As a globe-trotting Bitcoin buff, you’ve likely pondered, How do different countries regulate Bitcoin? Strap in for a whirlwind tour of the planet’s Bitcoin rulebook. From countries clamping down hard to those rolling out the welcome mat, Bitcoin’s legal ground is as varied as the cultures it crosses. Find out where Bitcoin’s a no-go, where it’s booming, and exactly why your crypto wallet cares. Get the scoop on what shapes Bitcoin law and dodge the pitfalls of a world not quite ready to agree on one way to keep Bitcoin in check.

Bitcoin Borders: Unraveling Cryptocurrency Regulations Worldwide

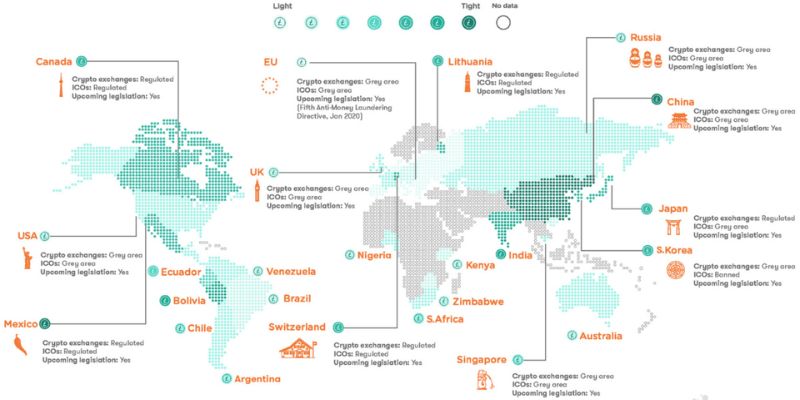

Mapping Global Bitcoin Legislation

Diverse Legal Landscapes and the Status of Bitcoin

The world is a patchwork quilt when it comes to Bitcoin laws. Each country decides if and how it regulates Bitcoin. I see vast differences as I look at Bitcoin legislation by country. Some fully allow it, some put up huge roadblocks, and others have taken a middle path. The legal status of Bitcoin often keeps changing, making my job both exciting and complex.

In the United States, for example, Bitcoin is legal. But, anyone selling needs a license. And, they must follow money handling laws. This balances freedom with control.

Canada sees Bitcoin as property. That means Bitcoin trades can get taxed like stock trades. People often ask me about using Bitcoin for small buys, like coffee. In Canada, that might lead to a tax event each time!

The Extremes: Countries Banning vs. Embracing Bitcoin

Now, let’s talk extremes. Some nations fear Bitcoin. They link it to crime, loss of control, and economic risks. These Bitcoin ban countries often outlaw its use fully. As for which countries have taken this route, think of places like Algeria or Bolivia. They say a strong “No” to Bitcoin.

However, some nations love Bitcoin. These countries see it as a chance to grow and lead in tech. El Salvador even made Bitcoin legal money! It’s a move showing trust in Bitcoin’s future and its power to help economies.

Others, like Singapore, create friendly rules for Bitcoin and crypto trading. They want to become crypto-safe havens. This attracts new business. Their laws also battle money crimes, like terror funding, without smothering the tech. It’s a fine line to walk, and they do it well.

Looking at taxes, each country writes its own playbook. Some see Bitcoin as money; others, as property or a tradeable asset. This changes how it gets taxed. I guide Bitcoin fans through this tax jungle.

Now, an often missed fact is anti-money laundering rules. They hit Bitcoin too. Exchanges must know who their customers are. This fights crime while keeping Bitcoin’s good name.

Bitcoin’s reach spans our globe. But its legal roots dig into local ground. From bans to open arms, Bitcoin laws differ widely. I hunt down these laws, making sense of them for folks like you. This helps you stay safe and legal in your Bitcoin moves. The key takeaway? Always check your local Bitcoin laws.

Remember, rules can change fast. So keep your ear to the ground and stay informed about Bitcoin’s legal trips around the world!

The Building Blocks of Cryptocurrency Regulation

Country-Specific Crypto Policies and Regulatory Frameworks

Every country has its own rules for crypto. As an expert, I track these policies. The legal status of Bitcoin varies across the globe. Some nations ban it, while others embrace it. Countries like Japan recognize Bitcoin as a legal payment method. El Salvador went further, adopting Bitcoin as legal tender. This means you can use Bitcoin for most purchases. Many countries don’t have specific laws for Bitcoin yet. Here, taxpayers must figure out how Bitcoin fits into existing tax laws.

Countries shape their regulatory frameworks for cryptocurrencies to manage risks. They want to stop crimes like money laundering. Regulations often include how to report Bitcoin for tax. They look at how companies do business with it too. Talking about business, all companies linked to Bitcoin must follow these rules. They need licenses to operate. They also must know their customers. This is part of the fight against crime.

Enforcement and Compliance in the Bitcoin Ecosystem

Anti-money laundering (AML) steps are big in Bitcoin’s world. Bitcoin firms must check where their money comes from. They can’t just take money from anywhere. They must make sure it’s not from illegal acts. This stops people from hiding crime cash.

Enforcement of Bitcoin transactions ensures rules are followed. Agencies keep an eye on the Bitcoin market. They can spot and stop bad actions. For instance, if someone tries to use Bitcoin for a crime, they act. They can trace Bitcoin use by watching the blockchain. This is a record of all trades.

We know lots of countries worry about Bitcoin and national security. They fear it could hurt their control over money. This is why they set rules for who can send Bitcoin across borders. They do this to manage risks and keep an eye on money movements.

In short, countries all over are building a better system to handle Bitcoin. They use laws and rules to make sure it’s safe and fair for all. They aim to let folks enjoy the perks of Bitcoin. But, they also work to keep the bad guys out. This can be tricky, but it’s crucial for a digital money future. It’s a balance between freedom and safety. A lot depends on how this plays out. It will shape how we all use money in years to come.

Financial Regulations Impacting Bitcoin Operations

Taxation and Anti-Money Laundering Directives

Bitcoin tax laws

Every country has its own way of taxing Bitcoin. In some places, when you sell Bitcoin and make money, you must pay a tax. This is like when you sell a toy for more than you paid. You have to tell the government and pay some of that money as tax. Other countries might not tax Bitcoin at all, which can be very different from one place to another.

Combating the financing of terrorism (CFT) regulations in crypto

Bitcoin is cool, but bad guys might try to use it for bad things. So, to stop this, there are strict rules called CFT. They make sure people can’t use Bitcoin to help others do bad stuff. Everyone dealing with Bitcoin must check where the money comes from. They make sure it’s not going to people who should not get it.

Centralized Institutions vs. Decentralized Currencies

Central bank stance on Bitcoin

Central banks are big, powerful banks that help manage a country’s money. They are like the boss of money in their country. They can say if they think Bitcoin is good or not. They might like it, not care, or even say no to it. If they say yes, it can make things better for Bitcoin in that country.

Decentralization and government control

Bitcoin is different because it’s not controlled by just one group or person. That’s called decentralization. It’s like having many captains on a ship, not just one. This can be tricky for governments. They like to be in charge and know what’s going on. But with Bitcoin, it’s not so easy. They have to find new ways to keep an eye on it without being the boss of it.

When we look at Bitcoin, we see a world of new rules and ideas. Some places welcome it with open arms, while others are still deciding. It’s like a giant puzzle where every country puts its piece in its own unique way. When it comes to laws about Bitcoin, it’s important to learn how each place treats it. Knowing this can keep you out of trouble and help make good choices when using Bitcoin.

Most of all, it’s not just about following rules. It’s about understanding them. That way, we can all enjoy using Bitcoin safely and fairly, wherever we may be.

Strategies for Navigating International Bitcoin Commerce

Cross-Border Payments and Exchange Guidelines

Cross-border Bitcoin payments

Sending Bitcoin across borders is simple. You just need the receiver’s wallet address. Money moves fast, often in minutes. Countries can’t block these transactions, but they control Bitcoin in two main ways. One is through Bitcoin exchange guidelines, which set rules for trading Bitcoin.

Bitcoin exchange guidelines

Exchanges must follow tough laws. This stops illegal acts with Bitcoin. For example, they use Know Your Customer (KYC) rules. This means they need your ID before you buy Bitcoin. Countries with strict guidelines keep a close eye to ensure rules are followed.

Investing in Bitcoin: Risks and Compliance

Bitcoin investment regulations

Investing in Bitcoin comes with rules. What rules? Like reporting gains on taxes. Yes, most places tax Bitcoin profits. They see it as property or an asset. Some have special tax laws just for Bitcoin.

Illicit Bitcoin use prevention

How do they stop illegal Bitcoin use? Countries use anti-money laundering rules. They look for suspicious activities. Bitcoin services must report these to the authorities. This helps catch bad guys using Bitcoin for wrong things.

Cross-border Bitcoin payments and exchange operations can be a minefield, with various rules and pitfalls waiting to trip you up. However, if you know the landscape, you can navigate these waters with confidence.

Let’s peel back some layers. You want to send Bitcoin from the US to France. Sounds easy, right? And it is, in essence – no need for bank accounts or currency exchange; just the recipient’s address. But there’s more to it. The US and France both have rules on how these assets move, and breaching them – even unknowingly – could lead to trouble.

Now, plug-in exchanges. They’re the ramps leading into and out of the Bitcoin highway. The aforementioned KYC protocols come into play here, as exchanges keep records to trail the money. Banks used to hold this responsibility alone, but now as digital currencies gain ground, so does the need for control. These controls are necessary – they deter money laundering and the financing of unsavory activities.

Investing is another beast. Think about a roller coaster – thrilling, yet accompanied by safety instructions. Before you hop on the Bitcoin ride, these regulations act as your safety harness. By knowing the rules – like how your gains will be taxed and what you need to disclose – you’re safeguarding yourself against future headaches. Tax laws vary widely, and keeping abreast with Bitcoin tax laws ensures you won’t get caught off-guard when tax season rolls around.

Finally, illegitimate dealings. Authorities worldwide cracked down on shady Bitcoin transactions to cut the criminal element off at the knees. Anti-money laundering mechanisms are key in this battle, pressuring platforms to monitor dealings closely. Information sharing frameworks between countries are also strengthening, tightening the net on lawbreakers.

Wading through the complex terrain of Bitcoin borders requires awareness and diligence. By understanding country-specific policies and maintaining compliance with international cryptocurrency measures, you can transact with Bitcoin more safely and legally, capitalizing on the strengths of this revolutionary digital currency.

In this post, we explored Bitcoin regulations across the globe. We saw diverse rules that change from country to country. Some ban Bitcoin, others embrace it fully. We delved into how countries build their crypto rules and make sure people follow them. Taxes and anti-money-laundering steps in crypto were key points, too.

We also checked how big banks see Bitcoin and the push and pull with government control. Finally, we tackled the tough parts of Bitcoin trade across borders and staying within laws when investing.

My final thought: knowing your local Bitcoin laws is crucial. Always stay updated and play it safe. It pays to be in the know!

Q&A :

How is Bitcoin regulated around the world?

Different countries take varied approaches to Bitcoin regulation. Some countries, like the United States and Canada, treat it as a commodity and subject it to specific financial rules and taxes. Others, like Japan, recognize Bitcoin as a legal payment method, while several countries, including China and Russia, impose restrictions on its use. The regulatory landscape is constantly evolving as governments assess the risks and benefits of cryptocurrencies.

What countries have legal frameworks for Bitcoin?

Many countries have started to develop legal frameworks to regulate Bitcoin and other cryptocurrencies, adapting their existing financial laws or creating new ones. For example, the United States has implemented regulations through the SEC, IRS, and FinCEN, affecting how Bitcoin is traded, taxed, and used. Countries like Japan and South Korea have also established regulations to oversee cryptocurrency exchanges and transactions.

Are there any countries where Bitcoin is completely banned?

Yes, some countries have outright banned Bitcoin and other cryptocurrencies. The reasons for these bans range from concerns over illegal activities, financial security, and the stability of the national currency. For instance, as of my last update, countries like Bolivia, Algeria, and Morocco have issued total bans on the use of Bitcoin and similar digital currencies.

Can Bitcoin be taxed internationally?

Bitcoin can be subjected to taxation in countries where it is recognized as a legal form of currency or property. Typically, these countries require citizens to report their cryptocurrency holdings and transactions for tax purposes. Capital gains tax, income tax, and other tax categories might apply, depending on the jurisdiction and the nature of the transaction.

How do international regulations impact Bitcoin trading?

International regulations can significantly impact Bitcoin trading as they affect the operations of exchanges, the ability to move funds, and users’ compliance obligations. Stringent regulations may lead to reduced liquidity and increased trading costs, while lax regulations can make a country a more attractive trading hub but may increase risks related to fraud and market manipulation. Traders often have to stay informed and adjust their strategies based on the regulatory climate in different countries.