Liquid Staking Unwrapped: Unlocking Crypto’s Next Revolution

Get ready to dive right into the heart of crypto’s latest game-changer: Exploring Liquid Staking in Crypto. This isn’t just another fad. Liquid staking is shaking up how you earn in the blockchain world, giving you the power to earn rewards without locking up your assets. Think of it as having your cake and eating it too.

Forget about the locked-in funds of traditional Proof of Stake (PoS) systems. This bold shift in crypto could be your ticket to smarter earning. Stay right here as we unwrap everything you need to know from the basics, the sweet rewards, the risks you’ll navigate, to the powerful impact on the future of DeFi and governance. Ready to unlock this revolution? Let’s get started.

Understanding the Basics of Liquid Staking

Exploring the Concept: Liquid Staking Explained

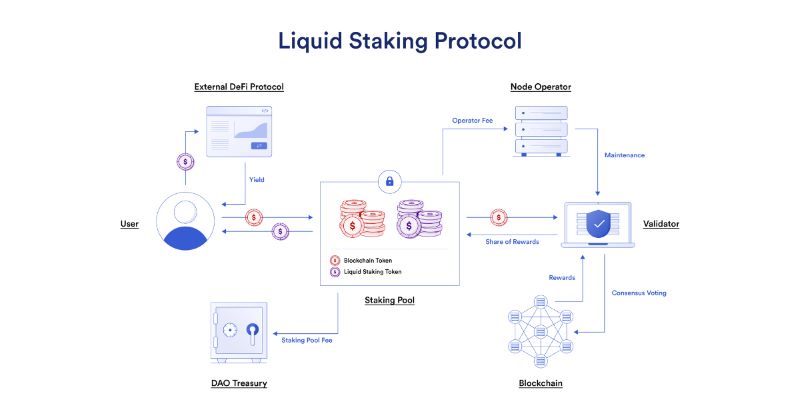

What is liquid staking? It’s a new way to earn more in the growing world of DeFi. When you stake cryptocurrency, you lock it up to help keep the blockchain secure. In return, you get rewards. It’s kind of like getting interest from a bank for your savings. But there’s a big catch in regular staking: you can’t use your coins while they are staked.

Now, here’s where liquid staking shines. It lets you stake and still have your coins work for you. With liquid staking, when you stake your digital money, you get a token. This token proves you staked, and it’s like a magic key. You can use this token to trade or to join in other parts of DeFi, like yield farming.

This means your staked coins aren’t just sitting idle. They are out there, still working for you. You keep earning staking rewards in crypto, plus, you can make even more money with that magic key token. It’s a smart way to grow your coins.

And the big hero here is Ethereum 2.0 staking. It’s getting a lot of people excited because it’s new and it could help you make more with your coins. Big changes are coming to Ethereum and they are all about staking.

Comparing Traditional PoS to Liquid Staking Methodologies

Let’s talk about the old way first. Proof of stake (PoS) has been a cool idea. Coins that use PoS don’t need huge computers that waste power to keep secure. Instead, they use staking. If you have enough coins, you can be a validator, which is like being a guard for the network. It’s a big job with big perks.

But here’s a problem: your coins are stuck while you’re a guard, and you can’t use them. If you want your coins back, there’s a wait time, called an unstaking period. Some people don’t like that because they want to be free to use their coins when they want.

Now, let’s compare that to liquid staking. With liquid staking, you also help keep the network safe. You can even join a staking pool, which is like a team of coin guards. The cool part is, you get that magic key token we talked about earlier. This key lets you play around in other DeFi games, while also being a network guard. It’s like being able to spend your money even while it’s locked up in that bank savings account.

What’s more, with liquid staking, those magic keys can become more coins too. They can give you passive income through staking. That’s money you make without doing much at all. Much like planting a seed and watching it grow into a tree of coins.

So, staking is kind of like playing a game. You put your coins in, do your part for security, and earn rewards. Liquid staking makes the game even better. You can do all that AND join other games at the same time! It’s a win-win in the crypto world. But remember, there are always risks with these games. Coins can lose value, or the rules can change. Keep that in mind while you play, and you can enjoy the game to the fullest.

The Mechanics of Earning with Liquid Staking

How Staking Rewards in Crypto Work

Staking cryptocurrency means you lock coins to help a network work. Think of it like a savings account, but for digital money. You earn extra coins for doing this. It’s like the bank pays you interest. But with crypto, it’s not a bank. It’s a big network of computers that you help out. The more you help, the more you earn!

If you’re new, this might seem tricky. But don’t worry! Most things that are worth it start out hard, then get easier. When you start staking coins, you become part of something cool called a blockchain. Blockchains are like magic ledgers that keep track of all the digital money.

By having your coins staked, you’re saying, “Hey, I promise not to spend these right now!” And the blockchain thanks you by giving you rewards. So, what you’re doing is helping to keep everything safe and running well.

When you think about liquid staking explained simply, it’s like staking with a twist. You can still earn money from your staked coins. But you can also use them for other stuff in DeFi protocols at the same time. It’s like having your cake and eating it too. Who wouldn’t want that?

Passive Income Potential through Ethereum 2.0 Staking and Other Platforms

Now, let’s talk about how to make money while you sleep. Sound good? Ethereum 2.0 staking lets you make passive income just by holding onto some Ethereum. It’s set to be a big deal. You lock up your Ethereum, the network uses it, and you get more Ethereum back. Pretty cool, right?

There are loads of platforms that let you do this. Not just Ethereum! But this one is extra exciting because it’s changing how Ethereum works. It’s moving from proof of work, which used a lot of power, to proof of stake. This is better for the planet and can be better for your wallet too.

We have these things called staking pools. They are great if you don’t have a lot of coins. You join with others to stake. This way, everyone gets to earn rewards. It’s like teaming up to get a bigger prize. And more rewards mean more passive income. That’s money that grows on its own!

Remember also that there are risks of staking tokens. Always think about this when you choose where to stake. Ask yourself, what’s the deal with unstaking? What are the staking minimum requirements? And how safe is the platform? These are key to keep your coins and earnings safe.

And if you’re worried about all the techie stuff, such as validator responsibilities in staking, don’t be! There are services out there that do the hard work for you. They’re called Staking-as-a-Service platforms. You use them for a piece of the pie without all the hard work.

The big deal about all this? Liquid staking is changing how we think about money. There’s now a way to earn without working more. It’s like planting a tree. The tree grows, and the fruit is all yours. That’s what staking does with your digital coins. And who wouldn’t want their money to grow while they’re busy living life?

Navigating Risks and Opportunities in Liquid Staking

Addressing the Risks of Staking Tokens

When you stake tokens, you might worry about risks. Let’s talk straight. You lock your coins up. This means you can’t use them for a while. This period is known as the “unstaking period.” It’s like giving your tools to a friend. You trust your friend to give them back. But, you can’t use them till they do. It’s a trade-off. You get rewards for locking them up, so it can be worth it.

The big deal is to know the risks of staking tokens and how to handle them. Yes, there can be risks like bad actors or bugs. But, picking a strong project and staking platform can help. You want one with a record of good security. It’s a bit like picking a bank. You go for the one you trust.

Another part to keep in mind is, sometimes the value of tokens can drop. Like a seesaw, when the value goes down, your locked coins might lose worth. That’s a market risk. But, over time, staking can still pay off. You get more coins, and they might go up in value.

Now, there’s something called liquid staking explained as a special way to stake tokens. It mixes earning rewards with being able to move coins if you need to. It’s like having your cake and eating it too. With liquid staking, you get a kind of ‘IOU’ token. This means you can trade or use it while you’re still earning rewards. It’s not magic. You still have to be careful. But it opens doors for using your coins in different ways while staking.

Validator Duties and the Impact on Staking Pool Advantages

What about the people watching over your staked coins? We call them validators. In Ethereum 2.0 staking and others, these folks have a big job. They make sure transactions are right and keep the network safe. Imagine them as guards, keeping watch over your staked treasure.

But why do you need them? Here’s the deal with blockchain: it’s a team sport. Validators do their part and in return, they earn rewards. When you join a staking pool, you’re trusting these validators with your coins. You expect them to do their job well. If they mess up, the pool could lose some stake. It’s serious business.

That’s why the staking pool’s choice is huge. You want one with a track record. A group that knows what they’re doing. And with the right staking pool, the advantages can be sweet. You get part of the rewards, and you don’t have to do the heavy lifting. The staking pool and validators do it for you. Plus, with more coins together, the pool gets a better chance at earning rewards.

In the end, navigating the liquid staking world is about balance. Weighing out the risks and the perks. It’s about understanding staking liquidity and making moves that suit you. With a bit of know-how, you could find it a handy way to grow your crypto pile. And remember, it’s always okay to ask questions. After all, it’s your stack on the line.

Liquid Staking: The Future of DeFi and Governance

Evolving Trends: Decentralized Finance and Governance Tokens

Let’s dive into the fresh world of DeFi. We see new things pop up like daisies! In this world, big words are scary, but big ideas? We love those! So, governance tokens are these cool keys to a door called ‘making choices.’ When you hold them, you get a say in how a project grows and changes. They’re a hot trend in DeFi, turning regular folks into decision-makers!

Now, what’s this liquid staking? Think of it like a double win. It’s staking your coins to help run a blockchain while keeping them ready to use, just like liquid. So you earn rewards and can still trade or use your coins. It mixes the best of earning and spending in one. It’s a bit like having your cake and eating it too!

Enhancing Liquidity and APY: Strategies for Staked Asset Management

Got your coins staked? Awesome. But don’t let them just sit there! Liquid staking keeps them working for you. It’s perfect for keeping things running smooth like a river. And when you mix in yield farming – that’s a way to make your coins do a little extra work – you get more out of them. Think of it as your coins having a side hustle.

You want to pick a staking method that lets you use your coins when you need them. That’s where liquid staking shines. It’s new, it’s bold, and it lets your coins move around freely. And you, my friend, can earn more through this thing called APY – how much you make over a year from your staked coins. We find ways to boost it, like picking the right pool or even adding more coins over time.

Staking isn’t just about sitting back. It’s active! You got to choose wisely, check in on your coins, and keep them earning. And always remember: the staking world has ups and downs. The more you know, the smoother your ride. Stay sharp!

In a nutshell, liquid staking in crypto is your ticket to joining the DeFi bandwagon while holding on to your freedom to move. You earn, you govern, you grow. And with the right strategies, those staked assets of yours—and their APY—can really soar.

In this post, we’ve unpacked liquid staking, a fresh twist on earning crypto. We compared it with old-school proof of stake (PoS) methods, eyeing up how both work. You’ve seen how liquid staking hands out rewards and might set up a steady cash flow, just like Ethereum 2.0 and other spots do.

We also walked through the nuts and bolts of making money by staking. Stay smart, though—we checked out what risks come with this game and how to play it safe. Plus, you got the scoop on what being a validator means for your pool perks.

To cap it off, we dived into how liquid staking is shaking up the DeFi scene and helping people manage their staked assets better. With all this in mind, it’s clear: liquid staking’s not just a buzzword—it’s a solid move for your future in digital cash. Keep these tips handy, and you’ll sail smooth in the liquid staking world.

Q&A :

What is Liquid Staking in Cryptocurrency?

Liquid staking is a process in the cryptocurrency world that allows token holders to stake their digital assets in a staking pool to earn rewards, while still retaining liquidity. Unlike traditional staking methods where assets are locked up and cannot be traded, liquid staking provides a way for participants to stake their assets yet also have them available for trading or use in other DeFi applications.

How Does Liquid Staking Improve Asset Liquidity?

Liquid staking improves asset liquidity by issuing derivative tokens in exchange for the staked assets. These derivative tokens represent the original asset and can be traded or used as collateral in various DeFi platforms, providing flexibility and preventing the staker’s assets from being tied down during the staking period.

What Are the Benefits of Liquid Staking over Traditional Staking?

The primary benefit of liquid staking over traditional staking is the freedom it offers to the asset holders to maintain liquidity. It allows stakers to continue participating in the broader crypto ecosystem, gaining access to liquidity pools, lending platforms, and other financial instruments while still earning staking rewards.

Are There Any Risks Associated with Liquid Staking in Crypto?

Like all DeFi innovations, liquid staking does come with risks. These can include smart contract vulnerabilities, the performance and stability of the staking platform, and the possibility of decreased staking rewards due to increased participation. Additionally, there’s a risk of market fluctuations in the value of the derivative tokens issued for staked assets.

What Should I Look For in a Liquid Staking Platform?

When choosing a liquid staking platform, consider factors such as the platform’s security history, the insurance mechanisms it employs, the transparency of its operations, and the overall liquidity of its issued derivative tokens. Also, review their fees, staking rewards, and the reputability of the team behind the platform to ensure a sound staking decision.