Dive in as we crack open the historical trading volume of top crypto exchanges. It’s no secret that these digital market hubs are the battlegrounds of modern finance. You’ve seen the surges and plummets of Bitcoin and other altcoins, but have you ever wondered about the exchanges themselves? From kings like Binance to the buzzing hive of Decentralized Exchanges (DEXs), every twist and turn tells a tale. We’ve got the charts, the inside scoops, and the raw facts that will change how you see these crypto coliseums. If you’re set to uncover the guts and gears of the crypto world’s trading titans, let’s lift the veil on their vital stats and startling stories.

The Evolution of Crypto Exchange Volumes: A Retrospective

Tracing Back the Bitcoin Trading Volume Trends

Remember the early days when Bitcoin was just a tech oddity? Now, it’s the king of trades! Back in 2009, in the wake of its creation, trading volume was nearly non-existent. It was a time of discovery, with folks tinkering with the idea of digital money. Fast forward to 2010, we saw a humble beginning. Someone even bought two pizzas for 10,000 bitcoins! A deal they might regret now.

As Bitcoin’s fame grew, so did its trading volume. We saw this clearly by 2013 and 2017, during Bitcoin’s first real peaks. These were times of huge jumps in trade. People from all over joined the rush, eager to get a slice of the action.

Changes in Bitcoin’s price had a massive effect on the volumes. When prices shot up, more and more trades happened. It was a rollercoaster, full of ups and downs. And as these trends kept going, exchanges became more developed and secure, inviting more traders to join.

Ethereum and Altcoins: A Historical Liquidity Outlook

Now let’s talk Ethereum and other coins, the so-called “altcoins.” Ethereum popped up in 2015 and quickly made waves. The birth of Ethereum invited new kinds of assets, like ICO tokens, into play. Unlike Bitcoin, Ethereum was more than money – it was a platform.

From there, altcoins bloomed. Each had its own story, its own value offering. Traders were lured by the potential of high rewards. And boy, did the trading volumes tell a tale of growing interest!

Let’s not forget the wild year of 2017, when ICO madness took over. New tokens popped up left and right, and trading volumes went sky-high. But it wasn’t just about quantity. Quality mattered too. Some exchanges rose to the top because they offered better security or more choices.

By tracking monthly and yearly exchanges metrics, we see the real scale of growth. Ethereum and altcoins showed us that the crypto world could be diverse. And it could offer a lot. With every new technology on the blockchain, traders got new opportunities. This offered a richer trading experience.

As a crypto analyst, I dig into piles of data. I look at historical exchange volume for Bitcoin, the flow of Ethereum’s liquidity, and the rhythms of altcoin trades. This isn’t just numbers on a screen. It’s a living history of digital money – our modern gold rush.

Peering through these numbers, we get a picture of the market’s heart. The loud beats during price surges and crashes. The silent hum when things are stable. Every figure tells a story of investors, traders, and a market that’s alive and kicking.

So, that’s our trip down memory lane. We’ve explored the starting line of Bitcoin’s trade tales. We dove into Ethereum’s liquidity saga and the altcoin variety show. It’s amazing how far we’ve come. From almost no trades, to a bustling world brimming with digital coins that continue to captivate our wallets and imaginations.

Comparative Volume Analysis: From Top Exchanges to DEX Platforms

Centralized Giants: Binance and Coinbase Volume Journeys

When we talk numbers, Binance and Coinbase lead the pack. Binance began as a small startup in 2017. Now, it moves billions in Bitcoin daily. Back in 2017, it reported less than $200 million in daily trading volume. Fast forward to today and those volumes can sky-rocket to $40 billion on a wild day. That’s a jump of 20,000 times!

Coinbase also took a wild ride. Its volume kicked off slower before the boom of 2017. It went from doing millions to hitting up to $9 billion daily. This growth hasn’t been steady, though. It sees ups and downs with Bitcoin’s price swings.

Rise of DEXs: Analyzing Historical Trading Volume Shifts

Now let’s chat DEXs, or decentralized exchanges. The name’s a giveaway. They let people trade without a central power. Uniswap, a top DEX, has changed the game. It went from no name in 2018 to a place where millions of Ethereum swap hands daily.

Volume tells us the health of an exchange. More volume means more action. It can show trust in an exchange or interest in certain cryptos. Early DEXs struggled to pull traders from giants like Binance. But they’ve become hot spots now. Their monthly trading can hit billions, standing tall next to the central heavyweights.

To track how high the volumes are today, just look at CryptoCompare or a Bitwise report. They have the down-low on crypto volumes and help you spot hinky data.

In sum, volumes at Binance and Coinbase have inflated like a balloon. They’ve blasted past their early days by a long shot. DEXs started slower but now claim their slice of the volume pie. Keep your eyes peeled on these trends. They map out where the crypto world is heading.

Interpreting Reported Data: Accuracy and Market Impact

The Role of CryptoCompare and Bitwise in Data Integrity

CryptoCompare and Bitwise help us trust market numbers. They check data for honesty. CryptoCompare reviews top exchanges to see if their volumes make sense. Bitwise reports show some volume claims are not true. We learn which numbers we can trust. Trustworthy data is gold in trading.

Crypto trading data can fool us if not checked. Some exchanges inflate their volumes. They do this for a better rank or to look big. CryptoCompare and Bitwise catch these tricks. How do they do this? They look deep into trade patterns and order books. They check if said trades could really happen. This is a big help for crypto traders.

For example, Bitwise claimed 95% of Bitcoin trading volume was fake in 2019. This shocked many. But it was a wake-up call to look closer at data. After that, exchanges started to clean up their act. Trust in numbers grew. Now, we look at numbers from CryptoCompare’s exchange review and feel sure. We know they toss out the fake stuff.

Good data lets us trade better and smarter. It helps us predict where Bitcoin and others are heading. CryptoCompare’s thorough reviews give us the real score. Bitwise guides us to true and accurate trading volume. They both help us dodge the lies. They are the guards of crypto data honesty.

Exchange Market Cap vs Volume: Making Sense of the Numbers

Market cap tells us worth. Volume shows how much trading happens. Bigger cap does not always mean more trades. We compare these to really see an exchange’s strength.

An exchange might have huge market cap. This comes from big coins like Bitcoin. But does it trade a lot every day? Not always. Trading volume often paints a truer picture. This number never lies. It shows how active traders are. It tells us if an exchange is really busy. We look at this and understand the market better.

Big trading numbers mean lots of action. It means people are trading back and forth. High volume gives more chances to buy or sell. It means the market is deep. You can jump in or out without pushing the price too much.

But small volume is tricky. It can cause prices to swing wide. These swings can be ups or downs. Small volume can also mean fewer coin options. It can mean less buzz and fewer traders. People might see this and not want to trade there.

What if an exchange has big volume but low market cap? That’s rare, but it happens. This can mean it’s popular for some reason. Maybe it has lower fees or faster trades. Maybe traders like one coin it offers.

In conclusion, comparing cap and volume is smart. It shows us more than just numbers. It shows the health of an exchange. It helps us choose where to trade. It leads us to safer, stronger places to invest. Next time you look at these numbers, think about the real market life behind them.

Trading Patterns and Volume Growth: Key Insights for Traders

Monthly and Yearly Crypto Exchange Volume Reports: A Deep Dive

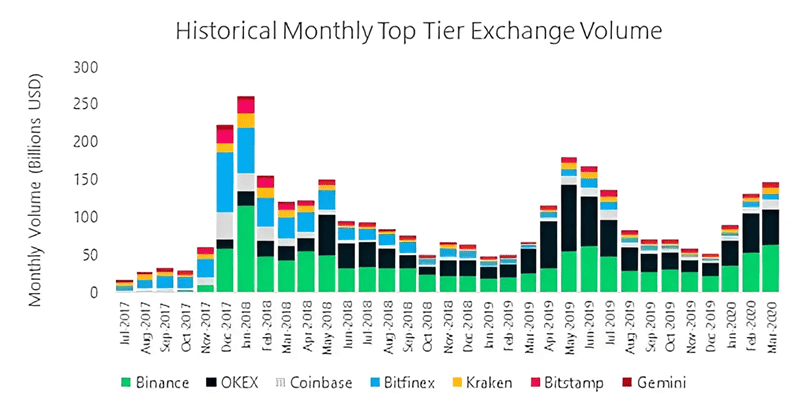

Every month, traders get fresh data. We all dive in to see how crypto moves. The top crypto platforms volume shows us who leads and who follows. Binance volume history tells a tale. It grew fast, making it a king of crypto trade. But it’s not just about one player. We track every big name. Why? To spot patterns. Coinbase, Kraken, Bitfinex – they all have stories.

It’s like a puzzle, with daily crypto trading volumes as pieces. Put it together, and you see the full picture of trade volume growth crypto. We scour the numbers, from Bitcoin’s ups to altcoin exchange volume analysis. Why again? Because with this map, traders spot trends before they’re news. They ride waves or dodge crashes. It’s all about that edge.

And the yearly trading volume crypto exchanges show? Even bigger trends! Think of it like a movie of crypto’s life. How did Ethereum historical liquidity change? What about shifts in fiat to crypto trading volumes? Yearly reports wrap this up in one big picture.

High-Volume Crypto Exchanges and Their Market Influence

Let’s talk about heavy hitters. High-volume cryptocurrency exchanges shape our world. They decide if a coin flies or falls. Their power is in their trade. The more they move, the more they lead.

Kraken historical liquidity analysis isn’t just fun stats. It shows influence. When Kraken moves, others watch. The same goes for Huobi volume trends and OKEx trading statistics. These are market makers. Their crypto market cap vs volume tells a rich tale. More cap and less trade could mean less real use. Or the opposite! Big trades and low cap could signal a sleeper hit.

On top of that, exchange market data crypto gives us clarity. How? By showing who truly trades and who just pretends. Volume can be pumped up, making a ghost look alive. It’s our job to spot these tricks.

Look, this isn’t just numbers. It’s a living story of digital coins weaving through our world. As a trader, you get to both read and write this story. Exciting, right? Each month, each year, you get new chapters. With a sharp eye on these patterns, you steer your own ship in the vast crypto ocean. So, set sail and use the historical exchange volume Bitcoin and friends give us. Make waves, chart new routes, and maybe just find a treasure on your trading voyage.

In this blog, we’ve looked back at how digital money like Bitcoin and Ethereum have changed trading forever. We saw their trading grow and felt the impact of new online spots to swap these coins, changing from just a few big names to a world full of choices.

We compared old and new ways to trade and found that where we trade matters. The numbers we see in reports paint a picture of the market that’s not always spot on.

For those trading, watching how volumes shift over months and years gives us clues about where the market’s headed. Big exchanges still shape our trading world, but now there’s room for new players too.

To sum it up, the journey of crypto trading volumes teaches us about the market’s past, and arms us with knowledge for the future. Keep an eye on the shifts, check the facts, and happy trading!

Q&A :

How do I find the historical trading volume of top cryptocurrency exchanges?

To uncover the historical trading volumes of top crypto exchanges, start by visiting the exchanges’ websites or market analysis platforms like CoinMarketCap, CoinGecko, or CryptoCompare. These resources often provide comprehensive historical data on trading volumes that can be filtered by date range and currency pairs. Additionally, for some exchanges, an API service might be available to retrieve this data programmatically. Remember to verify that the data comes from a credible source to ensure accuracy.

What tools can I use to track trading volume changes of major crypto exchanges?

A range of tools and services are available for tracking trading volume changes including:

- Analytics platforms: CoinMarketCap, CoinGecko, and CryptoQuant offer detailed insights into the trading volumes of various exchanges.

- Exchange interfaces: Most leading exchanges provide their own historical data to users directly within their platforms.

- API services: Many crypto exchanges offer APIs, which allow users to fetch historical trading volume data for analysis.

- Trading software: Some advanced trading applications and platforms include volume tracking and historical data analysis features.

Always look for tools that offer not only real-time data but also historical insights, which are crucial for informed decision-making.

Why is knowing the historical trading volume of crypto exchanges important?

Understanding the historical trading volume of cryptocurrency exchanges is vital for several reasons:

- Market Analysis: It helps traders and investors spot trends, high liquidity periods, and market sentiment.

- Due Diligence: When assessing the reliability and standing of an exchange, consistent high trading volume can be an indicator of trustworthiness and user adoption.

- Investment Decisions: It aids in making better-informed decisions, as volume often correlates with price movement and stability.

- Comparative Analysis: Traders can compare the performance of different exchanges and choose where to allocate funds for optimal trade execution.

Can the historical trading volume of crypto exchanges predict future market movements?

While historical trading volumes can provide insights into past market behaviors, they should not be solely relied upon for predicting future market movements. Crypto markets are influenced by a wide variety of factors, including global economic events, regulatory news, technological advancements, and market sentiment. However, analyzing patterns in trading volume can help form one element of a comprehensive market analysis.

Where can I find a historical comparison of trading volumes across different cryptocurrency exchanges?

For a historical comparison of trading volumes across various cryptocurrency exchanges, you can explore:

- Market aggregator websites: Platforms like CoinMarketCap, CoinGecko, and TradingView offer historical trading volume charts and comparison tools across multiple exchanges.

- Research papers and reports: Crypto research organizations and financial analysts often publish comparative studies of exchange volumes.

- Community forums and social media: Discussions on platforms like Reddit, Twitter, and crypto-focused forums sometimes share insights and analyses on exchange volume history.

Make sure you check the date and relevancy of the data when consulting such comparisons to ensure it reflects current market conditions.