As a crypto trader, you know the drill: security is king. And when it comes down to locking down your digital assets, safest crypto exchanges with cold storage stand out from the pack. Think of it as a digital Fort Knox for your coins. No fluff, just the facts: cold storage shields your funds from online threats. Now, I’m here to guide you through the secure cryptoverse, where cold storage isn’t just an option—it’s your digital safe haven. Let’s dive into why when it comes to protecting your crypto, cold storage is the undisputed champion.

Understanding Cold Storage in Crypto Exchanges

What Is Cold Storage and How Does It Work?

Think of cold storage as a super safe. It keeps your crypto offline. Much like a vault in a bank. When crypto is offline, hackers can’t reach it. This makes it very safe. Top cryptocurrency exchanges with secure storage know this. They use cold storage to keep lots of digital cash safe.

Now let’s peek at how cold storage works. You have a secure crypto platform. They take your crypto and move it off the internet. That’s cold storage. It’s locked away from cyber thieves. Many best cold storage wallets on exchanges are like secret bunkers. They are tough to break into without a key.

The Impact of Cold Storage on Exchange Security

Having your cash in cold storage means strong security. Secure asset storage in crypto is a big deal. With more people buying digital money, this is key. Reputable exchanges with cold storage know this. They keep your treasure offline in these cold wallets. This stops bad guys in their tracks.

Leading crypto exchange cold wallets are the answer. They help you sleep at night. Your digital money is snug and safe. Digital currency exchange security is no joke. Cold storage for digital assets is like a mighty shield. High-security crypto trading platforms often brag about having cold storage. This is good. It means they take safety seriously.

So, what does cold storage mean for you? Peace of mind. Your coins are tucked away. They’re out of reach from online bandits. Secure crypto platforms use cold storage to win your trust. And it works. People like their money safe. Cold storage does that.

Remember this. The best protection for your crypto is often the simplest. Keep it offline. Keep it locked up. Cold storage keeps it simple. It’s old-school, like a treasure map marking “X”. But instead of “X”, it’s a top-rated exchange security feature. And that’s what makes it gold.

Evaluating the Top Crypto Exchanges for Cold Storage

Criteria for a Secure Cold Storage Solution

When I look for a secure cold storage solution, several points stand out. It must be offline. This keeps hackers away. Top exchanges should have this. They must have strong data encryption and physical security too. These exchanges use many checks before moving assets. This waythey protect our digital currency.

Spotting the Best Cold Storage Wallets on Today’s Exchanges

The best cold storage wallets on exchanges have several marks of trust. Look for hardware wallet support first. Exchanges that let you connect a hardware wallet take security seriously. They understand the need for personal control over your assets.

These platforms often employ multi-signature systems. Multi-signature, or multisig, wallets require more than one key. This way, if a hacker gets a single key, your assets are still safe. Only top-rated exchanges use such high-security features.

Always check if the exchange has an insurance policy. This is your safety net. If theft or a breach happens, you still get protection. Secure asset storage in crypto goes beyond technology. Insurance speaks to the exchange’s commitment to your investment’s security.

Few exchanges stand out with these safety nets. They make sure crypto stays safe and moves without risk. Offline crypto storage services and exchange vaults safeguard from threats. We want these features when we choose where to trade.

Trustworthy digital asset exchanges make their security measures public. They often show a crypto exchange security ranking. This way, you see how they compare to others. Such visibility builds trust. It says, “We have nothing to hide.”

Again, the best protection involves multi-layer approaches. It includes encrypted cold storage in exchanges. But that’s not all. Customer asset protection means the platform takes extra care. They work to keep your funds out of harm’s way.

Key factors like these shape my idea of secure crypto platforms. They should have a blend of software and operational security measures. Look for hardware wallet integration and advanced security features. This offers a full scope of protection for your digital assets.

Safety features of crypto exchanges should make you feel secure. Think about what happens after you log out. Your crypto should be as safe as if it were right next to you, locked tight. Top cryptocurrency exchanges take this to heart. They provide more than a service. They deliver peace of mind.

Next time you’re on a popular exchange, dig into their security. Do they offer cold storage solutions you trust? Are they using advanced technology like multisig? Are they open about their safety measures? Answers to these questions help decide where to trade.

Experts agree that cold storage wins for safety. It’s simple, really. Keep it offline, keep it encrypted, and keep it insured. That’s the golden rule for secure crypto storage. And that’s how you protect your future in this digital gold rush.

The Intersection of Technology and Trust in Cold Wallet Integration

Hardware Wallet Integration and Multisig Protocols

We find safety where technology and trust meet. This is at the heart of hardware wallet integration. These wallets act as a safe for your digital cash. They lock away your crypto offline, keeping it away from online thieves. It’s like a bank vault for digital coins. The top cryptocurrency exchanges with secure storage use these devices. This gives you peace of mind.

Multisig protocols add another layer. They need more than one key to open your crypto safe. This means if a hacker gets one key, they still can’t get in. It’s like needing several keys to open a treasure chest. This makes secure crypto platforms even safer. Crypto cold storage solutions often use multisig. This is because it is super safe for your digital currency exchange security.

Imagine you’re part of a team guarding a treasure. Multisig means you all need to say “yes” to open the lock. Even if one person makes a mistake, your treasure stays safe. That’s the kind of team play you want in a digital world full of sneaky hackers.

How Insurance and Compliance Strengthen Trust in Cold Storage

Now, let’s talk about backing up this security with something we all understand: insurance. Crypto exchange insurance policies are not just words on paper. They are a promise. Like a safety net for a tightrope walker. It means if something goes wrong, you’re not left in the dark. Reputable exchanges with cold storage often have this backup plan.

And then there is compliance. We all follow rules. Road signs keep us safe while driving. In the world of crypto, rules make sure everything is fair and squared away. Compliance and cold storage solutions work together. It’s like playing a game where everyone knows the rules. This builds trust.

Cold storage for digital assets is like a digital fortress. Insurance is your backup plan. And rules are the game plan everyone sticks to. With these in place, offline crypto storage services at popular exchanges with security measures shine.

Remember, when you’re looking for a place to keep your digital coins, look for these signs of safety. The best cold storage wallets on exchanges will have all these things. They will have hardware wallet integration. They will use multisig protocols. They will offer exchange vault services for crypto. And they will show they play by the rules with proper insurance and compliance.

When you find a crypto exchange with the best protection, you find peace of mind. You want to sleep easy knowing your digital money is locked away safe. Like treasure in a chest, deep underwater, away from prying eyes and grabby hands. That is what you get with high-security crypto trading platforms. They turn the digital sea into a safe space for your treasure.

Implementing Best Security Practices in Everyday Crypto Trading

The Role of Two-Factor Authentication and Other Safety Features

Every time you trade crypto, you’re trusting a platform with your digital cash. It’s like picking a bank. You’d pick one with a big vault and guards, right? That’s why safe crypto platforms use tough security like two-factor authentication (2FA). Why is 2FA important, you ask? It’s like having two locks on your door instead of one. Even if someone gets your password, they can’t get in without the second code, usually sent to your phone.

The best cold storage wallets on exchanges are like hidden vaults. They keep your crypto offline, away from hackers. Think of a treasure chest buried in the ground, but way more high-tech. These leading crypto exchange cold wallets need special keys to open, just like your own personal Fort Knox.

Remember, these features matter. The next time you log in to a top cryptocurrency exchange with secure storage, you’ll feel better knowing they’ve got these protections in place. And if you really want peace of mind, look for hardware wallet integration crypto exchanges. This means you can keep your crypto in a physical gadget that only you can unlock, often with a secret pin.

Learning From Crypto Exchange Security Rankings and Reviews

Ever wonder how to pick a secure digital currency exchange? Look at the rankings and reviews. We’re talking about real feedback from users and experts who’ve done the hard work for you. They’ve checked out which top-rated exchange security features are actually worth your trust.

Good crypto exchange security ranking lists will show you the top dogs in the game. These are the places that check all the boxes. They’ve got cold storage for digital assets, where your crypto sleeps safe and sound, offline. They use advanced security to keep your trades locked down tight.

Now, it’s not just about what’s under the hood. Customer asset protection crypto exchanges are the ones that will have your back if things go south. They’ve got plans in place to protect you from the bad guys.

In this wild west of crypto, high-security crypto trading platforms stand like fortresses. They’re the trustworthy digital asset exchanges that value your coin just as much as you do. So when you find a good one, with solid reviews and all the safety bells and whistles, stick with it. It’s your best bet for keeping your crypto safe today and tomorrow.

In conclusion, security practices like two-factor authentication, cold storage, and good rankings should be part of your daily trading routine. They make sure that dealing in digital dollars stays as safe as a tucked-away treasure. Keep these tips in mind, and trade with confidence!

In this post, we dove into cold storage, the backbone of crypto safety. Starting with the basics, we explained how these digital iceboxes keep your crypto out of thieves’ hands. We then checked out what makes a cold storage solution surefire and how top exchanges stack up.

We also looked at the tech tango between hardware wallets and multisig setups, plus the big wins for trust when insurance and rules come into play. Lastly, we shared tips for staying safe, like using two-factor authentication, and why you should always study up on exchange security rankings.

My final thought? When it comes to crypto, your coins are only as safe as where you store them. So, choose wisely, keep learning and trade with confidence. Stay sharp and secure!

Q&A :

What are the advantages of using a crypto exchange with cold storage?

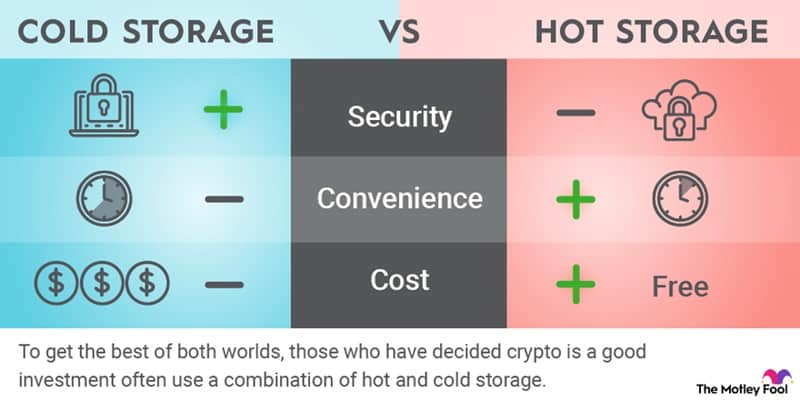

Cold storage refers to keeping a reserve of cryptocurrencies offline, which vastly reduces the risk of hacks and theft that’s common with online storage, also known as hot wallets. By using exchanges that incorporate cold storage, users benefit from enhanced security for their digital assets. Additionally, exchanges that use cold storage often have additional security measures and protocols, which can help protect users against the loss or theft of their funds.

How do I know if a crypto exchange uses cold storage?

To determine whether a crypto exchange uses cold storage, you can look for information on their security practices either on their website or in their user agreements. Many exchanges that utilize cold storage are transparent about their security measures and will explicitly state that they keep a significant portion of assets in cold storage. You can also check reviews or industry publications for insights into their security practices.

Which are considered the safest crypto exchanges with cold storage?

When it comes to the safety of crypto exchanges with cold storage, a few names often come up as industry leaders due to their strong security measures. These include exchanges like Coinbase, which insures its digital assets and uses cold storage for a large percentage of customer funds, as well as Gemini, which is recognized by its use of cold storage and a robust security program. Kraken is also notable for its extensive security measures and use of cold storage. Always do your due diligence and look for the latest user reviews and security audits for the most accurate information.

Can I access my cryptocurrencies immediately if they are in cold storage?

One potential drawback of cold storage on exchanges is that it usually takes more time to access your funds since they are not directly connected to the internet. Withdrawal times can vary depending on the exchange’s policies and procedures for moving assets out of cold storage. Some exchanges balance the convenience of quick access with the security of cold storage by keeping a small portion of assets in hot wallets for immediate transactions.

Is it more expensive to use a crypto exchange with cold storage features?

Generally, the use of cold storage by a crypto exchange does not have a direct cost that’s passed on to the customer. Instead, the exchange absorbs these costs as part of its operating expenses. However, exchanges with high-level security features, including cold storage, may charge higher trading or withdrawal fees. Nevertheless, these fees are usually justified by users for the added peace of mind and protection against potential losses due to security breaches. Always compare fee structures alongside security features to find an exchange that balances cost and safety to your satisfaction.