Dive Right Into the Heart of Your Digital Wealth

As an expert, I’ve seen how Blockchain and Crypto can shape your future. Get ready to uncover a world where tech meets treasure. We’ll start with the ABCs of digital cash and ledger magic, then level up to smart tips for growing your digital wallet. Hang on, because we’re also going to decode the latest in Ethereum and DeFi buzz. And when it comes to keeping your coins safe and sound, you’ll know just what to do. Let’s unwrap the mystery and dive headfirst into mastering your digital wealth together!

Understanding the Fundamentals of Blockchain and Cryptocurrency

Exploring Cryptocurrency Fundamentals and Digital Currencies

Cryptocurrency looks like money but is digital. You can buy stuff online with it. It works with the help of technology called blockchain. Think of blockchain as a train with many cars. Each car is a block that holds special and safe info. People all over the world keep copies of this train, so it’s hard to play tricks or make change without others knowing. Bitcoin was the first, now there are many, like Ether or Dogecoin.

What is blockchain? It’s a way to store data that’s tough to change or hack. When someone makes a transaction with cryptocurrency, this data is put into a “block” of info. Once filled, it links to the last block. This makes a chain, hence the name.

Defining Distributed Ledger Technology and Blockchain Security Protocols

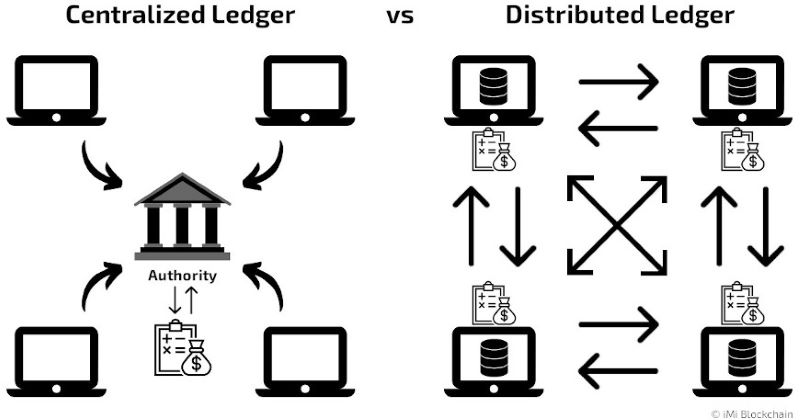

Distributed ledger technology (DLT) is a tech that shares info across many places. Unlike a single book that holds all records, here many copies exist. If one book has a mistake, others will show it. This makes it safer.

Blockchain uses a type of DLT. Each block in the chain holds many transactions. After a block is done, it gets a unique code called a hash. If someone tries to change something in one block, the hash changes too. This warns everyone something’s wrong.

Blockchain security is top-notch. It uses special ways to make sure blocks are safe. One way is proof of work. Miners use computers to solve complex puzzles. This process adds new blocks to the chain. Only after the puzzle is solved, others on the network agree and the block is added. Proof of stake is different. Here, people put up their own cryptocurrency as a promise they’re honest. If they try to validate bad transactions, they can lose their stake.

DLT is not just for money. It’s used to track things in a supply chain, keep healthcare records safe, and even to help artists sell their art as a special kind of one-of-a-kind digital item, called an NFT. It’s a big deal because it can change many parts of everyday life.

Blockchains can be public or private. It’s like having a diary. In a public one, anyone can read it. In a private one, you choose who can see. Depending on what you need it for, you choose the best type for you.

Understanding these basics helps make sense of digital cash. It’s more than just money online. It’s a whole new way that can make many things better and safer. It can be complex, but once you get it, it opens up a world of chances.

Investing Wisely in the Digital Currency Landscape

Strategies for Bitcoin Investment and Cryptocurrency Trading

Investing in digital cash is like planting seeds. You want them to grow into big trees. Think of Bitcoin as a big tree in a forest of many other digital coins. First off, know this: Bitcoin isn’t just cash; it’s also tech. It runs by rules no one can bend. This keeps it safe and sound.

Bitcoin investment should be careful. Ask, “How much can I afford to lose?” Never put all eggs in one basket. Spread your money across different places. This means buying a mix of digital coins and maybe other stuff, like stocks. Also, look at how the market’s doing. Watch the prices go up and down. Try to spot patterns. When you see a good chance, take it. But don’t rush. Bad moves can cost you.

Trading digital coins is a skill. You need a clear head and patience. Start small and keep learning. Use safe online spaces that let you trade. There you can buy and sell digital coins. Some folks like to trade a lot, hoping for quick wins. Others prefer to hold on for a long ride, waiting for the big prize. Choose what fits you best.

Diversifying with Altcoins and Understanding Crypto Wallets

Now let’s chat about altcoins. They’re all those other coins out there. Some altcoins are a bit like Bitcoin, while others bring new stuff to the table. They can do smart work, like making deals happen without a middle guy. This tech is fresh and can change how we do stuff.

Before you buy altcoins, make a list. Study them. Who made it? What’s it for? Is it different and better than others? Some coins are like stars; they shine bright and fade fast. Others slowly grow strong. Pick wisely and don’t just follow the crowd.

You keep digital coins in wallets. Crypto wallets aren’t like the one in your pocket. They’re software that holds keys – these keys unlock your digital wealth. Some live on your computer or phone, others float in the cloud. Keep your wallet’s keys secret. If someone else gets them, they can take your coins. And remember, just like real life, don’t carry all your cash with you.

To sum it up, invest in Bitcoin by doing your homework and not risking too much. Trade smart. Look at the big picture and the small details. Branch out into altcoins after learning a ton about them. And keep your wallet’s keys locked up tight. This way, you’ll be ready for the future of money.

Advanced Applications and Innovations in Blockchain

Unlocking the Potential of Ethereum Blockchain and Smart Contracts

Think of Ethereum like a big machine. This machine runs on code called smart contracts. These smart contracts are like super promises. Once they’re made, they cannot be broken or changed. That’s because they live on Ethereum’s blockchain, a digital ledger that everyone can see but no one owns.

What’s a blockchain, you ask? Picture a chain where each link is a box full of information. Everyone can see all the links at any time. This way, no one can cheat and say they didn’t agree to the smart promise.

Now, why use Ethereum and not another blockchain? Ethereum’s special because it can run any program. Other blockchains can’t do that. It’s kind of like how a smartphone can run lots of apps, and an old flip phone can’t.

For example, with Ethereum’s smart contracts, you can create a digital “IF-THEN” agreement. If something happens, then the contract will do something in return, automatically. This could be useful for things like making a bet, selling a home, or sharing your music.

The smart contracts guide us in creating deals without needing a middle person. This creates trust and saves time and money. With these smart contracts, we can build all sorts of things – like games where you own parts of the game, or systems that let people borrow money without a bank.

The Growth of Decentralized Finance (DeFi) and Blockchain Scalability Solutions

Decentralized finance, or DeFi for short, is like a big money fair where everyone plays fair. Anyone with the internet can join in. No need for banks or papers. They use smart contracts on blockchains like Ethereum to make this happen.

But there’s a hitch. Sometimes too many people want to use the blockchain at the same time. This can slow things down and make it costly. Think of it as a traffic jam on the internet.

People are working on making Ethereum faster – a blockchain scalability solution. Two big ideas are proof of work and proof of stake. Both are ways to agree on new info to add to the blockchain, but they work differently.

Proof of work is like a race. Computers work hard to solve puzzles, and the first one to finish gets to add a new box to the chain. But this uses lots of power.

Proof of stake is different. It’s like a lottery where you need to hold some of the cryptocurrency to play. The more you hold, the better your chances of getting to add a new box. It’s like being a part-owner of the fair.

Blockchain scalability solutions aim to let more people use Ethereum without clogging it up. As these solutions grow, so does the potential of DeFi. This could change how we use money, making everything quicker, cheaper, and open to all. Through DeFi, we’re seeing new ways to borrow, save, and invest — all without a middleman.

Both Ethereum smart contracts and DeFi are just the start. As we solve problems like making the blockchain faster, we’ll see new and exciting ways to use these technologies. This could mean better ways to share music, safer voting systems, or more honest ways to track goods from the factory to your home.

As you can see, blockchain isn’t just a new way to shuffle money. It’s a tool to rebuild how we trust and trade with each other. And with each day, smart folks are finding new uses for it, making sure our digital wealth future is bright and full of possibilities.

Navigating the Complexities of Crypto Regulation and Security

A Closer Look at Cryptocurrency Regulations and Taxation

When we talk about using money online, rules play a big part. Crypto rules keep changing. This can make it feel tricky to keep up. You might ask, “How is cryptocurrency taxed?” Well, just like when you buy something at a store, you need to pay tax when you earn through crypto. The exact rate can change based on where you live.

Paying taxes on crypto can be hard to grasp. Think of it like a game where the rules shift as you play. To win this game, staying updated is key. You’ve got to report your crypto income. Keep all records of your buys and sells. This helps you when tax time rolls around. Some places tax crypto like stock gains. Others have special rules for digital money.

Let’s dive into the topic of cryptocurrency fraud prevention. Safety is a big deal with online cash. Bad guys are keen to steal your digital dollars. But here’s a comfort: smart code keeps your coins safe. Blockchain privacy measures stop thieves’ sneaky moves. It works like a secret code only you know. Use a strong password. Don’t share your keys. That’s the part that unlocks your digital wealth.

Think about the doors in your home. They keep you safe from unwanted guests. Blockchain uses powerful locks—or protocols—to guard your money. These are lines of code that check who can see or use your crypto. Always pick a safe place to keep your crypto, like a secure wallet app. It’s like choosing a sturdy safe for your precious items.

Fraud can creep in if we’re not alert. Some warning signs? A deal looks too good to be true or someone asks for your keys. So, what can we do? Be smart. Only use well-known crypto exchange platforms. They’re like banks that watch over your digital dollars. And never forget this: only you should have your crypto wallet’s keys.

In short, think of crypto as your digital treasure. The adventure is thrilling but can be risky. Rules, taxes, and keeping your loot safe with strong passwords and careful trading are your best tools on this quest. Remember that your digital wealth’s future shines bright when you understand and play by the rules.

In this post, we dug into the basics of blockchain and how cryptocurrencies work. We looked at why blockchain’s safety features matter and how they can keep your digital cash safe. We also covered smart ways to invest in these digital coins, like going for different kinds, not just Bitcoin, and why it’s smart to have a crypto wallet.

We didn’t stop there. We talked about Ethereum’s power and how it’s changing the game with smart contracts. Plus, we saw how new finance systems, like DeFi, are growing because of blockchain. Finally, we tackled the tricky stuff, like how the law deals with digital currency and how you can protect yourself from crypto fraud.

I’m here to say, crypto is not just a trend; it’s reshaping money and business. Yes, it’s complex stuff, but it’s worth learning. Dive in, stay safe, and you could be part of a future where money is smarter. Keep an eye on the changes and always make informed choices. That’s how you win in the world of digital cash!

Q&A :

What is Blockchain and how does it relate to cryptocurrency?

Blockchain technology is a decentralized digital ledger that records transactions across many computers in a way that the registered transactions cannot be altered retroactively. This technology underpins cryptocurrencies, as it ensures the integrity and security of the transactional data without the need for a central authority, making digital currencies like Bitcoin possible.

How do Blockchain transactions work in the context of cryptocurrency?

Blockchain transactions involve the transfer of cryptocurrency units between parties. These transactions are grouped into blocks and each block is linked to the previous one, forming a chain. Every transaction is verified by network nodes through cryptography and recorded in a public distributed ledger, providing transparency and trust.

Can Blockchain be used for anything other than cryptocurrency?

Yes, Blockchain has a wide variety of applications beyond cryptocurrencies. It can be used for smart contracts, supply chain management, voting systems, identity verification, and much more. Its ability to provide a secure, transparent, and tamper-proof ledger lends itself to various industries seeking to streamline processes and enhance security.

What are the benefits of using Blockchain technology in crypto transactions?

The use of Blockchain technology in crypto transactions offers several benefits:

- Decentralization: Eliminates the need for a central authority or intermediary, reducing potential risks and fees.

- Security: Cryptography ensures secure transactions, and the immutable ledger prevents tampering and fraud.

- Transparency: All participants in the network have access to the transaction history, increasing accountability.

- Efficiency: Blockchain can provide faster transactions compared to traditional banking systems, especially across borders.

Are there any risks associated with Blockchain and cryptocurrency?

While Blockchain and cryptocurrency offer many advantages, there are also risks to consider:

- Market volatility: The price of cryptocurrencies can be extremely volatile.

- Regulatory uncertainty: The legal status of cryptocurrencies varies by country and is subject to change.

- Technology risks: As relatively new technologies, there are concerns about security flaws and the potential for loss if keys are not managed properly.

- Scalability issues: Some blockchains may face limitations in transaction speeds and processing times as they grow.