Blockchain and Crypto have sparked a digital uproar, forever changing how we view money and investments. Behind the screen, each click and transaction weave into a vast network of secure exchanges. But what does this mean for you? Imagine navigating a complex maze – you need a map and a guide. And that’s me. I’m here to decode these digital puzzles, showing you how to harness the power of this tech revolution. Join me, grasp the essentials, and become the investor who stands confident amid the digital currency storm. Ready to conquer the world of cryptocurrency? Let’s dive in.

Understanding the Building Blocks: Blockchain Technology and Cryptocurrency Essentials

Unpacking Cryptocurrency Basics and Blockchain Technology

Think of cryptocurrencies as digital money. They live online and aren’t backed by a bank or government. Unlike paper money, they are part of a system called blockchain technology. A blockchain is a list of records, kind of like a fancy ledger. These records are safe because they are stored across many computers. No one can change them alone.

Now, blockchain works like a team sport. Every player has to agree before a new record is added. This securing of records is called mining. People use computers to do hard math problems, and when they solve them, they help add to the blockchain. This process also makes new digital money, like Bitcoin.

Blockchain isn’t only for money. It can handle all sorts of info, and it’s super secure. That’s why businesses dig it. They use blockchain to keep track of things like shipping goods around the world.

The Principles of Distributed Ledger Technology

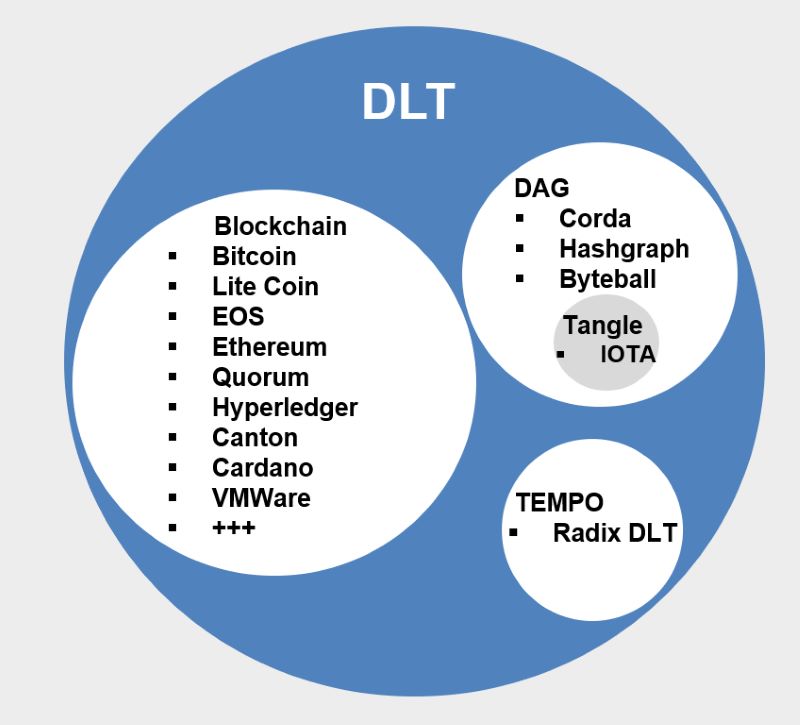

A big part of blockchain is something called distributed ledger technology (DLT). Imagine you and your friends keeping the same list of who paid for snacks. Every time someone buys, you all write it down. This list is a ledger. And since everyone has it, it’s distributed. That’s what DLT is all about.

This tech lets folks make and watch transactions. The best part? You don’t have to trust just one person. Everyone guards and confirms the list. It’s like having a bunch of referees. This makes it tough for cheats.

DLT is used in all kinds of ways. It helps with buying things online, sending money across the world, and even voting! Plus, it’s not just for Bitcoin. There are other digital monies, called altcoins, that use DLT too.

DLT also uses things called smart contracts. They’re like regular contracts, but they work automatically. If you do what you agreed to, like deliver some goods, the contract instantly does its part, like pay you. This is great because it’s fast and cuts errors.

Blockchain and DLT are changing how we do pretty much everything. Money is just the start. We’re talking about making things like owning a house, going to the doctor, and even our privacy safer and easier. And that’s the heart of this digital currency revolution—making life better, step by step, click by click.

Investing with Confidence: Digital Currencies and DeFi Trends

A Guide to Investing in Digital Currencies

Let’s dive into how you can invest in digital currencies like Bitcoin. Investing in digital money uses online “coins” or “tokens.” It’s like buying shares, but online and with digital money. To buy these, you join a crypto exchange. After that, you can buy, sell, or keep your coins.

When thinking about investing, know the risks. Prices can change fast. Only put in what you can lose. It helps to learn the basics of how it all works. That means knowing about blockchain, which is like a digital book that records all coin trades securely.

Some people mine cryptocurrencies. This means using computers to solve math problems to create new coins. But mining uses a lot of power and needs big, strong computers. It’s not easy and might not be worth it for everyone.

Bitcoin and Ethereum are the big names in digital cash. They are like online gold or silver. But there are more types called altcoins. Some of these could grow a lot, but it’s a guess game. Research a lot before you decide to buy altcoins.

Exploring the World of Decentralized Finance (DeFi) and Smart Contracts

Now let’s talk about decentralized finance, or DeFi for short. DeFi is finance without the big banks or middlemen. It’s like an online money world, open to anyone, anywhere, anytime. This world runs on something called blockchain. It’s all about being open and no one being the boss.

In DeFi, “smart contracts” are king. Smart contracts are like robot promises. They’re rules written in code on blockchain that do business for you when certain things happen. Because of smart contracts, you could borrow, lend, or earn interest on your digital money without a bank!

One more thing that’s cool about digital money is NFTs, or non-fungible tokens. Think of them as one-of-a-kind digital collector items. They can be art, music, even tweets! Using blockchain, each NFT is unique and can’t be swapped like for like.

People often worry about how safe their digital money is. Wallet security is key. Just like you wouldn’t leave your wallet on a park bench, don’t leave digital money easy to grab. Protect it with strong passwords, and learn ways to keep it safe.

Investing in digital currencies and diving into DeFi can be exciting. There’s a lot to know, but with some learning, you can be part of this new revolution. So keep asking questions, keep learning, and be smart with your choices!

Remember, it’s about being smart with money, staying safe online, and jumping into this new digital wave with your eyes wide open. And above all, never stop learning because the world of digital currencies keeps on growing and changing every day.

The Mechanics of Crypto: Trading, Regulation, and Technological Advances

Strategies for Cryptocurrency Trading and ICO Insights

Cryptocurrency trading can be a game-changer. It’s like playing a video game where coins can grow in value. To start, you must learn the rules. This includes understanding the market’s ups and downs. Always start with the basics of cryptocurrency. Knowing how Bitcoin and Ethereum work is key. They are the big players in the crypto world.

Next, check out altcoins and their potential. These are like the underdogs, often less known but with room to grow. ICOs or Initial Coin Offerings are like the opening day of a movie. It’s where new coins make their debut. Getting into an ICO can be exciting. But you need to read up first. Learn what the coin wants to achieve and who’s behind it. This way, you’re not just tossing coins into a fountain.

Don’t forget about the technology either. Blockchain technology explained simply is that it’s a digital ledger. It’s like a super-safe journal that keeps all the crypto details safe. Smart contracts overview is another neat feature. Imagine a vending machine. You put in a coin, and it gives you a snack. Smart contracts do this with digital promises. When one thing happens, they automatically do the next step – no human needed.

Navigating Crypto Regulations, Law, and Taxation

Now, buckle up! The world of crypto regulations and law is a wild ride. Different places have different rules. Some countries welcome crypto like a friend. Others are not so sure and can say, ‘No way!’ Make sure to check what your home place thinks about crypto.

And let’s talk taxes. Yes, they’re not fun, but they’re a must. You must keep track of your crypto gains and losses. This is just like when you save receipts for buying a toy. When you trade, you might make money, but Uncle Sam wants a share. This is part of cryptocurrency taxation. Remember, it’s always best to play by the rules.

Wallet security is super important too. Think of it as your online money jar. You wouldn’t want anyone to take your allowance, right? Same with crypto. A strong wallet keeps your digital coins safe.

When mining cryptocurrencies, it’s about using computers to find new coins. It’s like a digital treasure hunt. Each found coin adds to the blockchain. It’s a pretty cool process.

Look, blockchain and crypto keep on growing. And yes, while it can be tricky with lots of new words, it’s not magic. It’s a new way to think about money and who keeps track of it. So take your time, learn with each step, and you might just find the beat in this digital currency dance. Remember, being smart and safe is how you win in this game!

The Future of Finance: Adoption, Innovation, and Market Analysis

Assessing Crypto Lending Platforms and the Role of Stablecoins

Crypto lending platforms let you loan and earn. You use your digital money as collateral. Borrowers get cash without selling crypto. Lenders earn interest. Simple, right?

Stablecoins are a big part of this. They link to things with set values like the dollar. This means fewer price swings. People use them to make trades or lend on platforms. They find them safer in bumpy markets.

Comprehensive Cryptocurrency Market Analysis and Forecasting Trends

Cryptocurrency basics show it’s more than just Bitcoin and Ethereum. Altcoins, or alternative coins, bring new choices to the table. They have their own perks and uses. Everyone wants to know, “Which one will boom next?”

To make good choices in investing in digital currencies, one must look ahead. Spot trends and think, “Where is the market going?” Ledger transparency helps here. It lets you see all that’s going on in the blockchain. This is like an open book for trades and money moves.

Smart contracts are another piece of the puzzle. They are rules written in code. They act when certain things happen. If “this” happens, then “that” follows. It’s automated deals on blockchain.

Figuring out which coins or tech will rise involves knowing market basics. You watch how they’ve done in the past. You guess what might affect them in the future. Think laws, new tech, or big market moves.

DeFi, or decentralized finance, is a part of this new money world too. No banks or middlemen. Instead, it’s all run on the blockchain. Here, anyone can lend, trade, or invest. It’s an open market for all.

In blockchain for business, it can make things quicker and cut out mistakes. Like, tracking things moving in a supply chain. Or, making sure a deal is fair and follows the rules.

To sum up, understanding crypto lending platforms is smart. They’re an easy way to make your coins work for you. Meanwhile, stablecoins can be a safe haven for traders. For the market, knowing how things trend helps you make better moves. It’s all about seeing the whole picture and making choices that fit.

We’ve covered a lot in our chat about crypto and blockchain. We started by unpacking the basics like how blockchain works and why it matters. Then, we dove deep into how to invest in digital coins and the latest in decentralized finance. I showed you how to trade smart and stay on the right side of the law.

Now, thinking about the future, we see stablecoins and crypto lending as big players. And the market? It’s always changing, but with what you’ve learned, you’re set to tackle it.

Remember, whether you’re a newbie or a pro, the key is to keep learning and stay updated. The crypto world moves fast, but now you can move with it. Stay sharp, stay smart, and let’s ride the wave of finance’s future together. Here’s to making your mark in the digital currency revolution!

Q&A :

What is Blockchain and how is it tied to Cryptocurrency?

Blockchain is a digital ledger technology that enables the recording of transactions across a network of computers in a way that is secure, transparent, and tamper-resistant. This technology underpins most cryptocurrencies, including Bitcoin and Ethereum, by providing a decentralized system where transactions are verified and recorded without the need for a central authority, like a bank.

How do Blockchain transactions work and are they secure?

Blockchain transactions work by creating blocks of information that are linked together in a chain. Each block contains a number of transactions, and once a block is filled, it’s verified by network participants, commonly known as miners, and is then permanently added to the blockchain. This process is known as mining. The security of blockchain transactions comes from the use of cryptographic techniques and the decentralized nature of the ledger, making it extremely difficult to alter any recorded information without detection.

What are the main benefits of using Blockchain in Crypto?

The main benefits of using blockchain technology in cryptocurrency are increased transparency, enhanced security, and the elimination of intermediaries. Transactions are recorded on a public ledger, which provides transparency. The decentralized and cryptographic nature of blockchain enhances security against fraud and unauthorized manipulation. Lastly, blockchain allows for peer-to-peer transactions without the need for middlemen, reducing costs and increasing efficiency.

How does one invest in Blockchain and Crypto?

Investing in blockchain and cryptocurrency can be done in several ways. The most direct method is by purchasing cryptocurrencies through an exchange, which involves setting up an account and a digital wallet. Investing in blockchain companies’ stocks is another option, as is investing in blockchain-focused ETFs (Exchange-Traded Funds) and mutual funds. It is important to conduct thorough research and consider the volatility of the market before investing.

Are there any risks associated with Blockchain and Crypto?

Yes, there are risks associated with blockchain and crypto, such as market volatility, regulatory changes, and security issues like hacking and fraud. The market for cryptocurrencies is known for its rapid price fluctuations, which can lead to significant gains or losses. Regulatory uncertainty can also impact the market, as governments and financial institutions are still developing frameworks for cryptocurrencies. Additionally, while blockchain itself is generally secure, cryptocurrency exchanges and wallets can be vulnerable to hacking, emphasizing the need for strong cybersecurity measures.