Acala Network is one of the most prominent projects within the Polkadot ecosystem, and ACA Coin is the primary token of this platform. So, what is ACA Coin? This article will help you understand ACA Coin, its features, uses, and how to acquire it.

What is Acala Network?

Acala Network is a decentralized finance (DeFi) platform built on the Polkadot ecosystem. Polkadot is a multichain blockchain that allows parachains (individual blockchains) to interact with each other through the Relay Chain, providing flexibility and scalability for blockchain applications. Acala leverages this infrastructure to offer decentralized financial services, including stablecoins, lending, staking, and yield farming.

Operating as a parachain on Polkadot, Acala uses Polkadot’s consensus mechanisms and protocols to ensure security and interoperability between different blockchains. This allows the platform to seamlessly connect and share data with other ecosystems such as Ethereum and Cosmos.

How Acala Network works

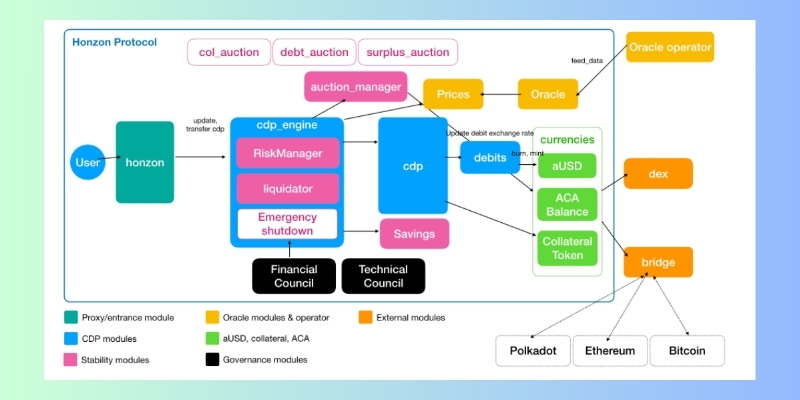

Acala Network operates on powerful protocols that provide a range of decentralized financial (DeFi) services. Two of the most important protocols are the Honzon Protocol and the Homa Protocol, which make Acala a flexible and secure platform for financial activities. Here’s an overview of how Acala Network works:

Honzon Protocol

The Honzon Protocol is a key protocol in Acala’s stablecoin issuance process, specifically for aUSD. aUSD is a stablecoin designed to maintain a stable value, typically pegged to 1 USD. What sets aUSD apart is that it is collateralized by digital assets such as DOT (Polkadot’s native token) or ACA (Acala’s native token). This mechanism helps Acala maintain the stability of the stablecoin in the volatile cryptocurrency market.

- How it works: To mint aUSD, users must collateralize digital assets like DOT or ACA in a smart contract on Acala. Once collateral is locked in, users can mint aUSD equivalent to the value of their assets. This ensures that each unit of aUSD is backed by real assets in the system.

- Value stability: Through its collateralization mechanism and the use of valuable assets like DOT and ACA, aUSD maintains its stable value, providing a reliable tool for financial transactions on the Acala platform.

Homa Protocol

Homa Protocol is another essential protocol of Acala that offers flexibility for users staking on Polkadot. Through Homa, users can stake DOT (Polkadot’s native token) and receive L-DOT (Liquid DOT), a token that can be used in Acala’s DeFi services.

- Staking and conversion process: When users participate in staking on Polkadot to secure the network, they lock up their DOT tokens. However, through Homa Protocol, users can convert their locked DOT into L-DOT, allowing them to continue engaging in DeFi activities on Acala without losing their staking rewards.

- Liquidity and DeFi: L-DOT can be used in DeFi activities like yield farming, lending, or providing liquidity in Acala’s liquidity pools. This allows users to earn additional rewards from DeFi protocols while still receiving staking rewards without having to withdraw DOT from Polkadot.

- Security and liquidity: Homa Protocol enables users to secure the Polkadot network via staking while also participating in Acala’s DeFi services without liquidity restrictions. This enhances flexibility and optimizes returns for participants.

Parachains and NPoS (Nominated Proof-of-Stake)

Acala Network functions as a parachain within the Polkadot ecosystem, enabling the platform to interact with other blockchains in the Polkadot network. Polkadot uses the Relay Chain to connect parachains, ensuring a secure and scalable ecosystem.

- Parachains: Acala is a parachain on Polkadot, meaning it is an independent blockchain that can interact and communicate with other parachains within the Polkadot ecosystem. This gives Acala the ability to scale its services and utilize Polkadot’s features to provide powerful DeFi products.

- NPoS (Nominated Proof-of-Stake): Acala uses the Nominated Proof-of-Stake (NPoS) consensus mechanism to secure the network. Users can stake ACA (Acala’s native token) to become validators or nominators, helping to verify transactions and maintain the stability of the network. Validators are responsible for confirming the validity of transactions and creating new blocks, while nominators choose and support trustworthy validators.

- Decentralized governance: ACA holders can participate in Acala’s governance process, making decisions about protocol changes, transaction fees, and platform development. This system ensures that Acala operates in a flexible and transparent manner, with active community involvement.

DeFi financial services on Acala

Acala goes beyond stablecoin issuance and staking management, offering a range of decentralized financial services to meet user needs. These services include:

- Lending and borrowing: Users can borrow aUSD by collateralizing assets (such as DOT or ACA) in the system. They can also lend assets and earn interest from borrowers.

- Yield farming and liquidity mining: Users can participate in yield farming or liquidity mining on Acala’s pools to earn profits from the assets they provide to the system. Rewards may be in the form of ACA or aUSD tokens.

- Staking and rewards: Users can stake DOT or ACA to earn rewards from securing the network. These rewards are distributed as ACA tokens.

Integration and Cross-Chain interoperability

One of Acala’s standout features is its cross-chain interoperability. Thanks to Polkadot, Acala can interact with other blockchains such as Ethereum, Cosmos, and others within the Polkadot ecosystem. This enables Acala to facilitate transactions and asset transfers across different ecosystems, expanding financial opportunities and enabling users to utilize tokens from various platforms within Acala’s DeFi products.

What is ACA Coin?

ACA Coin is the native token of Acala Network, playing a vital role in transaction fees, platform governance, and system security. This token serves not only as a payment medium but also as an essential tool in the governance of the platform.

- Transaction fees: Every transaction on Acala Network, including transfers, smart contract execution, or DeFi transactions, requires ACA for transaction fees.

- Network governance: ACA Coin holders can participate in voting and decision-making processes related to transaction fees, protocol upgrades, and system management.

- Security and staking: ACA Coin is also used in staking activities to secure the network and earn rewards for contributing to the security of the platform.

ACA has two main functions: Utility Token and Governance Token. This means that ACA holders can use it for DeFi services and also participate in crucial decisions about Acala Network’s development.

Detailed information about ACA Coin

- Token name: Acala Network

- Token symbol: ACA

- Blockchain: Polkadot

- Token standard: To be updated

- Contract: To be updated

- Token type: Utility, Governance

- Total supply: 1,000,000,000 ACA

- Circulating supply: To be updated

ACA Coin distribution

ACA Coin has a maximum supply of 1 billion tokens, distributed according to a detailed plan to ensure the stability and sustainable development of the Acala ecosystem:

- 18.33% allocated to initial investors and supporters.

- 11.56% for strategic investors.

- 20.25% for the founding team.

- 49.76% for the community and incentive programs.

This allocation helps maintain transparency, stability, and long-term community development.

How to acquire ACA Coin

There are several ways to acquire ACA:

- Purchase ACA Coin on major exchanges like Binance, KuCoin, and Huobi.

- Participate in Staking: Users can stake ACA Coin to earn rewards and secure the Acala network.

- Engage in DeFi Services: ACA Coin is used in DeFi protocols on Acala, such as lending, yield farming, and liquidity pools.

However, participation in Acala Network also carries risks, especially given the volatility of cryptocurrency markets. Therefore, users should carefully consider the risks before engaging.

So, what is ACA Coin? It’s not just a cryptocurrency, but a central element in building and maintaining the Acala Network ecosystem. With its applications in transaction fees, platform governance, and system security, ACA Coin plays a crucial role in the development of this DeFi platform. If you’re looking for an investment opportunity or wish to participate in the decentralized finance space, ACA Coin is a promising option.

Investing in ACA Coin could offer significant opportunities in the future, but it’s essential to have a thorough understanding of the project and the associated risks.

Don’t forget to follow Crypto Currency Bitcoin Price for more updates and insights on the financial and investment market every day.