On December 3, 2024, South Korean President Yoon Suk Yeol declared a state of emergency martial law to protect the nation’s constitutional order in the face of perceived threats from forces allegedly supporting North Korea. This article will provide a detailed analysis of the martial law’s effects on the financial markets, cryptocurrency, and the factors to monitor in the future.

Martial law in South Korea

On December 3, 2024, President Yoon Suk Yeol announced the imposition of martial law, an extreme measure that has not been seen in South Korea for 44 years. This decision came amidst rising political tensions due to threats from domestic forces believed to be connected to North Korea. President Yoon emphasized that the martial law was necessary to safeguard the nation’s democratic order and constitution from the influence of subversive elements.

President Yoon Suk Yeol’s martial law announcement

President Yoon Suk Yeol stated that the martial law was a necessary response to domestic forces suspected of ties with North Korea. He criticized the Democratic Party of Korea and opposition groups, accusing them of supporting North Korea and undermining the government. According to him, martial law was the last resort to ensure national security and protect the constitutional order.

Before the martial law decree, South Korea’s political landscape had grown increasingly tense, particularly between the government and the Democratic Party. These tensions were fueled by protests and actions that the government viewed as favorable to North Korea. President Yoon argued that some opposition forces were sabotaging South Korea’s foreign policies and endangering national security.

Political context and government decision

President Yoon’s decision sparked widespread political controversy, with strong opposition from the Democratic Party and civil society organizations. The Democratic Party, which currently holds a majority in the National Assembly, called for the immediate cancellation of the martial law order. The National Assembly convened an emergency session to protest the government’s decision, leading to a direct confrontation between the country’s political institutions.

While President Yoon maintained that the martial law was crucial to maintain national stability, the National Assembly expressed concerns over its potential negative impacts on democratic freedoms and the integrity of the legal system. The ongoing political discussions around this issue are expected to continue and could significantly affect the stability of South Korea’s political system.

Political and legal impact of martial law

Reactions from the national assembly and the democratic party

Following the martial law declaration, the National Assembly of South Korea reacted strongly, passing a resolution demanding President Yoon revoke the order. The resolution emphasized that martial law was an excessive measure and could violate citizens’ fundamental rights. The Assembly called for the government to provide a clearer explanation of the legal grounds and reasons behind this decision.

The Democratic Party, with its majority in the Assembly, vehemently criticized President Yoon, accusing him of abusing power and implementing an overly extreme measure. Party leaders argued that martial law could lead to violations of civil rights, freedom of assembly, and freedom of speech. Some Democratic Party leaders even called for a national referendum to assess the legitimacy of the martial law order.

These disputes not only emerged within political circles but also spread to civil society organizations and human rights groups. These groups argued that martial law could set a dangerous precedent for democratic freedoms in South Korea, and if left unchecked, it could lead to further government power abuses.

Legal measures and impact on freedoms

The declaration of martial law has triggered debates about the potential legal measures that may be implemented during this period. These could include controlling information, restricting freedom of protest and association, and even intervening in the activities of opposition parties. Legal experts have warned that if not closely monitored, such measures could infringe on citizens’ basic rights and undermine South Korea’s legal system.

One potential negative impact is the restriction of individual freedoms. In the context of financial markets and other sectors, uncertainty regarding the legal situation could cause concern among investors and citizens about the future. This uncertainty only adds to the instability in economic and financial spheres.

Impact on South Korea’s financial markets

Cryptocurrency market in South Korea

One of the sectors most severely impacted by the martial law declaration is the cryptocurrency market. South Korea is one of the largest cryptocurrency markets in the world, and domestic political turbulence can have far-reaching effects on cryptocurrency exchanges and investors.

Bitcoin price volatility

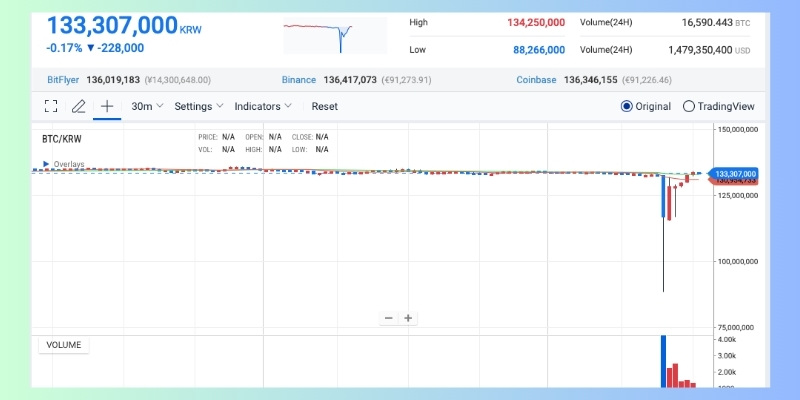

Immediately after the martial law declaration, Bitcoin’s price on Upbit, the largest exchange in South Korea, fell sharply. The price dropped from 132 million KRW (around 92,000 USD) to 88.26 million KRW (62,000 USD), a 27% decrease in a short time. However, this decline was short-lived, with Bitcoin recovering partially thereafter.

Bitcoin’s price on international exchanges also experienced similar volatility. Although it briefly dropped below the support level of 94,000 USD, it quickly rebounded to fluctuate between 95,000 and 96,000 USD. This reflects investor anxiety about political instability and government policy shifts.

These fluctuations demonstrate the strong impact that political factors can have on the value of digital assets. While investors may seek ways to protect their assets in times of uncertainty, the cryptocurrency market has shown resilience after clearer information about the political situation became available.

XRP and the negative “Kimchi Premium”

XRP, one of the most popular cryptocurrencies in South Korea, also experienced significant price volatility. XRP’s price on Upbit dropped from 4,000 KRW (about 3 USD) to 1,623 KRW (1.23 USD), a 60% decrease in a short period. However, like Bitcoin, XRP recovered and traded back at around 3,600 KRW (2.52 USD).

A key factor contributing to this volatility is the “Kimchi Premium” phenomenon, where cryptocurrency prices on South Korean exchanges are not aligned with international exchanges. This occurs due to inconsistencies in market makers’ operations and domestic political instability.

Impact on South Korea’s stock market

South Korea’s stock market also saw significant fluctuations following the martial law announcement. Major stocks, especially those of large corporations like Samsung Electronics, plummeted due to investor concerns about political instability. Samsung Electronics, one of South Korea’s leading companies, saw its stock price drop by 5.5% in a single session.

ETFs related to South Korea, such as the MSCI South Korea ETF and Franklin FTSE South Korea ETF, also experienced notable declines. This reflects investor worries about the long-term impact of the political situation on South Korea’s economy.

Decline of the South Korean Won

One of the most significant effects of the martial law declaration was the sharp depreciation of the South Korean won. The won fell by 2.5% against the US dollar, reaching its lowest level in eight years at 1,442 KRW/USD. This decline negatively affected traditional South Korean assets and created a wave of instability in financial markets.

The drop in the won reflects investor concerns about political and legal stability in South Korea. If the political situation remains unresolved, further negative impacts on the economy and financial markets could occur.

The declaration of martial law in South Korea has caused significant volatility in the financial markets, particularly in the cryptocurrency and stock sectors. Political instability and concerns about the future have made investors cautious and prompted them to adjust their investment strategies. However, the financial markets have shown resilience as clearer information about the political situation emerged.

Investors need to closely monitor political and legal developments in South Korea to make informed investment decisions and protect their assets in the coming period. The current uncertainty may persist and create both new opportunities and substantial risks for global financial markets.

Stay tuned to Crypto Currency Bitcoin Price for the latest updates and insights from the market.