In the shifting sands of the digital age, nothing shines brighter than the treasure trove of cryptocurrencies. But just as a treasure chest needs a sturdy lock, your digital gold demands robust protection. Enter the realm of types of crypto wallets: the guardians of your precious digital assets. Whether you’re a crypto newbie or a seasoned trader, understanding these wallets’ nooks and crannies is the key to fortifying your financial fortress. Get ready to explore the options that stand between your crypto coin and the cyber-thieves itching to snatch it. Buckle up, as we’re about to navigate the safest routes to secure your cryptocurrency stash!

Understanding Cryptocurrency Wallets for Optimal Security

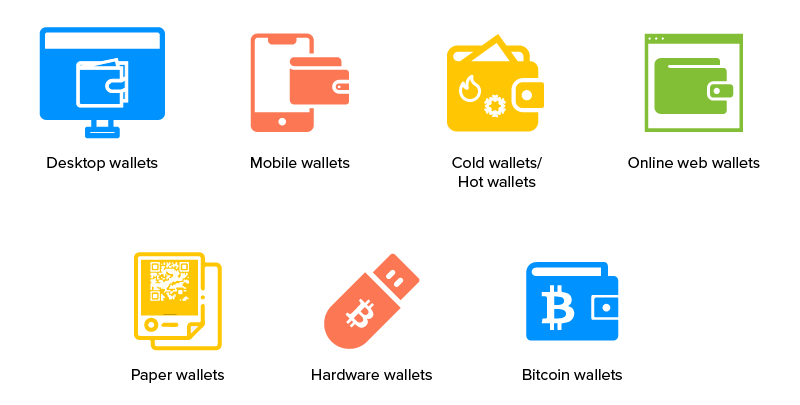

Types of Crypto Wallets – A Broad Overview

Hey, friends! Let’s dig into how to keep our digital coins safe. Picture wallets, but for crypto. There are a few kinds. Hardware wallets are like safe boxes for your digital gold. Think of Ledger Nano S and Trezor. These little devices hold your crypto offline so hackers can’t reach it. They’re a part of what we call cold storage solutions and are all about keeping things as secure as possible.

Then we have software wallets. These are programs you can use on your phone or computer. Your coins are online here, or “hot.” It’s like having money in your pocket. Quick to use, but you need to watch out for pickpockets, or I guess, hackers, in this case. Popular ones are Coinomi, Trust wallet, and Electrum.

Don’t forget mobile wallet apps that let you pay with crypto on the go and desktop crypto managers that give you more control when you’re at your computer. You might hear about hot wallet advantages. They’re convenient, sure. But always remember, with great power comes great responsibility.

And then there are the paper ones. Yes, you heard that right. Paper wallets! You print your crypto keys on a piece of paper. It’s super old school but still part of secure cryptocurrency storage. Just don’t spill coffee on it!

Key Features of Secure Cryptocurrency Storage

Now, for the nitty-gritty details. The big deal about secure cryptocurrency storage? Keeping your digital money away from bad guys. With hardware wallets, you’ve got to know your stuff. Setting up needs care. But once you do, it’s like fort Knox for your crypto.

For extra safety, you can use multisig hardware options. It’s like needing two keys to open a safe. This means you need more than one signature to say yes to a transaction. It’s a neat feature of Trezor wallet security.

Offline crypto management is crucial, too. This means keeping your crypto off the net, away from hackers. You can use USB crypto wallets or even make them out of paper. I’m serious – printable Bitcoin!

It’s like crafting a high-security bank vault for your coins, but remember, you’re the bank manager here. Whether you choose a hardware wallet setup or try DIY crypto storage, your biggest job is keeping those keys safe. Think of your keys like a secret code that unlocks your treasure chest. You wouldn’t just hand it out, right?

When you’re not transacting and just want to store crypto, cold is the way to go. Storing crypto offline is one of the best ways to make sure it stays under lock and key. So, learn about paper wallet security, get that laminator ready, and dive into the world of cold wallet paper backups. It’s like creating a map where ‘X’ marks the spot, but only you know where to look.

Be smart, be safe, and let’s keep our crypto secure!

Types of Crypto Wallets: Hardware Wallets and Cold Storage Solutions

Setting Up Your Hardware Wallet for Maximum Safety

When you get a hardware wallet, think of it like a mini vault. Ledger Nano S and Trezor are top picks. They keep your crypto safe, like gold in a bank. First, you need to set it up right. Here’s why it matters. If it’s not set up well, your coins might get stolen. That would be awful, right?

Set up needs a careful eye. Follow the steps given with your wallet. Write down the recovery phrase it gives you. Keep this secret and safe; it’s like the key to your vault! This phrase helps get your crypto back if the wallet is lost.

Remember to update the wallet’s firmware. This keeps your wallet secure with the latest software tricks. Always use the cable that comes in the box. This makes sure no bad software sneaks onto your wallet.

Now you’ve set it up, test it. Send a little bit of crypto to your new wallet. Then reset it, and use the recovery phrase to get the crypto back. If this works, you’re all set!

Benefits of Multisig Configurations in Enhancing Security

Multisig is like having several locks on your door. You need more than one key to open it. For crypto, this means several approvals before a transaction happens.

Multisig protects your funds. How? It spreads the risk. If one key is stolen, your crypto is still safe. You need all keys for access. This stops thieves and also helps manage big sums of money.

Multisig can use different hardware wallets together. You can have a Ledger, a Trezor, and even a USB wallet as keys. Only with all of them together can you move the funds. This might sound like a lot of work. But for your digital gold, it’s worth it.

To set up multisig, you need special wallet software. This software lets you set how many approvals you want. Think of it this way: One lock equals one key. Want two locks? Choose two keys! You get the idea.

Remember, more keys mean more safety. But also more responsibility! You must not lose any of the keys. Also, multisig can slow things down. Each key holder needs to agree to make a move.

But think about this. If someone tries to steal from you, they’d have to get all keys. That’s much harder than getting just one. It’s a powerful way to keep your crypto safe.

Hardware wallets and multisig protect you online. They are a strong shield against hackers and thieves. They are not just gadgets. They are your personal security team for your digital treasure. Keep them secure, and they’ll guard your crypto like warriors.

Software Wallets and Their Role in Crypto Management

Comparing Desktop and Mobile Crypto Wallets

Think of software wallets as friends that keep your digital cash safe. They work on devices like phones and computers. Here, we’ll dive into how mobile and desktop wallets differ.

Mobile wallet apps are like wallets in your pocket, handy and always with you. You can pay for things or transfer money fast. They use QR codes and make shopping with crypto easy.

Desktop crypto managers sit on your PC or laptop. They are like vaults in your home. They’re good for big amounts of money, trades, and checking all details.

Both types hold keys that let you use your crypto. They face risks like hacks, so it’s wise to add some layers of safety. Always keep software updated and apply all security features.

Remember, your mobile wallet is always with you, so it may face more risks. Desktop wallets are safer in one place, but both need backup. Backup means saving info to restore the wallet if something goes wrong.

Question: Can mobile wallets be safer than desktop wallets?

Not really. They can be more convenient but often have higher risk since they can be lost or stolen easier.

The Importance of Wallet Software Encryption

Wallet software encryption is like a secret code that guards your crypto. It scrambles data so only you can make sense of it with your own key. It stops thiefs from stealing your crypto. Always use a strong password, which is a mix of letters, numbers, and signs. A strong password is hard to guess.

Hot wallet security practices include checking the wallet’s safety features. They also involve keeping your keys private. And never share your secret codes!

Question: What’s the best way to keep your hot wallet secure?

Use strong encryption and keep your passwords and recovery phrases secret. Add extra security layers like two-factor authentication (2FA).

When you choose a software wallet, look for one with good encryption. Brands like Coinomi, Exodus, Trust, and Electrum offer solid protection. They help you by providing support if you need it. Always do your homework and read reviews. They show how other people like the wallet and if they trust it.

Remember, software wallets are useful, but should be one part of your crypto plan. For big savings, consider hardware wallets or other methods of cold storage solutions. This way, you keep most of your funds offline where they’re safer.

Your goal should be to understand these tools and use them smartly. Make sure your crypto stays safe and you can use it as you need. We must all play our part in protecting our digital gold.

Now, you’ll be better at picking the right wallet. It will help manage your crypto and keep it out of wrong hands. Remember to always stay updated on the latest ways to keep your crypto secure!

Paper and Physical Wallets: Tangible Security Measures

Crafting Secure Paper Wallets for Offline Storage

Storing crypto offline is smart. You keep your digital cash away from hackers. Paper wallets are simple, basically, they are just pieces of paper. That’s right, like dollar bills, but these hold your precious crypto keys. You print them, making your money almost hacker-proof. Remember, once lost or damaged, there’s no backup.

Now, how do we make one? It’s easier than a puzzle. First, find a reliable offline wallet generator. Next, disconnect from the net to avoid sneaky eyes. Then, create your wallet. It will spit out two QR codes. One is your public address, to receive coins. The other is your super-secret private key, to spend them. Print these out.

But don’t just toss it in a drawer. Protect it like a treasure map. Laminate it to keep water and wear away. Store it in a safe place, like a real safe. And don’t share it. Your private key is only for you. If others see it, they can take your crypto.

Laminating your wallet is a cool trick. It guards against spills and tears. Plus, it feels like making your cash waterproof. That’s double the security, with none of the tech fuss.

The Process of Creating and Managing Physical Bitcoin Wallets

Physical Bitcoin wallets bring your digital bucks into the real world. Think of it as a collector’s coin that has your Bitcoin value on it. You can hold it, put it in a safe, or even bury it if that’s your thing. But with great power comes great responsibility.

First, you need to buy a physical Bitcoin. Yes, buy, with real money. Some companies make these, often with a fancy design. On the back, there’s a hidden part. That’s where your Bitcoin key lives. Uncover it and you can access your Bitcoin. But then, it’s no longer safe to show off because the key is out.

So, manage it wisely. If you’re using it for long-term holding, maybe just leave it covered. Think of it like an investment or a rare collectible. It grows in value but isn’t for daily spending.

Physical wallets also need care. Keep them in a dry place where temps don’t jump around. And just like paper wallets, keep them secret, keep them safe.

To sum it up, paper and physical wallets are like old-school piggy banks. They’re simple, sturdy, and keep your crypto safe as long as you handle them right. Plus, they’re as offline as it gets. No tech-savvy thief can hack your shelf. But, if you’re the forgetful type, maybe stick with options you can’t misplace. Each wallet has its pros and cons. It’s all about finding the right fit for your treasure chest of digital gold.

In this post, we dove into the world of crypto wallets. From types that suit different needs to the must-have features for safety, we covered it all. We looked at hardware wallets and how to set them up right. We saw why many choose them for keeping their coins safe. We talked about software wallets, too, comparing desktop and mobile options.

Finally, we explored paper and physical wallets. We learned how to make them and that they can really lock down your crypto offline. Here’s the bottom line: Picking a wallet is key to keeping your digital cash safe. Think about what you need. Go for security. Don’t rush it. Find the wallet that fits just right. Take these tips, and you’ll do well in managing your crypto safely. Follow Crypto Market Pulse to update more knowledge about Crypto.

Q&A :

What are the main types of cryptocurrency wallets?

Cryptocurrency wallets can broadly be categorized into two main types: hot wallets and cold wallets. Hot wallets are connected to the internet and include desktop wallets, mobile wallets, and web wallets. Cold wallets, on the other hand, are not connected to the internet and are considered more secure. These include hardware wallets and paper wallets. Within these two categories, there are several variants with different features tailored to various user needs.

How do hardware wallets differ from software wallets?

Hardware wallets are physical devices designed to securely store cryptocurrency offline, which makes them less susceptible to online hacking attempts. They often resemble USB drives and must be connected to a computer or smartphone to carry out transactions. Software wallets, or hot wallets, are applications that can be installed on a computer or mobile device. Being online, they are more convenient for active trading and accessing funds but are potentially more vulnerable to security breaches than hardware wallets.

What is a paper wallet and how secure is it?

A paper wallet is a form of cold storage where a private key and a public address are printed on a piece of paper. It is among the most secure forms of cryptocurrency storage as it is completely offline and therefore immune to online hacking attacks. However, they can be lost, damaged, or deteriorate over time, which poses a different kind of risk. To maintain its security, it’s crucial to keep the paper safe and protected from physical damage.

Can mobile wallets be considered secure for storing cryptocurrencies?

Mobile wallets provide a good balance between security and convenience for managing cryptocurrencies on the go. They are securely encrypted and often offer additional security features such as 2-factor authentication or pin codes. However, because they are connected to the internet, they are inherently less secure than cold storage options. It’s important to ensure the security of the mobile device itself and regularly back up the wallet to protect against theft, loss, or damage.

Are cloud wallets a reliable option for holding cryptocurrencies?

Cloud wallets, also known as web wallets, are managed on a server and accessible from any computing device via the internet. While they are extremely convenient, especially for frequent traders, they are also among the least secure types of wallets. The private keys are stored online and often controlled by a third-party, which exposes them to potential security breaches and hacking. When using a cloud wallet, it is essential to use strong passwords and enable two-factor authentication, as well as to be aware of the associated risks.