Diving into the digital currency market without the right features of crypto charting tools is like surfing blind. You need the sharpest tools to carve through waves of data for making those crucial trade decisions. Here’s the deal: chart indicators aren’t just lines and bars—they’re your treasure map. Candlestick patterns whisper market stories; volume indicators shout where the action’s at for altcoins. But wait, there’s more! Real-time graphing gives you the power to act fast, and technical analysis tools? They’re your crystal ball for price predictions. Plus, when you mix multi-timeframe insights with on-chain data, you’re not just playing the game; you’re rewriting the rules. Ready to trade like a pro? Let’s get started.

Demystifying Chart Indicators for Digital Currency Trading

Understanding the Significance of Candlestick Patterns

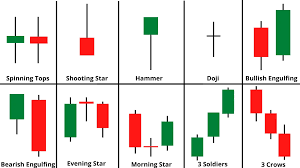

Let’s talk candlesticks – they’re not just for fancy dinners! In crypto, they tell you a story of what’s happening in the market. Think of each candlestick as a snapshot of a fight between buyers and sellers. The color tells you who won that round – green for buyers and red for sellers. It’s not just about wins, though. How long the candlestick is tells you about the fight’s range. Big ones mean a lot of action between high and low prices. Little ones, called Doji, show a tug-of-war with no clear winner.

Why fuss over candlesticks? They signal when to jump in or out of trades. Spot patterns, and you could catch a trend right as it kicks off, or ditch a bad deal before a drop. Patterns like bullish engulfing or the dreaded bearish harami can tip you off.

Candlesticks are the heroes of chart analysis. They pull back the curtain on market emotions, and with practice, you can read them like a storybook. Using trading view crypto features makes it a breeze to see these patterns in real-time. You can craft your own trading tale with a happy ending!

Implementing Volume Indicators for Altcoins

Let’s shift gears to volume – it’s like the beat to crypto’s music. Why’s volume a big deal? It confirms if a price move is the real deal or just fluff. When prices jump and volumes are sky-high, it’s like the crowd is cheering. That’s a good sign! But if prices shift and no one’s clapping (low volume), something’s fishy.

Altcoins, our crypto cousins, can sometimes throw curveballs. Their volumes can be spookier due to fewer trades. This is where volume indicators come into play. They help you peel back the layers of an altcoin’s market action. Tools like the On-Balance Volume (OBV) act like crypto detectives, tracing the flow of money in and out of an altcoin.

Volume indicators are your flashlight in the dark alleys of crypto trading. They can lead you to hidden gems or spare you from a bad trade. Mix them with candlestick patterns and you’ve got a dynamic duo. Together, they give you a clearer picture of the altcoin jungle.

It’s a wild market out there in the digital currency trading world. But when you use these chart indicators, you’re not just wandering around – you’ve got a map and a compass. Dive in, get your hands on the crypto chart analysis tools, and start your treasure hunt!

Real-time Crypto Graphing and Trading View Features

Maximizing Trading View Crypto Analytical Functions

Crypto traders, listen up! To stay on top, you need good tools. Trading view crypto features are gold. They give you charts that show price moves as they happen. It helps you make quick, smart choices.

Take candlestick patterns in crypto trading. They tell you if prices might go up or down. They’re like secret codes to a trader’s success. With trading view, you see these patterns live. This means you act fast, ahead of others.

Volume indicators for altcoins are key too. They show how much altcoin is traded. It’s a clue to where the market’s heading. More trading can mean a big price move is near. So, watch these to predict changes.

Now, altcoin trend analysis is about spotting trends. You use historical data for cryptocurrency charts to do this. With trading view, this data is right at your fingertips. It shows you if altcoins might rise or fall.

We can’t forget crypto price prediction tools. They try to tell you future prices. With Trading View, you get these predictions live. This means you make smarter bets on what’s coming.

Mastering Real-time Crypto Graphing for Strategic Decisions

Graphing in real-time? It’s a must for winning at crypto trading. Things change fast here. Real-time crypto graphing keeps you up-to-date. It’s like having a superpower in the crypto world.

Interactive crypto charts let you dig in deep. You can zoom in, move around, and see just what you want. This lets you focus on the details that matter to you.

Custom alerts in crypto tools are lifesavers. Set them for prices or trends you care about. When they hit, you get a buzz. It’s like having your own lookout.

Market sentiment widgets help you feel the mood. They’re like the crowd’s roar in a stadium. You sense if traders are happy or worried. Use this to decide if you should dive in or back off.

Crypto trading is thrilling. It’s full of ups and downs. With these tools, you’re set to chase the wins. Just remember, quick and smart moves are key. Use what you’ve learned and go get those gains!

Advanced Technical Analysis with Crypto Price Prediction Tools

Utilizing RSI Divergence and Fibonacci Retracement

Let’s dive into some cool tools you can use for crypto trading. One of these is the RSI Divergence. It shows if a coin’s price may change. How? It compares price moves to the RSI indicator. If they don’t match, get ready – a price swing may be near!

Now, let’s talk about Fibonacci Retracement. It’s a bit like a roadmap for prices. You see, after a big price move, it’ll often retrace a bit. Fibonacci levels show us where it might pause or turn around. It’s like stopping at gas stations on a long road trip.

Many traders check these levels before making a move. Using them can help you guess where to enter or exit a trade.

Navigating Bollinger Bands and MACD in Crypto Markets

Think of Bollinger Bands like guardrails on a road. They help tell you how far a coin’s price might swing. When the price hits the band’s edge, it could mean a change is coming.

The MACD is like a weather forecast but for markets. It helps see the trend strength and direction. It also spots trend reversals. If two MACD lines cross, it’s like a weather change. It signals traders about possible entry or exit points.

Both these tools are part of your trading toolkit. They guide you in a market that’s always moving. Use them well, and they can help you make smart, informed trades.

Integrating Multi-Timeframe and On-Chain Data for Comprehensive Analysis

Deploying Backtesting Strategies and Interpreting Order Book Depth

Trading is tough. But what if you could practice before going live? That’s where backtesting comes in. It lets you test your trading ideas using historical data. Think of it as a time machine for your trades. It shows if your strategy would have worked in the past. If it worked before, it might just work again.

Now, let’s talk order books. They show all buy and sell orders in the market. A deep book means a lot of orders. It’s like a big crowd at a concert all yelling their prices. A thin book? Not so many orders. Spotting big changes in these books can clue you in on market moves.

Enhancing Investment Strategies with Portfolio Tracking Features

Let’s switch gears to the power of tracking. Watching over your coins is key. With portfolio tracking features, you can watch all your assets in one place. This keeps you sharp on how your choices are playing out.

Imagine having an eagle eye on your investments, seeing how they rise and fall. You learn your wins, your losses, and get smart on what to do next. The best part? If a coin is diving or soaring, you can react fast. This is like having a personal coach for your coin collection, guiding your moves for big wins.

Both these tools, backtesting and tracking, are part of the crypto battle gear. They’re what you arm yourself with to face the wild crypto world. Use them well, and you’ll navigate through ups and downs like a pro!

We’ve covered a lot in this guide to chart indicators for crypto trading. From candlestick patterns that tip us off to market moves, to using volume indicators to get the scoop on altcoins. We looked at how real-time graphing and Trading View can sharpen our trades. Sure, those analytical functions and graphing tools need some practice, but they’re gold for smart choices.

Don’t sweat the advanced stuff, either. RSI Divergence, Fibonacci, Bollinger Bands, and MACD are your new pals for nailing crypto price predictions. And yeah, we can’t forget multi-timeframe and on-chain data. They’re key for deep analysis. Backtesting and peeping into that order book depth reveal the market’s mood, so use them well. Plus, portfolio trackers? They’re your wingman, helping you stay on top of your game.

In short, these tools and strategies can give you an edge. The more you know and use them, the more you set yourself up for success. Trading’s a tough game, but with these insights, you’re playing to win. Stay sharp and keep learning – that’s how we stay ahead in the crypto universe. Happy trading!

Q&A :

What are the essential features to look for in crypto charting tools?

When choosing crypto charting tools, traders should look for several essential features to aid in their analysis. Notably, tools should include a range of chart types (such as line, bar, and candlestick), customizable indicators (like moving averages, RSI, and MACD), real-time data, and market depth. Additional useful features might include drawing tools, multiple time frame analysis, and the ability to backtest strategies.

How do crypto charting tools enhance trading decisions?

Crypto charting tools enhance trading decisions by providing in-depth analysis of market trends and price movements. With advanced charting features such as technical indicators and analytical drawings, traders can identify patterns and signals that help to predict future price movements. This advanced analysis enables traders to make more informed decisions on entry and exit points, as well as managing risk more effectively.

Can crypto charting tools predict market movements accurately?

Crypto charting tools provide an analytical framework for understanding market trends and potential future movements. However, they do not guarantee accurate predictions as the cryptocurrency market is highly volatile and influenced by unpredictable factors. What these tools offer is the ability to analyze historical price data and various indicators that can inform a trader’s predictions and strategies.

What makes real-time data important in crypto charting tools?

Real-time data is crucial in any crypto charting tool because the cryptocurrency market operates 24/7 and is exceptionally volatile. Having access to real-time information allows traders to react quickly to market changes, capitalize on trading opportunities as they arise, and make decisions based on the most current market data available.

Are there free crypto charting tools available that offer comprehensive features?

Yes, there are several free crypto charting tools available which offer a range of comprehensive features comparable to paid versions. These tools often include various chart types, a selection of technical indicators, and sometimes even social media sentiment analysis. However, they may have limitations in terms of the number of features, the frequency of data updates, or available customer support when compared to premium tools.