Venturing into the crypto realm can feel like diving into uncharted waters; a sea brimming with opportunities yet fraught with uncertainty. Straight from the trader’s desk, factors to consider when choosing a crypto exchange are vital navigational tools in these digital depths. As someone who breathes market trends and has charted through the ups and downs of cryptocurrency waves, I know that where you trade can make or break your investment journey. Let’s cut the fluff and dive into the checklist that every astute trader should tick off – from ironclad security measures to the subtleties of user support. Join me in dissecting the essentials that will anchor your trading ship in a harbor that’s not just safe, but ripe for your financial exploration.

Security Measures and User Protection

Exploring the Importance of Crypto Trading Platforms Security Features

When you dive into the world of crypto trading, your safety comes first. You need to pick a place that keeps your coins and data under lock and key. Let’s talk about the must-have safety nets of any exchange worth its salt.

Two-Factor Authentication and Cold Storage Asset Protection

Keep eyes peeled for two-factor authentication (2FA). This adds a second check to make sure it’s really you trying to get in. Have your pick between a text code, an app, or a hardware token for this. Giving your nod to an exchange with 2FA is a big thumbs up for security.

When we talk about cold storage, we’re talking Fort Knox for crypto. It’s about keeping a bulk of assets offline, away from the sticky fingers of online thieves. If an exchange uses cold storage, you know they mean business in shielding your treasure.

Insuring Your Investments: The Role of Insurance Funds for Digital Assets

Now, for insurance funds – think of them as a safety blanket. If something goes south, like a big hack, this pot of money can help refund what you lost. Not all exchanges have them, so it’s key to check.

It’s simple, if an exchange tells you they have insurance funds, they’re adding another level of trust. You want to feel at ease knowing your investments have a backup. Plus, it shows the exchange is serious about guarding your assets.

Now that we’ve walked through the need-to-haves for security, let’s drill down a bit.

2FA is your main gatekeeper. It checks who’s trying to enter your crypto world. Without the keys – which only you hold – no one’s getting in. It’s like having a watchdog that barks only when you tell it to.

Cold storage means most of your assets are stored in a digital safe with no internet access. It’s the best way to keep the majority of your assets secure. Think of it as storing your gold in a vault deep underground, where no robber can reach.

Insurance funds show that your chosen platform prepares for the worst. It’s their promise that they’ve got your back. It gives you peace of mind that even if a disaster strikes, your assets won’t vanish into thin air.

Each feature we’ve talked about serves to put up a strong wall around your assets. They make sure you can trade with confidence, without a constant worry about what could go wrong. Remember, it’s all about trading safe and smart. When you’re checking out exchanges, make these your top checkboxes for a secure crypto experience.

Liquidity, Fees, and Asset Accessibility

Understanding Exchange Liquidity and Trading Volume

Let’s talk shop about crypto exchanges. You might ask, “What’s exchange liquidity?” Well, picture this: You want to sell your crypto fast, right? High liquidity means you can do just that. It’s like being at a busy marketplace where buyers and sellers are always ready. So, high trading volume equals more money moving, which equals better liquidity.

Now, why does that matter to you? Simple. A high trading volume often means you’re getting fair prices and quick trades. Nobody likes to wait, especially in the fast-paced crypto world.

Examining Cryptocurrency Transaction Fees and Fiat Currency Support

What about the fees you pay to trade? They can take a bite out of your wallet. Every trade, every move you make, they charge you. Some are small bites, others, well, not so much. But here’s a tip: Compare fees before you dive in. Each platform has its own menu. And fiat currency support? That’s about how you get your money in and out. Can you use dollars, euros, yen? Check it. It matters.

Asset Selection and Order Types: Crafting an Inclusive Trading Strategy

Asset selection is another biggie. It’s the coins you can trade. Some exchanges offer a wide variety, others just a few. You want options, right? So pick a place with a menu that makes your mouth water. And then, there’s order types. These are tools in your toolbox, ways to trade smarter. Market orders, limit orders—the works. They can help you get ahead, or at least, help you not get left behind.

So, remember this checklist: Look for high liquidity for quick trades. Keep an eye on fees to safeguard your loot. Check if you can use your local cash to trade. Make sure you’ve got a luscious list of coins to choose from. And finally, check they’ve got all the order types you need to trade like a pro. Got it? Good. Now go get ’em, tiger.

Regulatory Compliance and Platform Reliability

The Need for Regulatory Compliance in Crypto Exchanges

When we pick a spot to trade crypto, we must check if the law backs it. Yes, top-tier trading spots follow strict rules. They follow anti-money laundering (AML) polices and know your customer (KYC) steps. This builds trust and safety for our money. We don’t want to link up with dodgy exchange activities.

Such spots check who you are and watch out for shady money moves. This also means the site won’t vanish with our coins. That’s why we need to think hard about regulatory compliance before we join a new crypto market place.

Assessing Exchange Uptime Reliability and Its Significance

Now, let’s chat about uptime. It means how often the site stays up, no crashes. We need a spot that stays on, even when many folks want to buy or sell. If it crashes, we might miss a good chance to trade. A reliable exchange is one with great uptime stats. It gives us peace of mind that we can trade any hour.

If the market moves quickly, an exchange going down is bad news. We could lose cash if we can’t jump on a trade. So, we check if the exchange we like can deal with big trade waves. That’s key for sticking with them.

Decentralized vs Centralized Exchanges: Benefits and Drawbacks

The fight between decentralized and centralized spots is heating up. Each one has good sides and bad. Decentralized ones let us trade straight with others, no middle man. They give us privacy and drop fees but might lack in speed and features.

Centralized spots, on the other hand, are faster, have more tools, and customer help ready. But they keep our info, and if they get hit by a cyber-thief, we might lose out.

So, do we want a fast, full-service spot? Or one that keeps our deals private but has less gloss? Centralized or decentralized? That’s a big choice we all face in the crypto world. It shapes how we trade and what risks we might meet. Let’s weigh the pros and cons before we jump in.

User Experience and Support

Navigating the User Interface of Crypto Exchanges

Finding the right crypto exchange feels like picking out a new phone. You want one that’s easy to use, with big shiny buttons that you can’t miss. That’s how a good user interface (UI) should feel when trading crypto—intuitive, clear, and hassle-free.

The UI is your trading command center. It’s where you’ll spend hours looking at charts, pressing buy or sell, and managing your digital riches. It has to feel right, like a high-tech suit tailored for you. A complex UI can scare away not just newbies but even seasoned traders.

Let’s dive a bit deeper into the UI pond. Every crypto trader knows that time is crypto. A slow load or a hidden feature can mean missing a price dip or peak. You need a UI that shows everything in one glance, with no hide and seek. Filter options, easy navigation, and simple trade processes are a must.

Now, you spot the perfect trade setup. But wait, how do you place that order? The best exchanges have many order types. A good UI lets you quickly find and select limit orders, stop orders, or those fancy trailing stops without a treasure hunt.

Customer Support and Educational Resources for Digital Currency Traders

So, you’ve got a sleek UI, and you’re ready to take on the crypto market. But then you hit a snag. Here’s where customer support steps in. Imagine them as your pit crew in a Formula 1 race – they can make or break your racing experience.

What if you’ve got questions? Or maybe something went wrong? If the exchange has solid customer support, you won’t be left shouting into the void. They will be there with a helping hand or a quick fix. Live chats, email support, and even a good old-fashioned phone line can be lifesavers.

As part of our trading journey, we never stop learning. Crypto changes faster than a chameleon on a rainbow. You want an exchange that grows with you, offering up-to-the-minute educational resources. Quick guides, tutorials, maybe some webinars—real gold nuggets that can turn a rookie into a pro.

These learning tools should be easy to digest. They can teach you about new coins, or how to set up two-factor authentication for an added security layer. Some exchanges also walk you through the steps if you’re into more niche moves like staking or margin trading.

In sum, a crypto exchange should fit like a glove, be there when you stumble, and help you keep learning and earning. It should let you trade with confidence and grow your skills along the way. That’s what great user experience and support are all about.

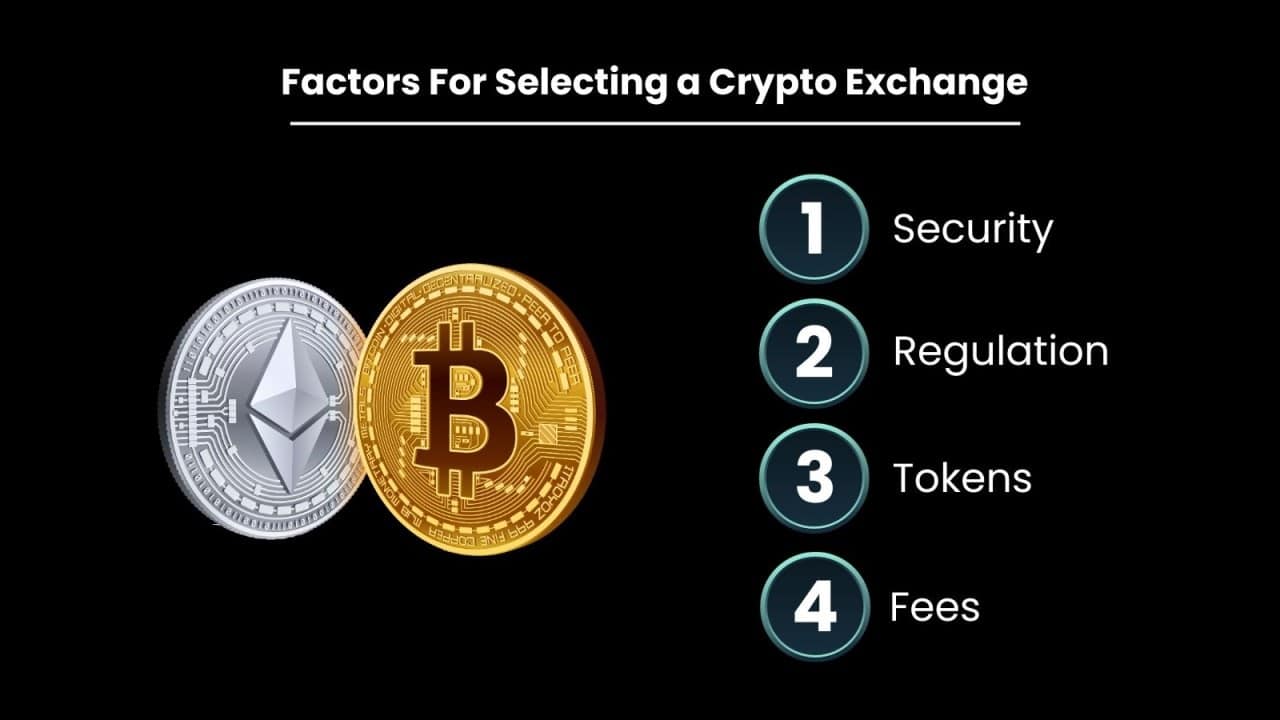

In this post, we walked through the key factors that make a crypto trading platform stand out. We started by looking at security must-haves like two-factor authentication and how exchanges keep your assets safe in cold storage. Remember, insurance funds are also crucial to protect your investments.

Then, we dove into what makes trading smooth – things like high liquidity, low fees, and a range of assets. These details can really shape your trading experience. We didn’t forget to talk about the importance of exchange reliability and staying within the law.

Lastly, we touched on the differences between centralized and decentralized platforms and what each means for you. We also covered the nuts and bolts of user-friendly features – vital for both new and seasoned traders. Good customer care and learning tools are the icing on the cake.

My final thought? Picking the right exchange is like choosing a partner in your trading journey. It must be trustworthy, supportive, and right for your needs. Pick wisely, and you set yourself up for success in the dynamic world of crypto trading.

Q&A :

What features should I prioritize when selecting a cryptocurrency exchange?

When choosing a cryptocurrency exchange, it is important to prioritize features such as security measures (like two-factor authentication and cold storage options), user interface (ease of use, mobile app availability), supported cryptocurrencies, liquidity and trading volume, fee structure, reputation and user reviews, customer support services, and compliance with regulatory standards. Depending on your specific needs, such as frequent trading or a larger variety of altcoins, additional features like advanced trading tools or the availability of fiat-to-crypto transactions might also be crucial.

How does liquidity affect my experience with a crypto exchange?

Liquidity pertains to the ease with which you can buy or sell cryptocurrencies without causing a significant effect on the asset’s market price. High liquidity on a crypto exchange ensures that orders can be filled quickly and at stable prices, minimizing the cost and time involved in trading. It also reduces the risk of price manipulation and enhances the ability to enter or exit positions. Factors that contribute to an exchange’s liquidity include a large user base, high trading volume, and a substantial number of trading pairs.

Are my investments safe with any crypto exchange?

The safety of your investments on a cryptocurrency exchange depends on both the exchange’s security protocols and your personal security practices. Look for exchanges that offer strong security features, such as SSL encryption, cold storage options for digital assets, insurance funds, and robust user verification processes. However, even with exchange security, it’s imperative to use best practices, such as setting up two-factor authentication, using safe internet habits, and considering cold wallets for long-term holding of large funds. Remember, the digital nature of cryptocurrencies often makes them a target for cyberattacks, making security a top concern.

What impact do fees have when using a crypto exchange?

Fees can significantly impact your profitability when using a crypto exchange. They can vary widely between exchanges and can include trading fees, withdrawal and deposit fees, and currency conversion fees. Typically, trading fees are a percentage of the trade value, and some exchanges offer discounted rates for high-volume traders or token holders. It’s crucial to consider both the fee structure and how often you plan to trade to understand the total cost of using a specific exchange.

How important is customer support for cryptocurrency exchange users?

Effective customer support is vital in any financial service, including cryptocurrency exchanges. Issues can arise at any time; hence, having access to responsive and knowledgeable support can greatly enhance your trading experience. Look for exchanges that offer multiple channels of support (such as email, live chat, and phone). Also, check for the availability of support in your native language, the typical response times, and whether quality help resources, such as FAQs and tutorials, are provided.