Imagine a world where money moves like email. What if I told you that’s not just a dream? It’s the purpose behind what is inter-ledger protocol, a revolutionary tech designed to connect different payment networks. This could be the dawn of hassle-free money transfers. We’re on the brink of seamless payments, and ILP is leading the charge. Gone are the days of waiting for transactions. Stick with me, and let’s dive right into how this game-changing protocol could redefine the financial landscape.

Unpacking the Interledger Protocol: A Primer for Seamless Payments

Demystifying ILP: Core Concepts and Functions

Have you ever asked, “What is this Interledger Protocol, or ILP?” You’re not alone! To put it simply, ILP is a way to send money across different kinds of systems. Think of it like an interpreter who speaks many languages, helping everyone to understand each other. It links banks, digital wallets and crypto, so money moves smoothly from one place to another.

ILP makes sure that all these different systems can talk to each other. No matter if it’s dollars, euros, or Bitcoin, it finds a way through. Because it’s smart like that, you can pay or get paid with ease, even if the other person uses a totally different money system.

Now, isn’t that just clever? It’s sort of like magic for your money. It’s a big deal in the world of financial technology. People call this “interoperability,” and it’s a fancy way of saying everything works together nicely.

This means, for you and me, we don’t have to worry about what money system someone else uses. We just know our money will get to where it needs to go. And that’s pretty awesome.

The Structural Design of ILP: How It Facilitates Cross-Ledger Transactions

Taking a closer look, ILP has a special design. It’s built with many layers to handle all the different money systems. Imagine a cake with lots of layers—each one has a job. One layer might talk to a bank, another to a blockchain, kind of like building blocks that connect.

In the heart of ILP, there are things called “connectors.” These connectors are the heroes. They move the money from one system to another. It’s like they’re passing a baton in a relay race. Nobody drops the baton, so your money gets where it’s going without a hitch.

You might hear words like “distributed ledger technology” or “crypto routing protocols.” That’s just fancy talk for the tech that helps your money take the right path. It’s all part of the ILP world, making sure your cash travels safe and sound.

And that’s the scoop on ILP in a nutshell! It’s all about making everything work together. So money moves fast, easy, and without trouble—no matter where it’s coming from or where it’s headed. That’s the future of payments, right in our pockets!

ILP and the Evolution of Financial Technology

Driving Interoperability in Blockchain Through ILP

Imagine a world where paying someone in another country is as easy as sending an email. That’s what the Interledger Protocol (ILP) is aiming to do. ILP makes different money systems work together. This is big news for blockchain, where everything is about sharing data across different chains. ILP is not just for cryptocurrency but for any kind of money transfer.

ILP works like a translator. It lets different ledgers speak the same language. This makes digital money move fast and securely from one place to any other, no matter what kind of ledger it uses. To explain ILP, think of it as a bridge. It connects banks, payment services, and blockchains. This connection allows money to flow smoothly.

ILP’s Impact on Banking: Enabling Real-Time Gross Settlement

Now, let’s dive into banking. Real-time gross settlement (RTGS) is a big deal. It means moving money from one bank to another in real time and all at once. This sounds simple, but it’s not always how things work today. With ILP, RTGS can happen anywhere, anytime. Banks that use ILP can move money in seconds. They can do this without waiting or charging lots of fees.

ILP makes money move like information does on the internet. The open payments network can cut costs and time needed for international payments. For example, if you want to buy a toy from a shop in Japan, ILP helps your bank talk to the shop’s bank. They work out the payment in seconds, not days. And they do it without extra steps or people in between.

Banks use ILP to improve services for their customers. ILP fits into what they already do and helps them reach new places. It gives banks a way to be part of the evolving financial technology world. Customers get faster, safer, and cheaper services. And that’s a win for everyone.

Understanding ILP is not just for tech experts. It’s vital for anyone dealing with money. As ILP grows, it will change financial systems worldwide. It will help people, businesses, and banks everywhere. The Interledger Protocol explained is the first step. It leads to a future where sending money is easy for everyone.

Advancing Global Payments with ILP Integration

Connecting Diverse Ledger Types: The Role of ILP Connectors

Have you heard about the Interledger Protocol? It’s like a translator for money. Imagine you want to send cash from one type of bank to another type. They’re different, right? ILP is here to help. It’s a way to connect all sorts of ledgers. Think of different banks, PayPal, even Bitcoin.

ILP connectors are super important. They are the bridges between ledgers. Let’s say you have dollars, and I want euros. ILP connectors change your dollars into euros smoothly. No fuss, no waiting. It works for many ledger types, fast.

Stream Payments ILP: Innovations in Continuous Settlement

Now let’s talk about something cool – stream payments ILP. It’s about small bits of money moving quickly over time. With stream payments, you can send or receive funds little by little. It’s non-stop, without waiting, like a stream of water.

Why’s that good? It’s safe, for one. Only a tiny bit of money moves at once, so there’s less risk. It’s also fast. Since it’s going bit by bit, you don’t have to wait for a big transfer. This is great for everyone.

Think of people who work by the hour or play video games for rewards. They get their money right away. No waiting for payday. Or a shopper getting refunds as a stream rather than one lump sum. It’s a game-changer, thus enhancing payment networks.

Interledger Protocol, or ILP, is changing the game in financial tech. It’s making money move in ways we never thought possible. Global payments are getting quicker and safer, thanks to ILP. Cool, right?

Ensuring Security and Trust in Multi-Ledger Transactions

Achieving Trustless Transactions: From Atomic Swaps to ILP’s Security Mechanisms

You might wonder, “How do we swap assets without risk?” Simple: atomic swaps. No, it’s not about splitting atoms. It’s about trading directly with others, safely. With atomic swaps, you trade across different blockchains. But there’s no need to trust the other person. If anything goes wrong, the deal gets called off. Nobody loses.

Here’s where the Interledger Protocol (ILP) levels things up. Think of ILP like a universal translator for money. It speaks bitcoin, dollars, euros, you name it. It lets any two currencies talk and move money around. ILP is like a bridge for digital money, using connectors to join different blockchains.

ILP’s like a security guard, too. It checks every payment. It only lets good payments through. This means you can move money across different blockchains without worry. ILP makes sure you can trust the process, even if you don’t trust the person on the other end.

By using ILP, you escape worry about the safety of your swap. Excellent for peace of mind!

Interledger Protocol in Action: Use Cases and Industry Adoption

So, how do people actually use ILP? Let’s look at some real-life examples. In the world of financial tech, ILP is a star player. Many companies want to move money fast and easy. ILP makes this happen by connecting different ledgers. This leads to faster payments, fewer hiccups, and happier customers.

Now, think about global business. They need a quick way to send money around the world. ILP helps here by making sure money moves quickly and safely. It skips the old system of waiting and worrying. This saves time and stress for businesses big and small.

Crypto is huge now, right? ILP acts like a bridge between different cryptocurrencies. It makes trading and using crypto easier for everybody. No need to jump through hoops. ILP connects all the dots, making sure everyone in the crypto game plays nice together.

Wrap up with the big dream: ILP aims to make our world’s payment systems work together. Imagine being able to send money anywhere, any currency, in a snap. That’s what ILP is building — a world where paying someone half a world away is as easy as sending a text message. It’s a big goal, but ILP is making huge strides. Every day, it gets us closer to a world with truly open payments.

ILP’s magic is that it works quietly behind the scenes. You might not see it, but it’s changing the way money moves. It makes paying someone in another country as simple as buying a coffee at your local shop. That’s pretty cool, huh?

Real talk: ILP is reshaping how we think about money in our digital age. And it’s just getting started. Keep an eye out — the future of payments is getting brighter, thanks to ILP.

In this post, we’ve dived into the Interledger Protocol, a game changer for seamless payments. We started with its core concepts and how it’s structured to work across different ledgers. Then we explored how ILP is shaping financial tech, making blockchains talk to each other, and speeding up bank transfers.

Next, we saw how global payments are getting a boost from ILP, thanks to connectors and continuous settlement options. And we wrapped up by looking at ILP’s role in secure, trustable multi-ledger deals, with real-world uses that show its growing reach.

My final take? ILP isn’t just tech talk; it’s a big leap forward. It’s the backbone for a world where money moves as easily as emails. For anyone who deals with money online, that’s a future worth getting ready for.

Q&A :

What Exactly is Interledger Protocol (ILP)?

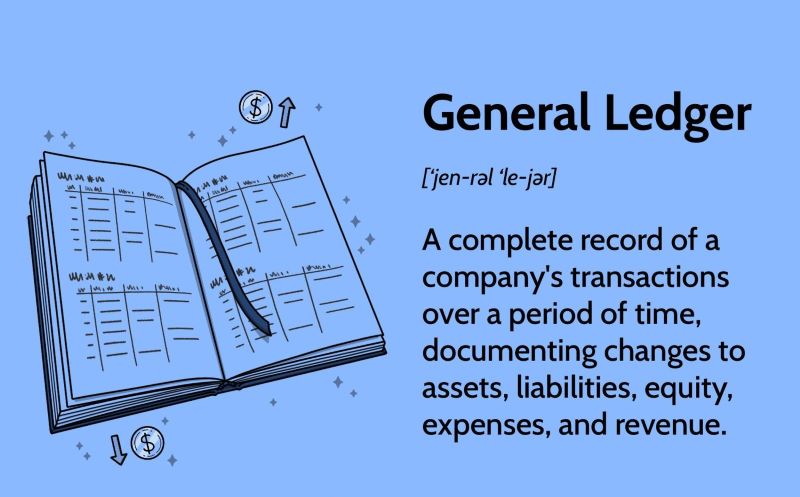

Interledger Protocol, often abbreviated as ILP, is a protocol designed for connecting different ledgers and payment systems. Its primary purpose is to enable seamless transactions across various blockchains and networks, creating a universal payment system. ILP facilitates the transfer of value between different ledgers, whether they are cryptocurrency blockchains, traditional banking ledgers, or digital payment platforms. By acting as a bridge, it ensures compatibility and interoperability, allowing for direct transactions without the need for a centralized exchange.

How Does Interledger Protocol Facilitate Cross-Ledger Transactions?

Interledger Protocol facilitates cross-ledger transactions by using a series of connectors, which are nodes that relay information and value between ledgers. ILP employs a standardized payment packet and cryptographic conditions, ensuring that funds are only transferred when certain conditions are met. This serves as a security measure and enforces the trustless execution of transfers. The protocol breaks down a payment into smaller packets, which independently find their way to the destination through the best route possible ensuring efficiency and increasing transaction speed.

What Are the Advantages of Using Interledger Protocol?

The use of Interledger Protocol brings several advantages:

- Interoperability: It enables transactions between diverse payment networks and ledgers, including different cryptocurrencies and fiat currencies.

- Scalability: As ILP routes packets individually, it can handle a high volume of transactions simultaneously, resulting in a scalable payment network.

- Enhanced Security: The protocol’s use of cryptographic conditions for fund transfers enables secure payments without the need to trust intermediaries.

- No Central Authority: ILP operates without a central authority or clearing house, reducing the risk of single points of failure and promoting a decentralized network structure.

- Lower Costs: By eliminating the need for multiple transactions across different networks, ILP can reduce transaction fees and costs associated with currency conversion.

Can Interledger Protocol be Used for All Types of Currencies?

Yes, Interledger Protocol is designed to be currency agnostic, meaning it can support transactions between any types of currencies, including fiat currencies like USD or EUR and cryptocurrencies like Bitcoin or Ethereum. The protocol acts as a layer that does not hold the actual funds but instead facilitates the transfers by connecting different ledgers and ensuring that they can communicate and transact with each other seamlessly.

Is Interledger Protocol the Same as Blockchain?

No, Interledger Protocol is not the same as a blockchain. While it can connect and facilitate transactions across blockchains, ILP itself is not a blockchain. It is a protocol that provides a set of standards for different payment networks and ledgers—including blockchains—to interoperate. While blockchains are decentralized digital ledgers that record transactions, ILP is a system for connecting these ledgers to enable them to work together efficiently.