Market Maker Magic: How to Sway the Crypto Seas

Ever wonder who keeps the crypto market afloat? Look no further. I’m diving into the might of the Market Maker in Crypto. These unseen heroes ensure you can buy or sell Bitcoin or Ethereum without waiting for days. In this post, we’ll strip down the complexity of market making in the cryptosphere and show what it takes to maintain market sanity. Hold tight as we reveal how these players use strategy, tech, and quick wits to help your digital dollars make waves. Get ready to appreciate their role in crypto stability and learn how they ride the tides of this digital ocean.

Demystifying Market Making in the Cryptosphere

An Overview of Cryptocurrency Market Making

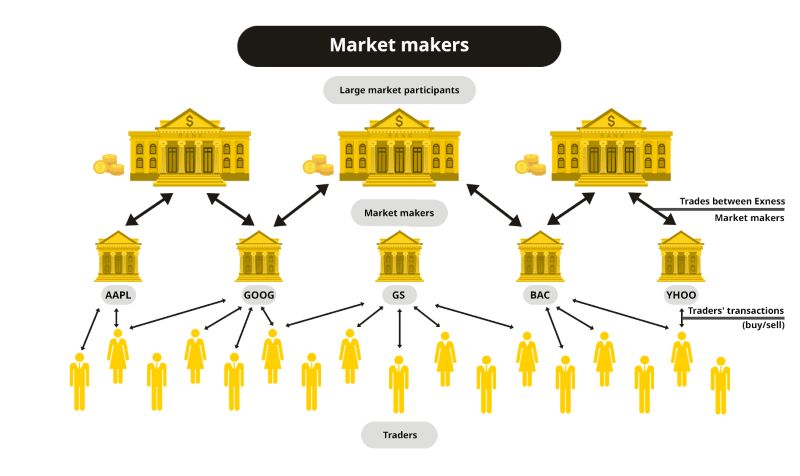

Market making might sound fancy, but let me break it down for you. A market maker is like that one friend we all have. You know, the one who is always ready to buy or sell something. In the world of crypto, these guys are critical. They’re the ones who make sure you can always trade your coins, any time.

Now, imagine a world where buying or selling crypto is as slow as a turtle race. That’s where market makers come in. They step up the game. They use fancy stuff called “algorithmic trading” and “high-frequency trading”. This simply means they buy and sell a lot, and super fast. This keeps things smooth for everyone.

Appreciating the Role of Market Makers in Crypto Stability

Stability sounds boring but trust me, in crypto, it’s gold. Picture this: You want to sell your coins, but nobody’s buying. Or maybe lots of folks want to sell, but there’s nobody to buy. Scary, right?

Enter market makers: heroes of the crypto seas. They keep buy and sell orders flowing, come rain or shine. This way, prices don’t crash or soar on a whim. It’s a balancing act and they’re in the center, juggling the orders like pros.

Now, you may ask, “Why do they do it?” Simple. They make a tiny bit of money each time trades happen. It’s called the bid-ask spread. Little profits add up, especially when they’re trading all the time. Plus, they help make the whole crypto market less rocky for you and me.

So, remember that friend who’s always ready to trade? In crypto, they ensure everyone plays fair and steady. They help us trade with ease and keep our crypto world balanced. Now that’s what I call real magic!

The Alchemy of Algorithmic Trading in Digital Assets

The Pulse of High-Frequency Trading in Crypto Markets

In the buzzing world of crypto, every second counts. High-frequency trading (HFT) pumps life into markets. It’s all about speed. Think quick trades, lots of them, all done by computers. These trades keep prices fresh and spread tight. No yawning gaps between buying and selling prices here!

Picture this: lightning-fast algorithms making moves before you blink. They scan market data, base decisions on this intel, and trade assets in milliseconds. This pulse of HFT sustains the crypto heartbeat. It’s like a digital drummer setting the market’s rhythm, all day and night.

Deploying Market Making Bots for Optimal Liquidity

Ever hear of market making bots? These are our trusty sidekicks in the quest for optimal liquidity. Market makers stand ready to buy and sell. This means traders can always find a match for their orders. It’s like having a dance partner on standby at a ball.

These bots don’t nap; they work round the clock. Using market making strategies, they place buy and sell orders. This act creates crypto liquidity pools. Think of these as big splashy puddles where crypto trades can jump in without causing a wave. This way, big trades stir less of a ripple in price. It’s crucial for keeping things stable.

Market making bots juggle a lot of tasks. They set prices for crypto trading pairs, like Bitcoin to the dollar. They sniff out the best prices across different exchanges. They ensure trade orders travel on smart routes to get the best deals. These bots also eye trading volume and liquidity. They play the numbers game like pros, all to keep the markets moving smooth.

Bots use algorithmic trading in crypto to make magic happen. They adjust to order book dynamics in real time. This means they fish where the fishes swim. They place orders thoughtfully, creating depth of market in crypto. It’s a fancy way of saying they make sure there’s enough action at different price levels.

Bots also bring out their charm to hook both big fish and small fry. They work in all waters, from the ocean of fiat-to-crypto market making to the pools of stablecoin trades. They even swim in over-the-counter (OTC) markets, where whales like to deal.

Now for a peek at incentive bait. Crypto exchanges often reward bots for their hustle. These incentives keep the market making bots casting lines into the market waters, non-stop. Their work is part of a loop that keeps the markets lively and spry.

What’s the outcome? These high-speed trades and nimble bots make for vibrant markets. Greater liquidity means better price discovery. That’s a win for everyone, from small-time traders to serious investors. It means less slippage—no slipping on wet market floors!

Think of it as a grand bazaar that never closes. The bots are the tireless traders, always calling out bids and offers. Because of them, prices in crypto markets reflect real supply and demand. It’s a concert where every player, big or small, has a part to play. Welcome to the fluid, ever-moving world of crypto markets; driven by HFT and held steady by algorithmic market makers!

Strategies for Wealth Waves: The Market Maker’s Toolbox

Navigating Through Arbitrage Opportunities

Do you know how some folks buy low and sell high across different markets? They’re using what we call arbitrage. It’s like finding a toy on sale at one store and selling it for more at another place. That’s what I do in the crypto world. I jump into these chances to make some bucks. It’s great because it helps keep prices in line across different crypto exchanges.

To nail it right, I keep an eye on many exchanges at once. I use special programs that trade fast—really fast. They catch tiny differences in prices of the same coin on different platforms. Buy here, sell there, pocket the difference. Quick and slick! That’s the game.

Enhancing Token Liquidity: Decentralized Finance (DeFi) at Work

Ever tried to sell something but no one was buying? That’s a bummer in the crypto world too. So, I help make sure that doesn’t happen. I dive into DeFi—short for decentralized finance. It’s all about shared money pools that anyone can touch. In DeFi land, I use these things called automated market makers or AMMs. These AMMs always stand ready to swap tokens with you. They make sure you can always trade, even if no one else is around at that moment.

With AMMs, I create markets that stay liquid. That means lots of trading can happen without tossing prices around too much. Deep pools mean big trades don’t make waves in prices. This keeps traders happy because they get to trade without worry. My bots help too. They keep the order book full with buy and sell prices, making sure trades go smooth.

These strategies—the speedy trades for small gains and the big pools keeping everything stable—are my magicians’ tools. They keep the crypto seas calm and the trading ships sailing smooth. Don’t get me wrong, the waters can be choppy, but with a smart market maker’s toolbox, I can sway the crypto seas and keep the trade winds blowing fair.

Steering Through Regulatory Tides: Market Making and Compliance

Understanding the Impact of Regulations on Market Making Activities

Market makers in crypto hold great power. They ensure you can buy or sell at any time. But with great power comes great duty. These duty-makers must sail by rules to keep markets safe and fair. This is where the big word “regulation” comes in. It sets the anchors and buoys for this journey.

Rules change from land to land. In the U.S., for example, if you want to be a crypto liquidity provider, you must follow the rules of the SEC and CFTC. These are like the captains of the crypto sea. They watch over things like how deep the market is and how wide the bid-ask spread gets. Why do they care? If the market is very deep, it means there’s a lot of crypto to buy or sell. This helps prices stay more stable.

Imagine you’re playing with toy boats in a pool. If you have many boats, you can keep playing even if one sails away. That’s like having a deep market with lots of crypto. Now, if there’s only one boat and it sails away, you can’t play. That’s what happens if the market isn’t deep. Prices jump like fish because everyone wants that one boat. Crypto rules try to prevent this.

Balancing Innovation with Regulatory Guidelines: A Path Forward for Crypto Market Makers

Rules bring safety, but they cannot tie down creativity. Clever crypto market makers use algorithms to make fast trades. This keeps the crypto sea calm and prices honest. But algorithms are like wind for the boats—they need the right direction to be helpful.

The clever path is when market makers use technology but also know the compass of rules. They create trading strategies that honor the law. This means they must know about every new turn of the rudder. New things like Decentralized Finance (DeFi) bring fresh winds. DeFi lets people trade without a big exchange controlling everything. It’s like smaller boats joining the sea. But even these boats must wave hello to the captains of rules.

Crypto market making is a dance with rules and innovation. The goal is not to step on each other’s toes but to glide together. Making rules that understand crypto’s quick steps will help everyone in the dance. Market makers can bring their market making bots to make trades faster than a blink. This helps everyone get a fair chance when trading.

Smart crypto sailors always keep an eye on the horizon. They know rules will come as the crypto world grows. They work with the officials, help shape the rules, and run a tight ship. This way, crypto trading becomes a sea where all can sail, knowing there’s safety and room for exciting new adventures.

Crypto market makers play the role of both sailor and guardian of the seas. They need to know the rules like the lines on their hands. Only by working with the currents of law can they make a splash in the crypto world. It’s challenging, no doubt, but for those with the know-how, it’s also a chance to build a legacy in the digital asset world.

In this post, we dived into market making, a key player in keeping crypto markets sane. Starting from what market making is, we saw how these players help avoid wild price swings. Then, we explored how high-tech trading and bots work non-stop to make sure there’s enough ‘juice’ in the markets for trading.

We looked at smart ways market makers cash in on tiny price differences and how they help new tokens get off the ground. Lastly, we tackled the big issue: staying inside the law while shaking up the crypto world.

Think about it: these market wizards hustle every day to keep your trades smooth. They work with numbers, codes, and laws so that the crypto world can thrive. As a pro in this field, I see their grit every day. They’re crucial, and they’re fighting the good fight, even with rules changing all the time. Keep an eye on these folks – they’re the unsung heroes of our digital coin purses.

Q&A :

What is a Market Maker in the Context of Cryptocurrency?

Market makers in the world of cryptocurrency play a vital role by continuously buying and selling cryptocurrencies at publicly quoted prices, contributing to the market’s liquidity and efficiency. They act as intermediaries between buyers and sellers and aim to profit from the spread between the bid and ask prices. A well-functioning crypto market often relies on these entities to facilitate smooth transactions.

How Do Market Makers Profit in the Crypto Industry?

Market makers generate profit primarily through the bid-ask spread, which is the difference between the price they offer to buy a cryptocurrency (the bid) and the price at which they sell it (the ask). By providing liquidity and setting spreads, they aim to execute trades that capitalize on the incremental differences, often doing this across many transactions to compile significant gains.

Are Market Makers Beneficial for the Cryptocurrency Market?

Market makers bring liquidity to the cryptocurrency market, which is crucial for enabling trades to be executed without significant delays or price discrepancies. Their presence helps to ensure that buyers and sellers can transact even in less active markets, contributing to price discovery and stability during varying trading volumes and volatility levels. This makes them an integral part of the crypto trading ecosystem.

Do Market Makers Influence Crypto Prices?

While market makers help facilitate trades by providing liquidity, they are not in the business of dictating market prices. Instead, their operations are based on reacting to current market conditions to set their bid and ask prices. However, their trading activities can inadvertently affect market prices, especially in less liquid markets, by narrowing the bid-ask spread and thus influencing the price at which trades are executed.

Can Anyone Become a Market Maker in Cryptocurrency?

Technically, anyone with sufficient capital, trading expertise, and infrastructure can become a market maker in the cryptocurrency space. However, effectively operating as a market maker requires advanced technological systems, a deep understanding of the market, and the ability to manage complex risks. Therefore, while it is possible for individuals or entities to take on this role, it typically demands significant resources and professional experience.