’re the good guys. Look for a rep for running things smoothly and putting security first.

A quick tip: mix it up with different staking pools to spread out your risk. Don’t put all your eggs in one basket. And always check out the fine print. How long do your coins get locked up? Are there any penalties if you bail early? Real talk: it’s crucial to know what you’re signing up for.

Also, remember network participation reward and staking conditions. By playing a part in the network, you’re backing up the whole system. You’re part of something bigger, and that comes with perks.

Last thing – if your delegate messes up, there’s a thing called slashing in staking. It means you could lose some of your stake as a penalty. Harsh but fair – it keeps folks in line. So pick your delegation service like you’d pick a babysitter for your prized goldfish. Got it?

There you have it, my savvy friends. Take this wisdom and use it to boost your crypto game. Go earn that passive income like a pro. And remember, in the world of staking, knowledge is the sharpest tool you’ll have.

Keep those coins working for you, and who knows? You might just get a slice of that sweet crypto pie without breaking a sweat.

We’ve just explored what crypto staking is, including the key role of proof of stake and validator nodes. Remember, it’s about taking part in network security and earning rewards. To get the most out of staking, picking the right pools and platforms is crucial, as is balancing the potential gains with the risks involved.

Technical details matter too. The length of time you stake and the locking periods can affect your returns. And as a validator, you must stay alert to avoid penalties. For those who’ve been staking for a while, knowing advanced tactics is vital. We’ve looked at how to understand yield and the importance of secure practices.

Remember, staking is more than just earning extra coins; it’s about supporting the networks you believe in. Be smart, weigh your options, and stake with care. Let’s help secure these networks and grow our investments wisely. Happy staking!

Q&A :

What Does Stacking Mean in Cryptocurrency?

Stacking in the realm of cryptocurrency refers to the process of holding, or “stacking,” digital assets as a part of a consensus mechanism known as Proof of Stake (PoS). Participants can lock up their coins as a way of actively participating in blockchain validation. In return, they earn rewards, usually in the form of additional coins or transaction fees, similar to earning interest on a savings account.

How Do You Stack Crypto?

To stack crypto, you typically need to own a PoS-compatible cryptocurrency and a compatible wallet. Users must choose the amount they wish to stack and then lock it up in the wallet for a certain period. This contributes to the network’s security and, in turn, stackers are often rewarded with additional coins, increasing their holdings over time.

Are There Risks to Stacking in Cryptocurrency?

Like any investment, stacking in cryptocurrency comes with its own set of risks. The value of the stacked cryptocurrency can be volatile, and there’s the potential of losing funds if the price drops significantly. Moreover, coins are locked for a certain period during which you cannot sell them, which might lead to opportunity costs if the market moves favorably and you’re unable to capitalize on it.

Can Stacking Crypto Generate Passive Income?

Yes, stacking can generate passive income. By holding and locking your cryptocurrencies to support a blockchain network, you can earn rewards. The rate of return depends on the cryptocurrency’s protocol and the amount stacked. However, it’s important to remember that crypto markets are highly volatile; therefore, the income from stacking can fluctuate substantially.

What is the Difference Between Staking and Stacking Crypto?

The terms “staking” and “stacking” are often used interchangeably in the crypto community, but there can be subtle differences. Staking usually refers to the action of holding coins in a wallet to support the operations of a blockchain network, whereas stacking might sometimes refer to the simple accumulation of cryptos without any specific participation in network validation. However, the precise meaning can vary depending on the context and community usage.