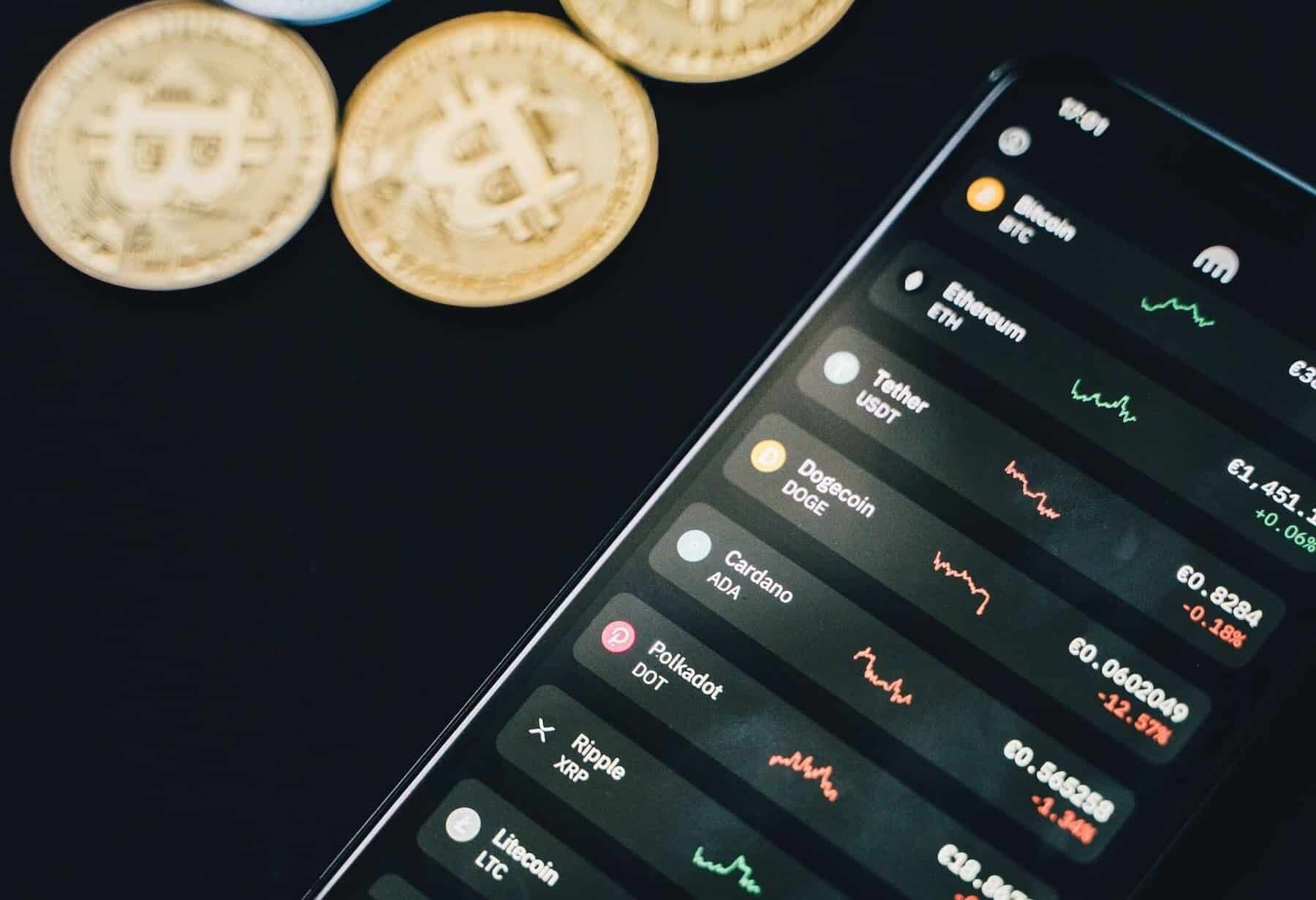

Navigating the world of cryptocurrency can feel like tiptoeing through a minefield, where one wrong step can spell disaster for your digital assets. You need most secure crypto exchanges that not only promise to safekeep your investments but also deliver on their word with iron-clad security measures. If you’re looking to trade with peace of mind, understanding the fortress-like protocols these platforms offer is critical. My deep dive into the crypto security realm peels back the layers of technical jargon to reveal the top-performing exchanges where your crypto isn’t just stored; it’s fortified. Here’s to making informed choices that pair your savvy trading moves with the paramount importance of safety!

Evaluating Exchange Security Frameworks

Ranking the Top 5 Crypto Exchanges by Security Measures

The best exchanges nail security. I am talking about top-notch systems that keep your digital money safe. How can you tell if an exchange is secure? Look at their track record, security measures, and user feedback. A secure exchange does more than just hold your coins. It fights off hackers, keeps private keys safe, and has a solid plan if things go wrong.

Let’s break it down. The top 5 crypto exchanges put security first. They use cold storage options to keep funds out of reach from online threats. These platforms handle your data with care, using encryption techniques. That means your info is scrambled, making it super hard for bad guys to figure out.

Each exchange also needs top-tier user privacy protection. This includes keeping your personal info under wraps. They must have a plan for DDoS protection. These attacks can crash a site by flooding it with traffic. Good exchanges can fight this off and stay running.

Two-factor authentication is a must. It’s like a double lock on your account. Even if someone gets your password, they still can’t get in without the second key. Key Security Protocols: From Encryption to Account Insurance Crypto is all about staying ahead of trouble. Secure exchanges know this and arm themselves to the teeth.

Think about insurance. It’s not just for your car or home. Insured crypto accounts mean even if something crazy happens, you’re covered. That’s peace of mind you can’t overlook.

Encryption keeps snoops out of your business. It scrambles your data so only the right people can unscramble it. And let’s chat about hardware wallet support. It’s a way to store coins offline, so hackers can’t touch them.

Now for regulatory compliance. It’s like a rule book that exchanges follow to play fair. This includes KYC, which stands for “Know Your Customer.” It’s a way for exchanges to know who’s using their platform. Then there’s AML, standing for “Anti-Money Laundering.” Both help keep everything on the up-and-up.

Multi-signature wallets need more than one key to open. This spreads the risk and keeps your stash safer. And let’s not forget customer support. If things go sideways, you want someone on your side, ready to help.

Safety and crypto go hand in hand. A safe exchange is like a bank vault for your digital dough. It keeps risks low and trust high. And that’s what you want when you’re trading in the world of crypto.

Advanced Security Practices for Cryptocurrency Safety

The Role of Multi-Signature and Hardware Wallets in Asset Protection

When you want safety for your digital coins, multi-signature wallets are key. They’re like a safe that needs two keys to open. Say your friend has one key, and you have the other. Now, imagine those keys as digital signatures. Your coins are only moved when you both agree. Pretty smart, right?

But wait, it gets better! Combine this with hardware wallets, and it’s like having a treasure chest inside a vault. A hardware wallet keeps your keys offline, so hackers can’t touch them. No internet, no hack. It’s that simple.

Now, some top exchanges let you use your hardware wallet. This means you can trade with ease and still sleep well at night. Best of both worlds!

And yes, there are exchanges that insure your assets. They do this so you’re covered even if something really bad happens. Think of it as a safety net for your coins.

Security is a big deal in crypto. Rules and checks make sure exchanges stay honest and safe. This is all to protect you and your money.

So, the next time you use an exchange, check if they use multi-signature and support hardware wallets. It’ll tell you they value security as much as you do.

Implementing DDoS Protection and Recovery Protocols

Ever heard of DDoS? It’s like a massive crowd trying to get through a shop door all at once. It gets jammed. This can happen to exchanges too. But the good ones have bouncers. They sort out who should come in and who shouldn’t.

If an attack happens, there’s also a plan to fix things quick. This plan is called a recovery protocol. It’s like having a backup key for your house.

The top exchanges test their defense against DDoS regularly. It shows they’re ready for anything. They also look back at past hacks to learn and get better. Exchanges that learn from the past are the ones that stay strong.

They keep your personal data safe too. Because no one should be poking around your business, right?

Remember, when you’re picking a place to trade, check for DDoS protection and a solid recovery plan. It shows they’re not just about making trades but also about keeping them safe.

Crypto is exciting, but it’s a lot more fun when you know your investments are protected. Secure exchanges don’t just happen; they’re made through smart design and a commitment to your safety. So, choose wisely and trade with peace of mind.

Understanding Compliance and User Safeguards

Navigating KYC and AML Standards in Secure Exchanges

Complying with KYC and AML is a must for safe trading. The top exchanges do this well. They check your ID and track suspicious money flows. This keeps everyone’s funds safe.

KYC means “Know Your Customer.” It helps stop crime and fraud. Exchanges ask for your photo and ID. They make sure you are who you say you are. AML stands for “Anti-Money Laundering.” If funds move in weird ways, AML finds out why. By doing these things, exchanges fight illegal money use.

To be secure, exchanges must follow these rules. It’s not just for their good, but for ours too. This way, we know our money is in a place that cares about security.

Strategies for Phishing Prevention and Enhanced User Privacy

Phishing tricks users to spill personal info. Secure platforms fight this hard. They use emails, texts, and even websites that look real, but they’re traps.

What do safe exchanges do? They teach users how to spot these fakes. They also use tech to block harmful links and sites. This helps keep our data and money safe.

User privacy is also a big deal. Encrypted chats and data storage are used. No one outside the exchange can see what’s in your account. Two-factor authentication is another wall for hackers. It asks for a code from your phone or email before you can log in.

By using all these tools, exchanges become places we can trust. We sleep well, knowing our crypto is secure. They show they care by protecting us from theft and spying eyes.

In a world where cyber crimes are common, these security steps matter a lot. Exchanges that use them get high trust ratings. They show they’re serious about keeping our assets and ID locked tight.

When choosing where to trade, we must think about these things. Safety should be a top concern. After all, it’s our money on the line. The best policy is to play safe, always.

Technical Safeguards and Customer Support Integration

Ensuring Secure Blockchain Networks and User Interfaces

Let’s talk safety in the world of crypto exchanges! Crucial stuff, right? The best platforms mix top-notch digital defenses with easy-use features. We want tech that guards our coins like a sleepless watchdog.

First, safe exchanges use strong walls of code—called encryption. It scrambles data so only the right eyes see your personal details. Imagine a secret language only you and your friend know. That’s encryption at work!

Two-factor authentication (2FA) is another critical shield. It confirms it’s really you trying to access your account by using something you know (like a password) and something you have (like your phone). Think of it as a double lock on your crypto riches.

Next up, hardware wallet support. Imagine a physical key for your digital cash. That’s a hardware wallet. It keeps your currency offline, so hackers can’t easily reach it. Just plug it in to move money or check on your stash.

Insured accounts bring peace of mind. If something goes wrong, like a hacking attack, insurance steps in to help cover losses. Secure exchanges take this seriously. They make sure you’re not left out in the cold.

We also can’t forget about cold storage options. They’re like vaults tucked away from the cyber world. Your coins sit in secure cold storage, far out of hackers’ reach.

Let’s focus on how secure blockchain networks stay safe. Think of a chain where each link is a bundle of transactions. These chains are stored in public, on tons of computers. This makes cheating or trickery really hard.

Now, for secure user interfaces—a fancy way of saying how you interact with an exchange online. The best interfaces are crystal clear. They make it easy to do what you need without confusion or mistakes.

The Importance of Customer Support in Managing Security Issues

When things get tricky, great customer support is key. The top exchanges know this. Their support teams are there to guide you through any hiccups.

Running into problems? They’ve got your back. Exchange teams can explain security features or help if you spot something fishy. Real humans ready to lend a hand—that’s golden.

Customer support can also teach you how to keep your account tight. By learning tips from them, you’ll make a hacker’s job way harder. So, keeping an exchange’s number close is a clever move.

But wait, there’s more! Teams also hear feedback on how their systems work in real life. They use your insights to sharpen safety measures. Smart, huh?

So, finding a platform that mixes tough security with helpful guides is a win. It’s how safety meets your assets in the crypto game. Remember, behind every successful trade is an exchange that’s got your back—24/7.

In this post, we broke down the keys to secure crypto trading. We kicked things off by comparing top exchanges and their safety steps. We talked about vital security rules, touching on everything from code scrambling to money guarding.

We also delved into cutting-edge security tricks. We saw how multi-sign tech and physical wallets keep your digital cash safe. We talked about fending off nasty online attacks and being ready with recovery plans.

Understanding the rules and defenses that keep users safe was up next. We walked through KYC and AML checks and shared ways to dodge scams and keep personal stuff private.

Lastly, we looked at tech safety nets and the role of help teams. Making sure the tech behind the scenes is solid and having support on speed dial for trouble is crucial.

So, remember, keeping your crypto safe is a big deal. Choose platforms wisely, use smart security, be aware of the laws, and use help when you need it. Here’s to trading with confidence and keeping your investments secure!

Q&A :

What are the top-rated secure cryptocurrency exchanges?

When it comes to finding the most secure crypto exchanges, the community often references platforms like Coinbase, Binance, and Kraken. These exchanges have built a reputation for implementing extensive security measures such as two-factor authentication (2FA), cold storage of funds, and insurance policies to protect users’ assets. Always check for the latest user reviews and security audit information to make the best decision for your crypto trading needs.

How do secure crypto exchanges protect user funds?

Secure cryptocurrency exchanges use a variety of methods to protect user funds, including employing encryption techniques to safeguard personal information, utilizing cold storage to keep a significant portion of digital assets offline, implementing withdrawal whitelist systems, and maintaining rigorous compliance with financial regulations. Many also offer security features like 2FA, email confirmations for withdrawals, and custom withdrawal limits.

What should I look for to ensure an exchange is secure?

When determining the security of a crypto exchange, pay close attention to several key aspects: the history of security breaches, the quality of the customer support team, compliance with regulatory standards, the existence of insurance funds to cover potential losses, and the deployment of security features like multi-signature wallets, 2FA, and cold storage options. Furthermore, reading up-to-date user reviews and seeking out independent security audits can offer additional insights into an exchange’s reliability.

Are decentralized exchanges more secure than centralized ones?

Decentralized exchanges (DEXs) offer a different approach to security compared to centralized exchanges by allowing users to retain control of their private keys and funds, typically resulting in reduced risk of server-side hacks. However, they are not immune to risks, such as smart contract vulnerabilities. Users should thoroughly research and possibly test out any DEX before fully committing, as the absence of a central authority makes it harder to recover funds in case of mistakes or issues.

What are the signs of an insecure cryptocurrency exchange?

An insecure cryptocurrency exchange might exhibit red flags such as a history of security breaches, poor user reviews regarding security practices, lack of transparent communication from the exchange’s team, minimal customer support, and insufficient information on the exchange’s website about their security protocols. Additionally, the absence of features like 2FA, insurance policies, or compliance with recognized financial standards can indicate a lack in security measures.