Cryptocurrency markets never sleep, and neither should your portfolio’s watchdog. To stay ahead, you need to compare crypto exchange tracking tools effectively, finding the one that keeps you informed and ready to pounce on opportunities. I have flipped every digital stone to show you key features that set each platform apart. You’ll discover how smooth user interfaces can make or break your tracking efficiency. Let’s dive into a world where security marries real-time data, and advanced tools shake hands with API integration. We’ll also weigh the costs versus benefits to ensure your digital asset spy kit is top-notch without breaking the bank. Dive into the nitty-gritty with me and optimize your crypto tracking to expert levels.

Understanding Crypto Exchange Analytics Comparisons

Evaluating Key Features Across Platforms

When you hunt for the best tools to monitor cryptocurrency investments, consider key features. Crypto exchange analytics comparison starts with tracking accuracy. Real-time crypto tracking means seeing your coin’s value change by the second. This makes deciding when to buy or sell way easier.

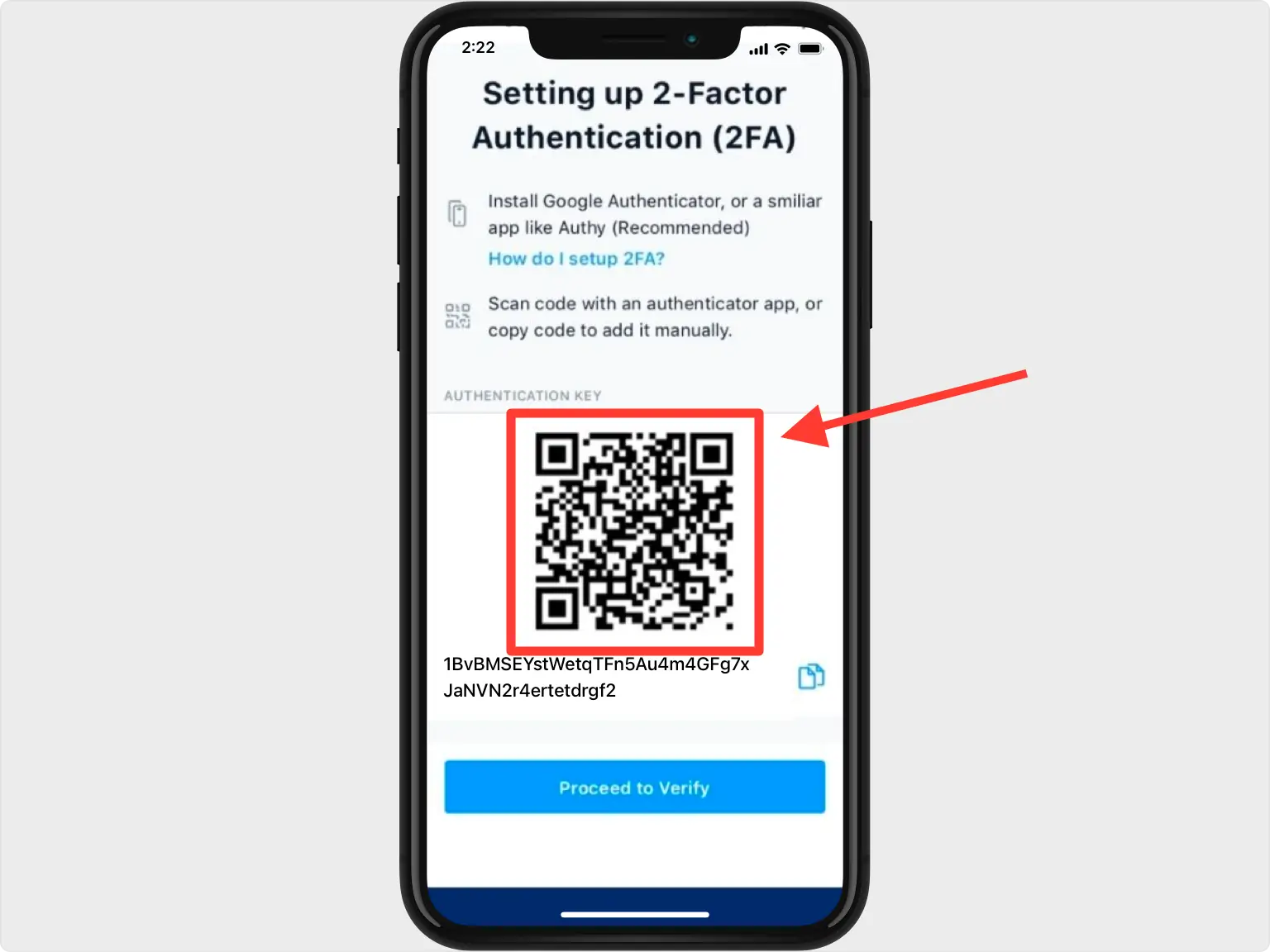

Next, dive into security in crypto tracking tools. Your digital gold must stay safe. Ask, does this service protect my data? Good software shields you from thieves trying to crack your digital safe. It should have strong passwords and maybe two-factor auth (a double-check to prove it’s you).

Good exchange tracker software can handle lots of different coins. This is about having many options in one place. It should let you track everything from Bitcoin to those new, quirky coins you just heard about. More coins mean you can chase more chances to make your wallet fat.

For analyzing crypto market trends, your software should show charts. Charts help you see if your crypto’s riding a money-making wave or about to crash. And if you have several coins, a tool to manage your whole crew is key. They work together, showing you the big picture.

Also, look for crypto tax reporting tools. When tax time rolls around, you’ll be all set. It’s sad but true, the taxman wants to know about your crypto cash too.

The Role of User Interface and Experience in Tracking

Now let’s check out the user-side of things. The user experience in crypto tracking impacts how quick you can move. A messy or confusing app steals your time and frays your nerves.

Here’s what makes an app user-friendly: First, can you find everything without a headache? It should have neat menus and labels. The best crypto tracker apps make sure you’re never lost. Simple and clear—that’s the sweet spot.

Your app should work fast, letting you jump on chances in a snap. Slow apps can cost you big. And we can’t forget mobile app crypto tracking. We live on our phones, so being able to check your coins on the go is a must.

API connectivity exchange trackers stitch your crypto world together. They link your app with places you trade or hold your coins. Your app’s like a command center, sending orders to these sites with a click.

Ease of use for tracking software is all about feeling like a pro, even if you’re fresh on the scene. You should be able to use it from day one. And when you’re stuck, help should be a quick shout away.

Seek out exchange tracker software that grows with you. New features and better design keep you at the top of your game.

In short, you’ve got to weigh what matters to you. Cost, safety, and smarts of the app play into finding your perfect digital asset spy kit. Keep tabs on these points, and you’ll be the wise owl in a forest of crypto tracking choices.

The Importance of Security and Real-Time Data in Cryptocurrency Portfolio Tracking

Implementing Robust Security Measures in Exchange Tracker Software

When you track your crypto, think of it as guarding a treasure. The software must be a fortress. Why so? Hackers eye digital coins like shiny gold. That’s where security in crypto tracking tools steps in. It’s a big deal. Exchange tracker software must have strong walls against unwanted guests. This means complex passwords, two-factor authentication (2FA), and encrypted data. Picture it as a vault, only letting you in with the right keys.

Now, let’s chat about backing up your data. Say your computer crashes, or you lose your phone. Scary, right? With backups, you’re safe. You can get all your coin info back. It’s like having a spare treasure map. So, when picking a tracker, ask, “Does this tool back up my data securely?” Your future self will thank you.

Accessing Live Market Data for Effective Investment Monitoring

Next up, real-time crypto tracking. Imagine a race car. You want to go fast but also smart. Live data helps here. It lets you make quick, wise moves. This means buying or selling at the right moment. With real-time data, you catch the best deals. It’s like knowing exactly when to jump into a game of jump rope.

Think of a stock market but for crypto. It moves super fast and never sleeps. So, your tracking tools should be speedy too. They fetch the latest prices and trends. You can see how your investments do, anytime, anywhere, like having a spyglass that shows you distant ships in real time.

But wait! If you’re a busy bee, you can’t always watch the numbers. This is why alerts and notifications are lifesavers. They ping you when things go up or down a lot. It’s your personal lookout saying, “Heads up!”

Lastly, it’s not just about watching. You also want to understand what’s happening. Analyze crypto market trends to spot patterns or shifts. Imagine looking at clouds and predicting rain. That’s you with the crypto market if you have the right tools.

By picking the right tools with top-notch security and live data, you’re set up for success. Remember, your crypto journey is yours to command. With these tools, you’re the captain of your ship, navigating the vast seas of digital currency with confidence. Happy tracking!

Advanced Tools and API Integration for Blockchain Portfolio Management

Customization Through API Connectivity in Exchange Trackers

When you pick a tool to track your crypto, API connectivity is key. It lets you link your tool straight to your exchange accounts. This means you can see all your moves in one spot. Checking on trades and keeping tabs gets way easier.

APIs make your crypto life less of a hassle. Say goodbye to jumping from one app to the next for updates. Gaining more control over your data, you can better manage your digital wealth.

The Impact of Advanced Analytics on Crypto Trading Strategy

Advanced analytics are game changers for crypto trading. These tools take piles of market data and turn it into insights. Cool, right? You get to spot trends early and make moves that win. You’re in the loop faster than saying “blockchain”!

Personalize your strategy with tools that track your trade history. Stay sharp with metrics that show how your investments perform. Use crypto tax reporting tools to not get caught off guard during tax season.

If you read between the lines of market patterns, you’re crafting a solid trading plan. So, dig into the data, find your groove, and let the analytics guide your next big trade.

The Economic Aspects of Crypto Tracking Software and Its User Benefits

Assessing Cost Against Efficiency in Crypto Tracking Systems

Let’s talk money and tools. When you pick crypto tracking software, think value. Cheap systems might miss key features. Costly ones may have too much fluff. You need the right mix. A solid tracker will have real-time updates and be easy to use.

It should give you clear insights. Are you winning or losing? Where are you spending? A quick peek should tell you. It should sync with every exchange you use. No more jumping between tabs or apps. Imagine, all your coins lined up, with a neat bow on top. That’s your dream tool talking, efficient and cost-saving.

A great system doesn’t need to bleed your wallet dry. Some of the best crypto tracker apps offer a bang for your buck. They blend cost and quality like a smoothie. They serve the essentials. They track gains, losses, and even your tax headache. They send alerts to keep you in the loop. Don’t let their price tag fool you. They can hold their own.

Balancing Portfolio Diversification with Comprehensive Tracking Tools

Now, remember, crypto is a wild ride. One coin’s rise doesn’t guarantee another’s. That’s why you juggle different coins. But how do you keep tabs on them all? You need a tracking tool that loves variety as much as you do.

A top-notch system offers portfolio diversification crypto tools. It supports many coins across exchanges. It helps you see the big picture. How’s your portfolio doing as a whole? Are some coins stars while others just tag along?

Here’s something cool – some trackers let you see past trades. Want to learn from your wins and whoopsies? These tools have your back. They are like a highlight reel. You spot patterns and tweak your moves.

Analyze crypto market trends, check. Manage digital assets, got it. Sync with exchange accounts, you bet. Notice a theme? Yeah, it’s all about the power combo. Safety, smarts, and your ever-growing coin collection under one roof.

Don’t forget to check if the tracker speaks to your devices. Desktop vs mobile tracking tools – it’s a personal choice. But why not both? Your portfolio doesn’t nap when you step out. Your tracker shouldn’t either.

At the end of the day, it’s about managing your coins well. And your tracker should help you do just that, without burning a hole in your pocket. That’s smart investing. That’s efficiency meeting economy. Keep this in your mind when you compare. Your portfolio and your peace of mind will thank you.

In this post, we dived deep into how to pick the best crypto exchange analytics. Remember, key features like security and live data are vital for tracking your investments. User experience matters, too. If it’s hard to use, it’s not helpful.

Then, we talked about APIs and advanced tools. They let you tailor your trading strategy with precision. We also touched on cost versus efficiency and finding the right balance in tracking software. After assessing all these points, my final thoughts are clear. A good crypto tracker boosts your control over investments and saves you time. Choose a platform that’s secure, easy, and packs the right tools for your trade style. There’s no one-size-fits-all, so pick what works best for you!

Q&A :

What are the key features to compare when looking at crypto exchange tracking tools?

When comparing crypto exchange tracking tools, you should consider their ability to track multiple exchanges simultaneously, real-time updates on prices and trades, comprehensive charting tools, and analytical features. The availability of notifications for price movements, security measures to protect your data, as well as user interface and ease of use are also essential. Lastly, consider the cost, support for various cryptocurrencies, and integration capabilities with other tools or platforms.

How do I choose the best crypto exchange tracking tool for my needs?

To choose the best crypto exchange tracking tool, evaluate your trading habits and requirements first. If you’re a day trader, real-time data and advanced charting features will be crucial. Long-term investors might prioritize portfolio tracking and historical data analysis. Also, consider the types of cryptocurrencies you’re interested in, as some tools may offer more extensive coverage than others. Additionally, assess the tool’s security measures, the quality of customer support, and read reviews from other users before making a decision.

Can I track all of my crypto exchange accounts in one place?

Yes, many crypto exchange tracking tools offer the ability to manage and monitor multiple exchange accounts from a single dashboard. This feature allows for a more streamlined and efficient way to keep track of your assets across different platforms. Ensure the tool you choose supports all the exchanges you use and offers the type of integration, like API connections, that matches your personal requirement for security and convenience.

Are there free crypto exchange tracking tools available?

Yes, there are free crypto exchange tracking tools available, but they may come with limitations such as fewer features, supported exchanges, or analysis tools when compared to paid versions. Free tools can be ideal for beginners or those with simpler portfolios, but for advanced traders who require more robust analytics and real-time data, investing in a premium service might be worthwhile. Always compare the features offered in free versus paid subscriptions to determine which suits your needs best.

How secure are crypto exchange tracking tools?

The security of crypto exchange tracking tools varies from one provider to another. It’s paramount to opt for tools that prioritize security measures such as encryption, two-factor authentication, and other privacy safeguards. Research each tool’s security policies and user reviews for any red flags or breaches in the past. Remember, you are usually providing the tool with access to sensitive information, so exercise caution and opt for trusted, well-vetted platforms.