Diving into the Latest Crypto Regulation News feels like charting unknown seas. Every day, new rules reshape how we mine, trade, and invest in digital coins. I keep my ear to the ground to bring you the freshest updates. Understanding what’s new in 2023 can shield you from storms and keep your crypto journey smooth. Read on as I navigate these changes with you, making sure you stay compliant and confident in the choppy waters of cryptocurrency laws.

Understanding the Current Climate of Crypto Regulation Updates

Overview of Cryptocurrency Laws 2023

New rules are shaping how we use digital money today. In 2023, we’ve seen big changes in cryptocurrency laws. Countries worldwide are rolling out fresh laws and looking closer at how folks use crypto. They want to make sure people stay safe. They are also thinking about how to get their share in taxes. This year, crypto tax guidance is in the spotlight. Every trader and business that deals in crypto has to pay attention.

Some places are setting up new rules for digital wallets. They say it’s to stop bad actors from misusing them. We’ve seen more governments asking for detailed info about people’s trades. They want to make sure money isn’t hiding from the law. This means your Ethereum and Bitcoin activity could get a closer look.

We’re also watching stablecoins, a type of crypto that’s meant to be steady in price. Governments want to be sure they really are safe and steady. So, they’re bringing in more checks.

And it’s not just the big names like Bitcoin and Ethereum getting attention. Even altcoins and privacy coins are getting their own set of rules.

Impact of Digital Currency Regulatory Framework Evolutions

Crypto regulation updates are not just about new rules. They change how we look at money itself! For example, some countries are talking about making their own digital cash. These are called central bank digital currencies. They could change how we spend, save, and send money.

Rules are also aiming to make trading crypto clearer and fairer. They want to stop folks from betting on prices without proper knowledge or guidance. That’s why we now have rules for crypto trading platforms too.

As for businesses, imagine you’re running a company that lets people trade or hold crypto. Now, there’s a whole list of things you must do. You have to keep an eye out for shady deals and report them. Virtual asset service providers’ laws keep getting tougher.

Even the way we handle laws across borders is changing. If you’re sending crypto to someone in another country, you’ll find more rules to follow. It’s all to keep things safe and above board.

Then there’s the smart contract legal environment. These are like computer programs that handle deals on their own. They’re super handy but also new to many law people. So, rules around them are growing.

And don’t forget, the way we confirm who’s who in the crypto world is getting tighter. We call it “Know Your Customer,” or KYC, and it’s key to follow these rules.

So, as the year goes on, keep your eyes open for the latest. From Bitcoin’s changes to global policy moves, we all need to stay sharp. For anyone who’s into crypto, understanding these laws is as important as knowing your coins!

Complying with the Evolving Crypto Tax Guidance and DeFi Compliance Requirements

The Role of Central Bank Digital Currencies Regulations

Central banks are stepping into the crypto world. They’re making rules for their digital cash. These rules aim to keep everyone safe and the economy stable. They share goals with our paper cash but must fit the digital age.

Digital money from central banks will need its own laws. These laws help avoid fraud and protect your money. Imagine a digital dollar that’s as safe as the one in your wallet. That’s the plan with these new rules. They also look at how these new coins affect banks and prices.

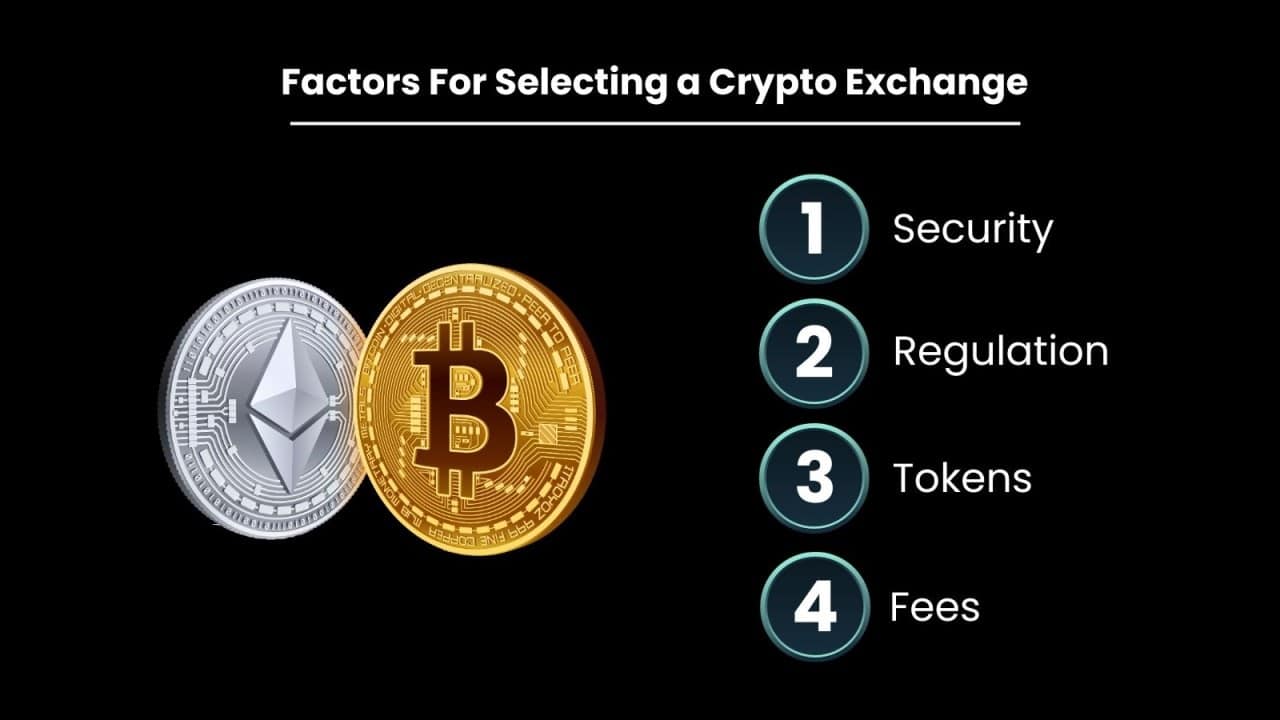

Adapting to Crypto Exchange License Standards and Virtual Asset Service Providers Laws

Crypto exchanges and virtual asset service providers must follow the rules too. They need licenses to operate. This means they must show they are fair and will not scam you. These rules also help fight money laundering. By taking these steps, they prove they are safe and trustworthy.

Each country may have different rules for these licenses. Exchanges need to check local laws and work with regulators. This means they have to know about anti-money laundering laws. And they must follow them strictly to keep their licenses.

Keeping up with crypto tax changes can be tough. Now, many countries want to know about your crypto income. The rules can differ a lot – from what counts as income to how you report it. The rules are still changing, and it’s important to stay current.

DeFi platforms also have compliance tasks. They need to look out for who’s using their services. They must identify and stop bad actors. This helps protect all users and follows the law.

In this fast-moving space, new rules can pop up anytime. It takes work to keep exchanges and DeFi services on track. Staying in the know about these changes is key for businesses and users alike. This helps avoid surprises and ensures you’re always trading safely and legally.

Ensuring Compliance Amid Global Cryptocurrency Policy Shifts

Navigating Anti-Money Laundering Crypto Rules

As a crypto pro, I’m here to help you stay clean with the law. We all know money must be clean. So, here’s the deal with new rules for anti-money laundering in crypto. Countries around the world are saying, “We need to know who’s sending crypto cash and why!” They’re making strict rules to spot bad guys using crypto for dirty money.

What does this mean? If you run a crypto business, you must check who your customers are. You have to ask them for IDs, like driving licenses, and keep these records. No excuses. You must also watch all transactions carefully. If something looks fishy, you tell the government right away.

This helps keep everyone’s money safe. Think of it like having a guard who checks ID before anyone enters a party. It makes sure those who join play by the rules.

Addressing the Expansion of Stablecoin Oversight and Digital Wallet Regulatory Criteria

Now, let’s talk about stablecoins. These are like the steady ships of the crypto sea. They don’t wave up and down like other coins because they’re tied to real stuff like dollars or gold. But just because they’re stable doesn’t mean anyone can sail without a map.

Governments want to know: “Are these stablecoin folks playing fair? Are they really holding dollars like they say they are?” So they’re keeping a closer eye on them now. They ask stablecoin makers to show proof that they have the real money for every coin out there. This way, every coin is like a ticket that you can trade for a real dollar bill anytime.

And for digital wallets? Think of them as the pockets where you keep your digital coins. The rules now say, “Show us whose pocket that is!” Wallet providers need to make sure they know their customers just like the exchanges do. You can’t just have a wallet with no name on it anymore. It has to have your ID tied to it, so nobody can say, “It’s not my wallet,” if they get caught in trouble.

That’s the scoop on sailing the crypto sea these days. You’ve got to have your papers ready and fly the flag of trust. Keep your boat tidy, and you’ll ride the waves just fine.

Responding to Enforcement and Regulatory Guidance within the Crypto Sphere

SEC Cryptocurrency Enforcement Actions: Recent Trends

The SEC has been on high alert. The mission? Protect investors. Keep markets fair. Bust only the bad players. What’s happening now? More SEC crypto actions than ever. Think of them as crypto cops, patrolling digital streets. Their target? Scammers, secret ICOs, sneaky exchanges. If you’re playing by the rules, no sweat. But break them? Expect trouble.

They look at how crypto firms work. Does a new token look like a sneaky security? The SEC will call it out. They’re not against crypto. But they hate tricks that hurt investors. And they’re good at finding them. Just ask the folks behind Ripple. They felt the sting when the SEC called their XRP token a security.

So, what do you do? Be clear with investors. Know the rules. If you’re launching an ICO, tread carefully. It’s not the Wild West anymore. Be ready to explain your token. Why it exists. How it works. Keep investors in the loop. A thumbs up from the SEC can mean smooth sailing.

Aligning Blockchain Operations with New Anti-Money Laundering Standards and KYC for the Crypto Industry

Keeping crypto clean is a big deal. Governments don’t like dirty money in digital form. Enter AML and KYC rules ― a one-two punch to wash that money clean. If you’re running a crypto exchange, listen up. You need to know your customer, no kidding. Name, address, the whole nine yards. Why? To stop bad money moves. And it’s not just for show.

See those big headlines about crypto crime? They’re why we now have tough AML standards. It’s not just a checkbox. It’s your shield against the dark side of crypto. Play by the rules or face stiff fines. But it’s not all stick ― there’s a carrot, too. Do it right and build trust. Trust means more users. And more users mean good business.

And here’s the kicker. It’s not just about signing up new customers. You gotta watch the money move. Big transfers? They need a closer look. Got a strange feeling about a deal? Dig deeper. Block the shady stuff. The aim is to keep everything on the up and up.

In a world that changes fast, one thing stays the same: Play fair, stay informed, and adapt. Stick to this, and you can ride the crypto wave without wiping out.

In this blog, we dove into the thick of crypto rules in 2023. We explored how laws shape the use of digital cash today. I broke down what you need to know about taxes, DeFi, and central banks. The way we handle crypto exchanges and licenses was also a hot topic.

We tackled how global policy changes affect your crypto choices. Anti-money laundering steps and stablecoin rules also got some spotlight. In the end, I talked about the SEC’s moves in crypto and keeping up with blockchain rules.

I hope you now see the big picture in crypto law. It’s tricky, but staying informed is key. Stick with me, and let’s keep our crypto clean and in line with the law. Stay sharp and stay compliant!

Q&A :

What are the recent updates on cryptocurrency regulations?

The landscape of cryptocurrency regulation is rapidly evolving to address concerns related to investor protection, market integrity, and financial crime. Recently, several countries have taken steps to define and regulate digital currencies, focusing on taxation, compliance with monetary policies, and anti-money laundering (AML) strategies. For the latest developments, it is advisable to check with reliable financial news sources and official government releases.

How are governments responding to the rise of cryptocurrencies?

Governments worldwide are formulating responses to the rise of cryptocurrencies that range from embracing the technology to taking a more cautious approach. Some jurisdictions are exploring the creation of their own digital currencies, known as Central Bank Digital Currencies (CBDCs), while others are implementing strict regulatory frameworks for exchanges and initial coin offerings (ICOs) to protect investors and deter financial crimes.

Can changes in crypto regulations affect the market value of cryptocurrencies?

Yes, changes in regulatory frameworks can have immediate and profound effects on the market value of cryptocurrencies. Regulatory news can lead to market volatility as investors respond to the potential impacts on accessibility, stability, and legality of crypto assets. Clarity in regulations can attract institutional investors, whereas unfavorable regulation can lead to decreased market participation.

What should investors know about the latest crypto compliance requirements?

Investors should be aware that compliance requirements are becoming more stringent as part of the global effort to integrate cryptocurrency into the financial system responsibly. This means enhanced due diligence, know your customer (KYC) checks, and adherence to new reporting standards. Investors should consult with financial advisors or legal experts to navigate the latest requirements in their jurisdictions.

How is international cooperation shaping the future of crypto regulations?

International cooperation is key to creating a standardized regulatory framework for cryptocurrencies. Organizations like the Financial Action Task Force (FATF) and various economic unions are working towards global guidelines that combat illicit activities while fostering innovation. Collaboration among countries can lead to widespread adoption of best practices and more consistent enforcement of regulation.