Navigating the world of cryptocurrencies can be a maze of confusion, but when it comes to securing your digital wealth, custodial wallet crypto is a term you need to know. It’s like having a personal guard for your coins, providing peace of mind as you dive into the ocean of digital currencies. Yet, not all that glitters is gold. This blog will unlock the secrets to using custodial wallets effectively, bringing clarity to both the bright sides and the blind spots. Join me as we explore the keen insights and expert knowledge you need to make the best decisions for your digital treasures.

Understanding Custodial Crypto Services

What is a Custodial Wallet for Cryptocurrency?

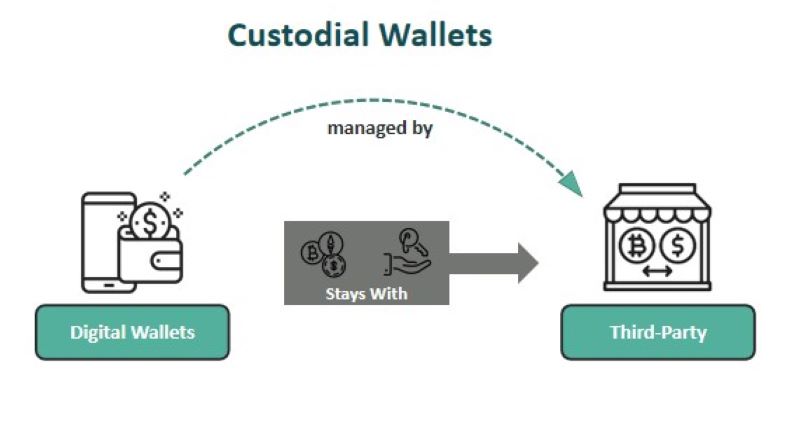

A custodial wallet is like a safety deposit box for your digital coins. A company holds the keys for you. This means they keep your crypto safe. You trust them to manage your digital money. They help you buy, sell, and store it. Using a custodial wallet is easy. You log in online and can see your crypto there.

Custodial crypto services give you a simple way to enter the crypto world. You don’t have to worry about losing keys. Your coins stay safe, even if you forget your password. They are good for new users in crypto. But relying on someone else always has risks. It’s crucial to pick a trusted service.

The Role of Third-Party Crypto Management

Third-party crypto management means a company takes care of your coins. Think of it like a bank for your digital currency. These companies know how to handle security well. They work hard to protect your money from theft and hacks. This is key in the world of crypto.

Using third-party services can be good. They make it easier to buy and sell crypto. They often link to your bank, too. But it’s important to understand how they work. Some may use your crypto to lend or invest. They might make money from it. So, knowing their rules is important.

Managing your crypto is a big deal. You want a company that’s serious about keeping it safe. They should follow strong security steps. They need to show they are legal and safe to use. You need to trust them with your digital wealth.

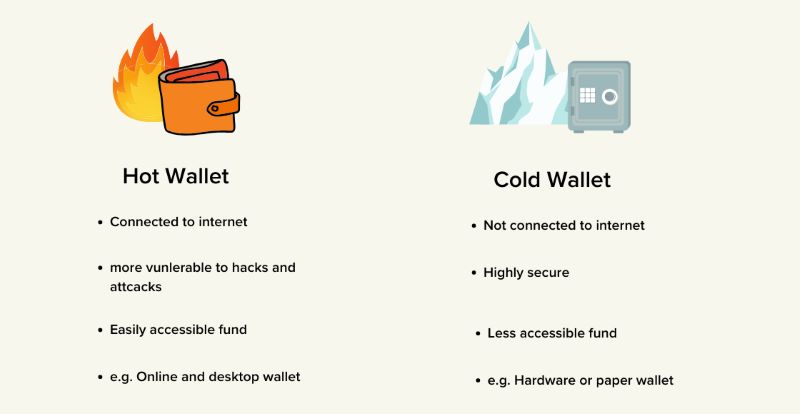

Always check if a company uses things like cold storage or multi-signature tech. Cold storage keeps coins offline, away from hackers. Multi-signature needs several keys to make a transaction. This is an extra layer of protection.

A good custodial service must be clear about their fees. They will charge for managing your crypto. Make sure you know what the costs are. They should also be easy to use. Nobody likes complicated stuff, right?

Using a custodial wallet means putting trust in a third party. It’s a trade-off. You get ease and support for your crypto. But you have to be okay with someone else holding the keys. It’s all about what works for you and gives you peace of mind.

The Benefits and Risks of Using Custodial Wallets

Advantages of Managed Cryptocurrency Accounts

When you step into the crypto world, there’s a lot to learn about keeping your coins safe. That’s where managed cryptocurrency accounts come in. They’re held by a third party – think of it like a bank, but for your digital cash. These pros have the tools and brains to guard your coins against theft with layers of security you might not have on your own.

But why pick a custodial wallet? For starters, they make it easier to jump into buying and selling crypto. You sign up, and boom, you’re ready to trade. They deal with the tricky stuff like key management and software updates. Plus, if you lose your password, you’re not out of luck. The service can help you get back into your account.

Here’s a big point: managed cryptocurrency accounts often have back-up plans, like insurance, in case things go south. Yep, your crypto can be insured, so if there’s a hack, you might not lose everything. That’s some real peace of mind, especially if you’re new to this and don’t want to swim without a life jacket.

Potential Risks Associated with Crypto Exchange Wallets

Now, let’s not sugarcoat it. There are risks with custodial wallets. The biggest one? You’re trusting someone else with your digital gold. That means you’ve got to pick a service you trust – one with a solid rep and strong security. It’s a bit like choosing a babysitter. You don’t want just anyone. You want the pro who won’t let the baby get into the cookie jar.

Then there’s the online aspect. Even the top-dog crypto services with all their fancy security could get hit by cyber-attacks. It’s rare, but it happens. Hackers are like ninjas, always trying to find a way in.

And remember, these wallets are held by companies that must stick to the law. That’s good for stopping fraud, but it can mean they have to share your info with the government if asked. It’s like they’re keeping secrets, but they have to tell the teacher when it’s time.

Here’s a thing you might not like: fees. Using these wallets isn’t always free. You might pay to move your coins in or out, or even just to keep them there. It’s like a safety deposit box that charges you every time you peek inside.

To wrap up, custodial crypto services are like a seesaw. On one side, you have less worry and more time to trade those coins like a boss. On the other, you’ve given up a bit of control and might have to be okay with some extra costs. It’s up to you to weigh the pros and cons and see if it’s the right ride for your crypto journey.

Advanced Security Measures for Safeguarding Digital Assets

The Importance of Crypto Custodial Regulatory Compliance

No one wants to lose their digital gold. I make sure that doesn’t happen. I follow the rules. This means sticking to the laws that keep custodial crypto services safe. These rules help to protect your digital riches from bad people and mistakes.

Why is this important? Because crypto is like the wild west. It’s new and full of chances. But with big chances come big risks. Think of compliance as a strong safe. It locks your assets away from thieves.

For clients, this means peace of mind. You can sleep tight, knowing your digital money is tucked in safe. Regulatory compliance stops cheats. It makes sure everything is fair and square. Crypto custodian regulatory compliance is not just fancy talk. It’s a must for keeping your coins safe.

Implementing Cold Storage and Multi-Signature Features in Custody

Cold storage and multi-signature are like the big, tough guards of the crypto world. They keep digital assets extra safe. Cold storage is like a secret vault. It’s not online, so hackers can’t reach it. All the important stuff, your crypto, stays offline.

Why does this matter? Think about leaving your bike in a busy park. If it’s not locked up, it could vanish. But if it’s in your garage, behind a big, strong door? Much safer. That’s cold storage for you.

Multi-signature is another hero in our story. It needs more than one key to open the wallet. This is good. It’s like having a combo lock on your secret vault. It keeps out people who shouldn’t be there.

These two, cold storage and multi-signature, mean serious business when it comes to security. They’re tough on crime in the crypto world. With them, your digital fortune stays out of reach from bad guys.

To sum it up, keeping digital assets secure today means playing by the rules and setting up big, strong security. With the right moves, your digital riches stay yours. Only yours. That’s the simple truth. And I’m here to help make it happen.

Navigating the Costs and Accessibility of Custodial Wallets

Evaluating Fees and Trust Management in Crypto Custody

When you pick a custodial wallet for your coins, you think about costs. Every wallet has fees. These could be for keeping your coins, moving them, or other services. You might wonder, “What’s the true cost of using a custodial wallet?” The short answer: it varies. Fees will depend on which service you go with. Now, let’s break that down.

Wallets can charge per trade or a flat rate. Some even take a cut of your earnings. It’s important to know this before you dive in. You want a service that’s clear about what they charge. That way you’re never in the dark.

But it’s not just about cost. It’s also about trust. You give them control of your coins. In return, you trust them to keep them safe. Good services work hard to earn your trust. They follow laws, protect your coins, and are always there to help. You need to feel sure your digital riches are in good hands.

Balancing User-Friendly Access with Secure Coin Storage

You might also ask, “How easy is it to use these wallets?” No one likes a tough-to-use wallet. Good wallets make it easy to get in, trade, and check your coins. But ease can’t slice into safety. The wallet must block hackers too.

Top wallets offer a mix. They’re easy to use and lock tight as a drum. They use smart ways to keep your coins locked up. Cold storage keeps coins offline where hackers can’t get them. Multi-signature needs more than one key to open the vault. That ensures nobody can sneak in and grab your coins. It’s like having a bank vault with several locks.

People love these wallets for the mix of easy and safe. You just need to pick the right one. It should suit how you use your coins. If you trade a lot, choose one with low move fees. If you keep a lot in there, go for one with the best safety tools. That might mean paying more, but peace of mind is priceless.

So, when you’re after a custodial wallet, think fees and trust first. Then check for a balance of easy use with tight security. That’s the key to keeping your digital wealth safe and at your fingertips. Remember, the right wallet can make or break your crypto journey. Choose wisely.

In this post, we explored what custodial crypto services are and why they matter. Simply put, custodial wallets are a type of crypto wallet where a third party holds your coins. They handle the complex stuff like security and backups. We dived into how these wallets can make your crypto life easy but also carry some risks. It’s clear that with great perks come some dangers.

Next, we discussed the high-end security tools these services use, like cold storage to keep coins away from hackers, and multi-signature methods for extra safety. These features show how serious custodial wallets are about guarding your digital cash.

Lastly, we looked at the cost of using these wallets and how they make buying and storing crypto simpler. Yes, there might be fees, and yes, trusting somebody else with your coins might feel odd, but the balance of convenience and security can make it worth it.

Remember, managing your digital wealth wisely is key. Custodial services offer a mix of ease and protection, so consider both sides before deciding. Stay safe and smart with your crypto choices!

Q&A :

What is a custodial wallet in cryptocurrency?

A custodial wallet in cryptocurrency is a type of digital wallet where a third-party service holds and protects the private keys for a user’s crypto assets. This service often comes with added security features, ease of use, and the ability to recover your account in the event you lose your access credentials. However, the user must trust the custodian to secure their assets properly.

How does a custodial crypto wallet differ from a non-custodial wallet?

Custodial and non-custodial wallets differ primarily in who holds control over the private keys. With custodial wallets, the service provider maintains control and takes on the responsibility of security measures. In contrast, non-custodial wallets grant full control to the user, who is solely responsible for the safety of their private keys and consequently, their funds.

What are the benefits of using a custodial wallet for crypto?

The benefits of using a custodial wallet include enhanced security provisions, provided by the custodian, which can be particularly reassuring for new users. Additionally, they often offer increased convenience, with user-friendly interfaces and sometimes additional services like currency exchange or transaction support. Another advantage is the potential for account recovery options if access is lost.

Are there any risks associated with custodial crypto wallets?

Yes, there are risks associated with custodial crypto wallets. Centralizing your assets with a custodian can make them a target for hackers. Additionally, users must trust the custodian to act in good faith and to have robust security measures in place. Dependence on the custodian’s infrastructure and the potential for internal fraud or mismanagement also pose risks.

Can I convert my custodial wallet to a non-custodial wallet?

It is not a direct process to convert a custodial wallet to a non-custodial wallet. However, you can transfer your crypto assets from your custodial account to a non-custodial wallet you control. This process usually involves setting up a non-custodial wallet, generating a transfer request from the custodial wallet, and then confirming the transaction to move your funds securely.