Stablecoins Explained: Securing Your Cryptocurrency Investments

If the crypto world feels like a rollercoaster, what are stablecoins might just be your safety harness. These digital bucks keep your money from taking wild rides. Think steady, think solid. In this read, I’ll break down the what and how of stablecoins, making sure your crypto journey is smooth sailing. They’re the anchors in the stormy sea of volatile Bitcoin and friends. Ready to dive into the stablecoin pool? Let’s paddle through the calm waters of smarts on your coin moves!

Understanding Stablecoins in the Cryptocurrency Market

Defining Stablecoin and Its Purpose in Crypto Investments

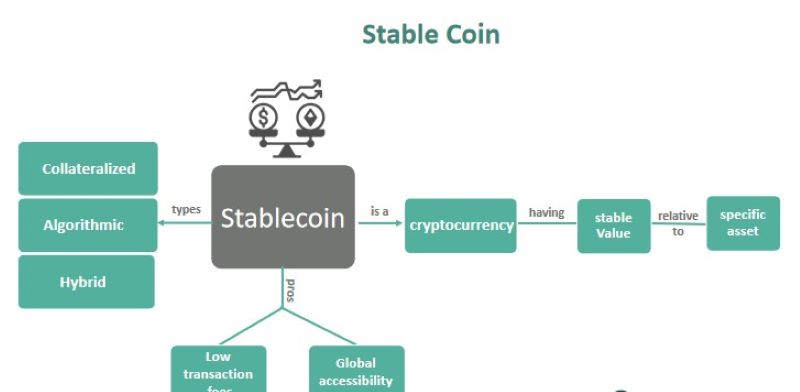

What is a stablecoin? It’s a type of cryptocurrency that stays at a fixed value. It does this by tying its worth to something else, like the US dollar. This link helps keep its price steady.

There are three main types of stablecoins. First, we have fiat-collateralized stablecoins, these are backed by real-world money. Next, crypto-collateralized stablecoins hold other digital currencies as collateral. Last, algorithmic stablecoins use computer programs to keep their value.

Why use a stablecoin? They help reduce risk. Think of them as the calm in the stormy crypto market. They give folks a safe place to park their cash. Plus, you can use them just like other cryptos without wild price swings.

The Connection Between Stablecoins and Cryptocurrency Stability

Do stablecoins help keep the cryptocurrency market stable? Yes, they can. Imagine them as anchors. They help prevent big price drops or spikes. That’s because their value doesn’t change much.

Cryptocurrency stability is a big deal for traders and investors. With stablecoins, the market gets a tool to fight off big price changes. They make it easier to trade and invest without worry.

Stablecoins can be a bridge between fiat currency and cryptocurrency. Because they are stable, they help people trust and accept digital money. They also make dealing with crypto exchanges safer and less scary.

So, what’s the big deal with stablecoin market cap? Market cap tells us how much money is in stablecoins. It shows if they’re popular and how much they are used. A high market cap means lots of trust in stablecoins. It means people are using them a lot.

Blockchain technology makes all this possible. It keeps stablecoins secure and lets everyone see what’s going on. This transparency helps build trust.

Stablecoins help with price stability in crypto. They are like cushions that soften big price moves. Without them, people might be too scared to use or invest in crypto.

In short, stablecoins are key for keeping things steady in the crypto world. They let you invest without the roller coaster ride. They’re like the trusty sidekick in your crypto adventures. They’ve got your back when the going gets tough.

The Different Faces of Stablecoins: Types and How They Work

Examining Fiat-Collateralized, Crypto-Collateralized, and Algorithmic Stablecoins

Think of stablecoins like digital dollars, with a twist. Just as Superman has different forms, so do stablecoins. They bring cryptocurrency stability to the table. Here’s how they work.

Fiat-collateralized stablecoins are the first type. They are like a safe with money inside. For every stablecoin, there is real money, like USD, stored away. This kind is simple and easy to get.

Crypto-collateralized stablecoins are a bit trickier. They use other crypto, not cash, to back them up. This is like building a house with Legos. If you have more Legos, your house is stronger. It’s the same with these stablecoins; extra crypto means extra security.

Lastly, meet the brainy ones: algorithmic stablecoins. These are smart coins. They don’t use cash or crypto to stay stable. Instead, they use math and rules set in code to keep their value. It’s like a seesaw that keeps itself level.

Digital Currency Pegging: How USD Pegged Tokens Maintain Their Value

You might wonder, how do they all keep their value? Well, think about a tag on your shirt, it’s always there. It tells you the size. USD-pegged tokens have a “tag” that keeps them worth one dollar.

They do this through pegging mechanisms. These are the tools that help stablecoins stick to a set value. Picture a ship tied to a dock. No matter the waves, the ship stays close by. That’s what these tools do to the stablecoin value.

Some use a reserve of money. Others rely on other crypto holdings. Some even adjust the number of coins available. It keeps the ship of value docked to one dollar.

Knowing about the types of stablecoins helps you make smart stablecoin investments. Whether you trade, save, or send money, choosing the right kind of stablecoin is key. Keeping this in mind will help you as we dive further into the world of digital currency pegging.

The Role of Stablecoins in Modern Finance

Stablecoin Use Cases from DeFi to Remittances

Imagine having a dollar that lives on the internet. That’s a stablecoin. It’s a coin whose value doesn’t change much. Think of it as a safe haven in the wild world of crypto. It bridges real money, like dollars, to the digital space. People use it in many ways.

What are some use cases of stablecoins? They’re handy for sending money across the world without the high fees or waiting that banks make you face. They are big in DeFi, short for decentralized finance. This is where people lend, trade, or invest without a bank or middle man. They use stablecoins to make these deals easier and smoother.

For workers sending money home, stablecoins are a game-changer. Imagine sending cash from the U.S. to family in another country. It’s quicker and cheaper with stablecoins. No need to worry about exchange rates or bank days. It gets there fast, anytime. Businesses like them too. They use stablecoins to keep money safe when dealing with other countries.

Stablecoins are a key piece in the crypto puzzle. They link old-school money and new digital trades.

Navigating Through Stablecoin Regulations and Their Impact on Blockchain Technology

Is it all smooth sailing? Not quite. With stablecoins, rules are key. Governments watch stablecoins closely. They want to make sure people’s money is safe. Let’s talk about what’s happening in stablecoin rules.

What impact do stablecoin regulations have on blockchain technology? Rules bring trust. With them, more people feel okay using stablecoins. Think of rules as a safety net. They help make sure stablecoins really have the dollars they say they do. This helps the whole blockchain world.

For the tech to grow, people must trust it. Stablecoin rules help with this. They keep the bad guys out. They make sure every coin is fair and square. When people trust stablecoins, they use them more. This means more action on the blockchain. It’s a win for everyone.

But, rules change and can be tricky. Each place has its own ideas. This makes it hard for stablecoin-makers. They have to be ninjas, always ready to move with the rules. It’s a lot of work, but it keeps your money safe in the end.

Stablecoins are a big idea. They take the ups and downs out of crypto. They make sending cash easy and less costly. They let people lend and trade on their terms. And with smart rules, they’re set to be the bridge between dollars in your wallet and money on the blockchain. They’re not just tokens—they’re the ticket to a brand-new financial world.

Investing in Stablecoins: Risks, Benefits, and Best Practices

Analyzing Leading Stablecoins: Tether (USDT) and USD Coin (USDC)

When we talk about top stablecoins, Tether and USD Coin lead. They are like safe harbors in the rough seas of cryptocurrency. They tie their value to dollars. This means one token is much like one real green dollar.

Tether (USDT) was the first and most known stablecoin. People know it for its huge place in daily crypto trading. USD Coin (USDC) came later, with its strong focus on safety and trust. Both aim to keep a stable one dollar value. This comes from holding enough cash or safe stuff to back up every coin.

These coins are great for moving money in and out of markets. They also offer calm among wild price moves in other cryptos. But, not all is as calm as it seems. Both coins must prove that they really have what they claim. Audits are key here. They show if a stablecoin has enough backing. Without this, the trust goes poof, and with it, the coin’s stable value.

Now, look close at Tether. It has faced doubts about its true reserves. This shakes investor trust. Still, it stays on top in trading volume. USD Coin, however, has a cleaner image. It does regular public check-ups. This helps build trust.

The Importance of Reserve Backing and Auditing in the Stablecoin Market

A stablecoin without a firm backing is a house of cards. It can fall fast. The backing comes from keeping dollars or other real assets, tied to each coin. This is a big deal. It’s what makes a stablecoin stable.

Let’s dive deeper into reserve backing. For fiat-backed stablecoins, firms must have a dollar in the bank for each token. For crypto-backed, they must have other cryptos locked as safety. And for algorithmic ones, it’s all about math and smart contracts trying to keep the value.

Audits matter a lot too. Think of an audit like a health check for stablecoins. It shows investors the stablecoin is fit and strong. Regular, clear audits help us sleep at night, knowing the stablecoin won’t crash suddenly.

So, why does all this audit and backing talk matter to you? It’s simple. You put your hard-earned money into these coins. You deserve to know it’s in a safe place. Imagine putting cash under your mattress, but not knowing if the mattress will be there tomorrow. That’s what investing in a stablecoin with no good backing feels like.

Choosing where to put your cash in the crypto world takes smart thinking. You want coins that are not just stable by name, but by their true nature. Look for the leaders, yes, but also look behind them. See if there’s real strength there. Only then can you be sure your investment won’t vanish when the market shudders.

Putting money in stablecoins is smart for many. They offer a still point in a turning world. But only if backed well and checked often. That’s the golden rule in this new age of digital dollars.

In this post, we talked about what stablecoins are and why they matter. We looked at how they help keep crypto prices steady. There are different kinds of stablecoins: ones backed by cash, other cryptos, or using special rules to keep their price fixed. They are key in today’s money world, useful in many ways from making DeFi work to sending money over borders.

We also went deep into how stablecoins get their value from things like dollars. We explored how they fit into laws and why that’s important for keeping blockchain tech safe. When it comes to investing, knowing about top stablecoins like Tether and USD Coin is a must. It’s also smart to know how their cash reserves and checks work.

To wrap it up, stablecoins are big in crypto and can be pretty solid to invest in. Yet, always do your homework first. By understanding their types, uses, and the rules they follow, you can make smarter choices. Keep safe and stay informed – that’s the best way to deal with stablecoins and any investment!

Q&A :

What Exactly Are Stablecoins?

Stablecoins are a type of cryptocurrency designed to maintain a stable value as compared to a reference asset, such as the US dollar or gold. They aim to combine the best of both worlds: the instant processing and security of cryptocurrencies, and the volatility-free stable valuations of fiat currencies.

How Do Stablecoins Manage To Maintain Their Stability?

Stablecoins maintain their stability through various mechanisms. The most common one is pegging to a stable asset like fiat money (e.g., USD, EUR), while others may use algorithms, or a reserve of other cryptocurrencies to manage supply and maintain their peg.

Are Stablecoins Safe To Invest In?

While stablecoins are generally considered less volatile than other cryptocurrencies, they are not entirely risk-free. The safety of an investment in stablecoins depends on the specific stablecoin’s structure, management, reserves, and regulatory compliance.

Can Stablecoins Be Used Like Regular Money?

Yes, stablecoins can be used like regular money for transactions where they are accepted. They facilitate transfer of value on the blockchain and can be used for trading, payments, and as a store of value, particularly in the digital and decentralized finance ecosystems.

What Are The Most Popular Types Of Stablecoins?

The most popular types of stablecoins are fiat-collateralized stablecoins, crypto-collateralized stablecoins, and algorithmic stablecoins. Each type has its own mechanism and degree of stability, with fiat-collateralized versions being the most common ones, pegged directly to a fiat currency like the US dollar.