Welcome to the deep dive you’ve been waiting for. If you want to unlock the power of market analysis, mastering cryptocurrency analysis methods is key. Forget the guesswork. Here, I’ll walk you through techniques that pros use to predict market moves. With each method decoded, you can make informed decisions that steer clear of the herd. So, let’s cut to the chase and explore these secrets to market mastery, one insight at a time. From technical know-how to fundamental finesse, you’ll leave ready to tackle the crypto cosmos like a pro.

Cryptocurrency Technical and Fundamental Analysis Explained

Grasping the Basics of Crypto Analysis

Let’s dive into the world of crypto analysis. It’s exciting and, yes, it can be easy too! We’ve got powerful tools at our fingertips, so buckle up! If you’re new here, think of analysis as a treasure map. With the right map, finding crypto gold is simpler.

First up, cryptocurrency technical analysis. It’s all about chart patterns, price action, and cool tools. Think of it as the crypto detective kit. Spot those clues in candlestick chart patterns and watch the price moves! Plus, ever heard of RSI and MACD? These are fancy tools to guess where prices might go next!

Now, let’s not forget volume analysis. It shows us how much crypto is trading. It’s like checking who’s in and out at a giant crypto party. More guests can mean a bigger bash or a quick exit.

Next, on-chain data. It’s like peeking into crypto’s engine room. See where the money flows between wallets and how much! Blockchain explorer tools are here to help us see this magic up close.

Lastly, smart contract audit reports. These are health checks for crypto programs. We want our crypto safe, and these reports help keep things in check.

Technical vs. Fundamental: When to Use Each Method

Wondering when to go technical or fundamental? Let’s clear that up. If you love quick moves and charts, then technical is your game. It’s best when you want to jump in and out fast, riding the price waves like a pro surfer!

Now, if you’re in for the long haul, fundamental analysis is your friend. It’s like getting to know someone deeply. Look at token economics, whitepaper promises, and if the project has a bright future.

For example, you find a new coin. Check its whitepaper. It’s like a coin’s resume. Then, explore coin supply dynamics. Are there a few or a ton of coins out there? This can tell you if the coin’s rare like a diamond or common as sand.

Take it a step further. Dive into the project’s roadmap. Is it a path to treasure or a trail to nowhere? Check if the team walks the talk, and the community is alive and kicking.

But wait, there’s also market sentiment. It’s like the mood at a party. Are people excited or scared? Social media sentiment and what influencers say can give you a big hint.

Ready for some next-level stuff? Altcoin performance metrics and exchange liquidity analysis let you uncover hidden gems and know if you can sell when needed.

Remember, whether it’s technical or fundamental, your crypto toolkit can gear you up for smart choices. Let the treasure hunt begin!

Delving Into Advanced On-Chain Analytics

Understanding Network Value Transactions (NVT)

Have you heard of NVT in crypto talk? NVT stands for Network Value Transactions. It’s like a company’s price-to-earnings (P/E) ratio but for digital money. NVT equals the market cap divided by the daily dollar volume of transactions on the network. We use this to check if a coin is cheap or costly right now. Low NVT means a coin may be undervalued; high NVT signals it could be overvalued. Clear so far?

You can find the market cap and transaction volume on many crypto websites. To get NVT, just make a simple division. Look for NVT data already done for you on different sites. This can help inform your decision on whether or not to buy.

Deciphering Wallet Transaction Patterns for Investment Clues

Now, let’s talk about wallet transaction patterns. Every buy and sell in crypto ends up in a blockchain wallet. By studying wallet patterns, we get valuable investment tips. Big wallet activities often hit the market hard. When a high-value wallet, or ‘whale,’ makes a move, it can shake up prices for everyone. By spotting these moves, we can be one step ahead. We can use blockchain explorers to peek at wallet activity.

When you see a ‘whale’ move coins, pay attention. Is it to an exchange wallet? This might mean they’re ready to sell. If it’s away from an exchange, they might be holding for the long run. Wallet analysis helps us predict what big players are doing next.

In crypto, knowledge is true power. These on-chain methods give us a new way to see what’s happening. They let us peek behind the curtain and make smart choices. The pros use every tool at their disposal — and now you know two more they use. When you get the hang of on-chain analytics, you’ll join the ranks of informed traders making educated bets in the wild world of crypto.

Mastering Chart Patterns and Trading Indicators

Reading Candlestick Patterns for Predictive Insights

You’ve seen those charts with bars that look like candles, right? They’re actually powerful tools for predicting price moves in the crypto market. These candles show opening, closing, highs, and lows of prices within a certain time. Just like a weather forecast, candlestick patterns can give you hints about future price action.

Imagine a long green candle. It means buying pressure was strong, and prices went up. A long red candle indicates strong selling pressure. Patterns of these candles can reveal much more. For example, a ‘head and shoulders’ pattern often means a reversal is coming. This means if the chart was climbing, it might turn and go down soon.

Utilizing RSI and MACD Indicators for Precise Trading Signals

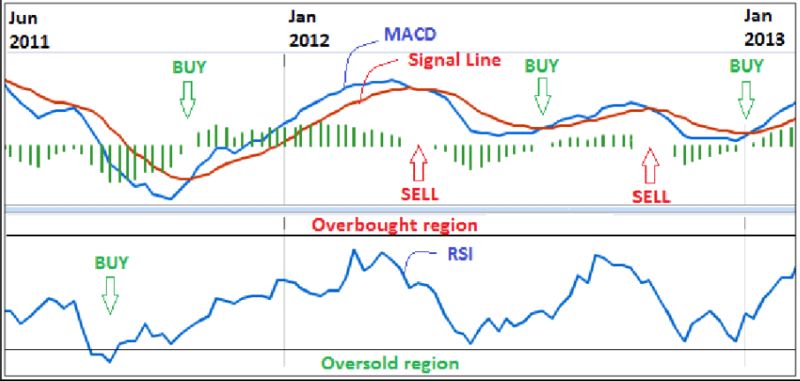

Now, to fine-tune your market insights. Two gems of trading indicators are RSI and MACD. RSI stands for Relative Strength Index. Think of it as a speedometer for market momentum. It tells you if the crypto is overbought or under sold. Over 70 on the scale, and it’s overbought, so watch out, a price drop may come. Below 30 means oversold, and prices might go up.

MACD is short for Moving Average Convergence Divergence. This sounds complex but stick with me. MACD uses two moving trend lines. One is the signal line. When the other line, the MACD line, crosses it, it’s signal time. A cross up could mean buy, and a cross down might say sell. These tools help you see if the crowd agrees with your predictions.

Understanding these patterns and indicators takes practice. But once you get the hang of them, you can anticipate market moves more accurately. They’re the secret language of charts, revealing whispers of where prices might head next.

Now you know. Candlestick patterns and RSI and MACD indicators aren’t magic. They’re part of a smart trader’s toolkit. With them, you’re reading the market’s pulse, gaining insights for better trading decisions. They could make the difference between guesswork and strategy. Happy trading!

Tokenomics and Project Assessment Techniques

Evaluating Whitepaper Claims and Project Legitimacy

In the crypto world, whitepapers are key. They tell us what a project is about. But can we always trust them? No, not always. We must dig deep to uncover the truth. We ask, “Is this new coin worth our time?” To find out, we study its whitepaper. We check if its goals make sense, and if the team can really make them happen. We also see if they have something new to offer.

A good whitepaper shows clear plans. It talks about the coin’s purpose and how it will survive. The team’s history counts too. Seasonsed pros likely have more know-how to succeed.

A project with good tech and fresh ideas has a shot to grow. But we can’t just take their word for it. We should read reviews and look for proof of their claims. A project that’s too good to be true might just be a high-risk bet.

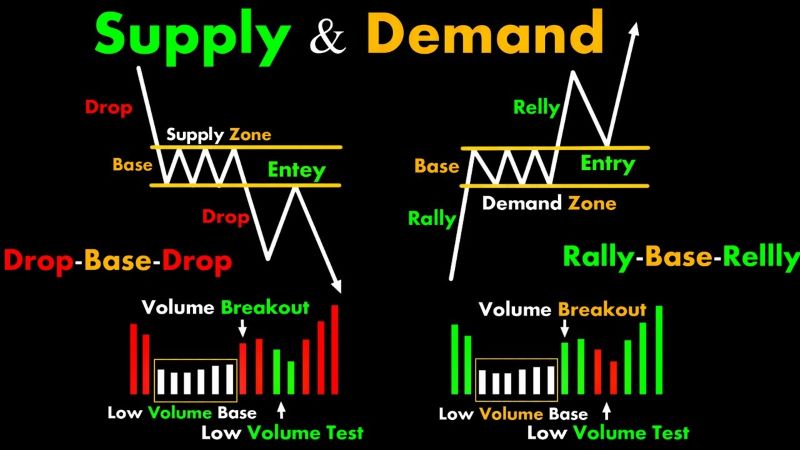

Analyzing Coin Supply and Demand Dynamics for Long-term Value Prediction

Now, let’s chat about supply and demand. These are big deals in valuing any currency. If a coin has a huge supply but not enough demand, its price may fall. But, if a coin is scarce and people really want it, the price might soar. Think of it like your favorite sneakers. If everyone wants them but there aren’t many pairs, they become more valuable.

Understanding a coin’s supply means checking the total number of coins it will ever have. Some coins have a cap, like Bitcoin’s well-known 21 million cap. Others don’t, which might mean the value could drop if too many coins are made.

We also look at demand drivers. What makes people want this coin? It might be its use in payments, in games, or for saving fees. When a coin has a real job, demand might stay strong, and so might its price.

We use tools like blockchain explorers to check transactions. This tells us if the coin is really being used. We look at trading volumes too. Big volumes can mean strong interest in the coin. Lastly, we peek at what big market players are doing. They often know things we don’t.

By knowing how many coins exist and why folks might want them, we make smarter choices. We find coins that could shine and avoid those that might not. It’s like picking the winners in a race before they take off.

So there you go! A quick dive into how we tackle tokenomics and project reviews. We peek behind the scenes to see if a project’s claims hold up and figure out if demand could push a coin’s value up. These steps help us cut through the noise and make ace choices in a busy crypto market.

In this post, we’ve explored the ins and outs of crypto analysis, from the basics of technical and fundamental methods to the complex clues hidden within on-chain analytics. I’ve shown you how to look at candlestick patterns and use tools like RSI and MACD to make smart trading choices.

We also dived into tokenomics, assessing project goals and the push-and-pull of coin supply and demand. All this knowledge arms you with the power to make informed decisions in the ever-changing crypto market. Always keep learning and stay ahead in the game of digital currency investment! Stay sharp, and trust the signs that lead to wise investments.

Q&A :

What are the most effective methods for analyzing cryptocurrency trends?

Cryptocurrency trends can be analyzed through a variety of methods, each serving a particular purpose. Technical analysis (TA) is a popular approach which uses historical price data and charts to predict future movements. Fundamental analysis (FA) looks at the underlying factors that could affect a currency’s value, such as market news and technological advancements. Sentiment analysis gauges the mood or opinions of the market participants, often using social media and news trends. Additionally, quantitative analysis involves using mathematical models to predict currency movements.

How do technical indicators assist in cryptocurrency analysis?

Technical indicators are essential tools in a trader’s kit for cryptocurrency analysis. They help traders make more informed decisions by providing insights into market trends, momentum, and potential reversals. Common indicators include Moving Averages (MA), Relative Strength Index (RSI), and the Moving Average Convergence Divergence (MACD). By applying these indicators to cryptocurrency charts, traders can identify patterns that may suggest future price movements.

Can fundamental analysis be applied to cryptocurrencies effectively?

Yes, fundamental analysis can be effectively applied to cryptocurrencies, though it differs from traditional markets. It involves examining the intrinsic value of a cryptocurrency by analyzing various factors such as its supply mechanics, the blockchain technology behind it, the strength of the development team, community engagement, and the potential for mass adoption. Market news, such as regulatory changes and technological advancements, can also significantly impact a cryptocurrency’s value.

What role does sentiment analysis play in predicting cryptocurrency prices?

Sentiment analysis plays a significant role in predicting cryptocurrency prices since the crypto market is highly influenced by investor sentiment. This method analyzes the overall emotional tone from various sources like news articles, social media posts, and blogs to gauge the market’s attitude towards a particular cryptocurrency. Positive sentiment can indicate a possible price increase, while negative sentiment might suggest a downturn. Investors use sentiment analysis to capture the mood of the market and make predictive judgments on currency movements.

How can quantitative analysis be utilized in cryptocurrency trading strategies?

Quantitative analysis involves the use of mathematical and statistical models to understand and predict market behaviors in cryptocurrency trading. By employing algorithms and complex calculations, traders can create strategies which are often known as algorithmic or systematic trading. These models can process vast amounts of data to identify profitable trading opportunities based on historical data and real-time market data. Quantitative analysis can help traders to minimize emotion-driven decisions and increase the precision of their trades.