In the wild west of digital currencies, nothing matters more than the safety of your coins. That’s why I dived deep into reviews of crypto exchanges with cold storage, checking which ones keep your crypto chilled to perfection. A secure exchange isn’t just nice to have; it’s a must. Here, I’ll tear into how they safeguard your digital gold by going offline. You’ll get the scoop on who’s doing it right, who’s cutting corners, and what it all means for your assets. You trade to win, and that starts with keeping your crypto in a digital vault, not a digital display window. So, buckle in for a no-nonsense breakdown of where to park your virtual coins.

Evaluating Exchange Security: The Cornerstone of Cryptocurrency Trading

Analysis of Top Crypto Exchange Security Features

When you trade crypto, security is key. Think of crypto exchanges as banks in the digital age. They hold your money. So, their security must be iron-clad. The best exchanges use lots of tools to keep your assets safe. These include two-factor authentication, advanced encryption, and regular security audits. Strong security features stop hackers in their tracks. They give you peace of mind. Exchange cybersecurity evaluations are crucial, too. They help us see which platforms can stand against threats. Customer feedback on platforms often highlights these aspects.

Dive into Cold Storage Capabilities and Offline Crypto Storage Diversity

Now, let’s talk cold storage, a term you’ll often hear. It simply means storing crypto offline. It’s like a safe for your digital coins, away from online threats. The best secure exchanges offer cold storage. This keeps your crypto safe from hackers. How does it work? Well, imagine a vault that never touches the internet — that’s cold storage for you. Hardware wallets are a form of cold storage. They store your crypto and stay offline. This way, only you can touch your money.

Crypto platforms with diverse offline storage show they care. They give you options. You can choose from different hardware wallets and cold storage methods. For example, some people go for encrypted USB drives. They hold the private keys to your crypto. Others prefer specially built hardware wallets. These come designed just for crypto storage. Now, some folks ask, “Why not just a bank safe?” Yes, you could do that. But these wallets offer tech designed for crypto’s unique needs. They’re built to work with blockchain.

The term “air-gapped” might sound techy, but it’s simple. Air-gapped storage is totally cut off from the internet. Not even a Wi-Fi signal can reach it. That’s what makes it so safe. Even if a hacker breaks into the exchange, they can’t get to your crypto.

Offline crypto storage diversity also means flexibility. Some exchanges offer single storage options. But top-rated secure exchanges often have many. You can pick from paper wallets, hardware devices, and even dedicated offline computers.

Hardware wallet integration makes trading smooth. You can link your secure wallet to an exchange for easy trading. Then, you pull it offline when done. It’s like taking your card out of an ATM when you have your cash. This tech keeps your trading secure, yet simple.

Do these features make an exchange foolproof? No system is perfect, but with cold storage, the odds are in your favor. Exchanges with these tools take your financial safety in crypto seriously. They understand that in the crypto world, good security means good business. After all, crypto hacker prevention is no small task. It needs strong tools like encrypted cold storage, safe transaction processing, and smart private key storage. These turn a trading platform from risky to reliable.

Remember, in crypto trading, security isn’t just nice to have — it’s a must-have. Your coins’ safety depends on the storage and security measures of the exchange you choose. Pick wisely!

In-Depth Reviews: Hardware Wallet Integration and Air-Gapped Solutions

The Importance of Hardware Wallet Integration for Secure Trading

Secure crypto wallets are a must for anyone trading crypto. Think of them like a bank vault. But for digital money. Hardware wallet integration means adding an extra lock to that vault. It lets you keep your crypto off the web and safe from hackers.

How? Well, hardware wallets store your private keys offline. You might wonder why that’s a big deal. Here’s the answer: if your keys are offline, no one can steal them without physical access. This is why the best secure crypto exchanges tie in hardware wallets.

I’ve seen loads of crypto exchanges. The top-rated ones always make hardware wallet use easy. They blend online trading with strong offline key defense. It’s a one-two punch against theft.

Even the best systems can fall prey to slick hackers. So, exchanges need to keep a step ahead. Hardware wallet integration does just that. It puts a robust barrier between your stash and the sly foxes out there.

Assessing the Safety of Air-Gapped Storage in Exchanges

Now let’s talk about air-gapped storage. It’s cold storage turned up to eleven. It means the storage device never meets the internet. Not even a side glance. This is cold storage trading platform safety in its best form.

Does this make a difference? You bet it does. The safety of air-gapped storage in exchanges is top-notch. No net means no way for remote cyber crooks to get in. It’s like having a treasure chest on a desert island. Only you have the map.

Of course, this isn’t a set-it-and-forget-it kind of deal. Exchanges must check and double-check their setups. So, they perform what’s known as a digital currency exchange audit. They bring in pros to do deep dives into the security. They ensure the air-gapped system is snug as a bug.

And what about the user end of things? I always keep an eye on crypto platform safety features through user reviews crypto platforms. Why? Well, if something’s a hassle or not working, people will shout about it. This feedback from users can tell a lot about a platform’s trustworthiness.

Remember this though – no single security measure is perfect. But stacked together, they build a fortress. Exchange platform reliability grows when we mix hardware wallets and air-gapped solutions. It means having many layers, like an onion, to keep your digital treasures safe.

As someone knee-deep in cybersecurity for crypto, I sweat the details so you can trade with a calm mind. Remember to always look for exchange cold wallet features. And lean on exchanges that know the worth of a good air gap.

Protecting your digital riches is what it’s all about. And these tech tricks are the secret sauce for financial safety in crypto. Keep these tips in your pocket, and you’ll trade with peace of mind.

User Experience and Security Feedback

Analyzing User Reviews of Crypto Platforms for Security Insights

When crypto traders talk, I listen. Their words hold clues about security. User reviews can reveal much about crypto exchange security features. One says, “This platform’s offline crypto storage diversity gave me peace of mind.” Another notes, “The cold storage capabilities here are top-notch.”

I dig through these reviews. I look for trends. Are people happy with how their private keys are handled? Do they trust the exchange’s blockchain security protocols? Hardware wallet integration often gets praise. It makes trading safe.

Secure digital asset exchange isn’t just nice to have; it’s a must. Users often share details about their secure transaction processing experiences. They might say, “Setting up my hardware wallet was simple and made me feel secure,” or “The multi-layered security exchange approach here puts barriers between my funds and hackers.”

Comparing Exchange Safety Ratings and Customer Feedback on Security

Next, I match user reviews with official safety ratings. I aim for consistency. A high-security crypto trading platform should have both top-rated secure exchanges status and glowing user experiences to match. Financial safety in crypto is not just technical. It’s personal. Every positive review suggests that someone slept well at night, confident their digital currency is safe.

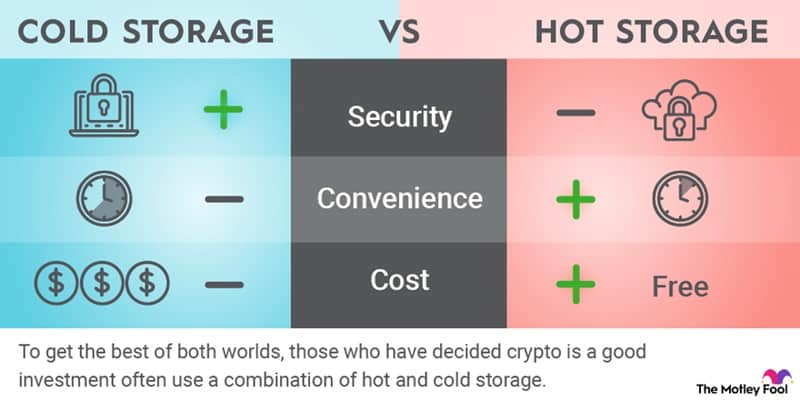

I notice cold storage trading platforms get a lot of love. It’s because cold storage versus hot wallet isn’t just a choice. It’s a statement about security. Crypto cold wallet benefits are clear. They keep your stash offline, away from online threats.

Finally, customer feedback on security helps me guide others. It’s one thing to tout secure crypto wallets. It’s another to see a stream of users confirm it. Encrypted cold storage options? They’re a hit. Users feel their assets are protected better.

This feedback loop is vital. It shapes trust. It builds a picture of exchange platform reliability. Crypto custodian services get scrutinized, too. How well do they guard other people’s coins? The answers lie in the stories traders tell.

Overall, every piece of user experience creates a roadmap. It leads to the best secure crypto exchanges out there. It’s not just about the cold wallet; it’s also about the care behind it.

Security Protocols vs. Convenience: Finding the Right Balance

Cold Storage Versus Hot Wallet: Making an Informed Choice for Crypto Asset Management

When you keep your crypto, you have two main options: cold storage or a hot wallet. Cold storage means keeping your digital cash offline, away from thieves and hacks. Hot wallets are connected to the internet, so they’re ready for quick trades but at higher risk. Think of it as cash in a safe versus cash in your pocket.

You must ask, “What matters more, security or easy access?” If you don’t plan to trade often, cold storage is safer. If trading daily is your style, a hot wallet’s quick access helps. Best secure crypto exchanges offer both, letting you choose based on your needs.

Let’s get into the nitty-gritty of cold storage. It’s like a vault. Your crypto is offline, so hackers can’t reach it. Secure crypto wallets mean a hardware wallet – a device you plug in to trade and unplug when done. Hardware wallet integration matches the toughness of a vault door. It keeps your digital gold locked tight.

The balance is clear: cold storage for peace of mind, hot wallets for speed. Secure transaction processing is a must for either choice. Always look at crypto exchange security features before deciding. Exchange platform reliability can make or break your experience.

The Role of Multi-Layered Security in Exchange Platforms and Custody Services

Now, multi-layered security—it’s like an onion. Each layer you peel adds more protection. Crypto hacker prevention starts with a tough outer layer. This usually means strong logins, like two-factor authentication (2FA). It stops unwanted guests at the door.

Going deeper, there’s encryption. This scrambles your data into code only you can read. Even if a hacker gets in, they find gibberish. It’s another win for exchange cybersecurity evaluation. Crypto custodian services should use this to shield your stash.

Air-gapped storage safety is a layer often praised in user reviews crypto platforms. Air-gapping is like putting your crypto on an island without bridges — totally isolated. Only trusted folks with a boat, or in this case, a secure device, can reach it.

Each layer, from offline crypto storage diversity to advanced cryptographic storage solutions, defends your wealth. Crypto trading with security features like these is less risky. You can sleep at night knowing your digital coins are behind walls, moats, and guardians.

High-security crypto trading isn’t just about locking down assets. It’s about smart systems that protect without getting in your way. With the right exchange, you can trade swift and safe. Exchange cold wallet features, like encrypted cold storage options, align safety and speed.

Secure digital asset exchange is the goal. Look for the balance that fits your trading life. Remember, your keys, your crypto. Keep them safe and trade with confidence.

In this post, we’ve dug deep into how vital security is for crypto trading. We looked at exchange features that keep your coins safe and cold storage methods. It’s clear that hardware wallets and air-gapped measures boost security for your crypto assets. Your own reviews and the feedback from other users give us real insight into which platforms do security right. And we’ve seen how exchanges balance strong safety with ease of use.

My final thoughts? Always choose a crypto exchange that values your security as much as you do. Opt for ones with solid cold storage, hardware wallet support, and listen to what other traders say. In crypto, the right balance of security and convenience can make all the difference. Stay safe and trade smart!

Q&A :

What are the benefits of using crypto exchanges with cold storage?

Cold storage is a security measure used by crypto exchanges to protect users’ digital assets from online threats such as hacking, as it involves keeping a reserve of cryptocurrencies offline. By storing assets in a way that they are not accessible via the internet, cold storage significantly reduces the risk of unauthorized access. Users often seek out exchanges that offer cold storage because of the enhanced security it provides, which can be a critical factor for those looking to safeguard substantial amounts of cryptocurrency.

How do reviews rate the security of crypto exchanges that utilize cold storage?

Reviewers often rate the security of crypto exchanges with cold storage highly, citing it as a top feature for ensuring the safety of digital assets. Many reviews focus on the robustness of security protocols, the percentage of assets held in cold storage, and the ease of access for the legitimate user. It is important for users to read through reviews and conduct their own research to ensure that the exchange’s security measures, including its cold storage practices, meet their individual needs and expectations.

Are there any drawbacks to using exchanges with cold storage according to reviews?

While the enhanced security of using exchanges with cold storage is praised, some reviews highlight potential drawbacks such as delays in withdrawal times due to the offline nature of cold storage. Because funds are not immediately accessible as they would be in hot (online) wallets, some users may experience inconvenience when accessing their assets. Reviews may also mention that the complexity of the exchanges’ security processes can be a barrier for less experienced users.

What should users look for in reviews when choosing a crypto exchange with cold storage?

When choosing a crypto exchange with cold storage, users should look for reviews that discuss the exchange’s track record for security, the user experience, the accessibility of funds, and the responsiveness of customer support. It’s important to consider the proportion of assets the exchange holds in cold storage versus hot wallets, and any insurance or additional security measures they provide. Reviews that detail personal experiences with the exchange’s services can give valuable insight into the reliability and trustworthiness of the platform.

How often do crypto exchanges with cold storage get reviewed for their security measures?

Crypto exchanges with cold storage are typically reviewed for their security measures by both users and cybersecurity experts periodically. The frequency of these reviews can vary; however, major exchanges are often subject to continual scrutiny due to the fluctuating nature of security standards and the evolving strategies of cyber attackers. Professional review sites and forums may update their assessments annually, or after significant updates to the exchange’s security protocols. Users looking for recent reviews should look at the latest user comments, professional security audits, and any news relating to the exchange’s security performance.