Distributed ledger technology in crypto is turning heads, and for good reason—it’s on track to flip the world of finance on its head. Gone are the days where transaction logs were the private domain of select institutions. Now, public access to this radical tool is blurring the lines between users and providers. Each transaction writ large and clear across a network, scampering across the globe quicker than you would dare imagine. In this deep dive, prepare to crack the code of DLT—from the ironclad security protocols that keep crypto safe to the cutting-edge ways it’s reshaping banks and payments. If you’re thirsting for clarity on how these innovations might future-proof our wallets, pull up a chair. We’re stepping into the core of how smart contracts and a new wave of tech might just spark a financial uprising.

Understanding the Building Blocks of Distributed Ledger Technology (DLT)

Demystifying blockchain technology and crypto ledgers

Imagine all of your friends keeping the same list of who paid for lunch. This list gets updated only when everyone agrees. That’s a bit like how blockchain, the tech behind Bitcoin, works. Each person’s list is a “node” and the group’s list is the “ledger.”

A blockchain is a chain of data “blocks”. Each block records crypto dealings. Everyone has a copy. To change the list, you need a “key,” something very secret that works like a password. But with a chain, your secret notes stay safe. It’s like writing in a shared diary that everyone locks with their own padlock.

Types of distributed ledgers: Public vs private blockchain

Now, in this tech world, we have public and private. A public blockchain is open for all. Think of a large, digital square where everyone can join in. But a private blockchain is like a club. You need an invite to get in. Both types protect your notes. They just decide who can peek at them.

Why does this matter? For things like your money or ID, it’s big. A public ledger is out there for anyone. It’s tough to change because so many eyes are watching. A private one is more like a vault. Fewer eyes, but they’re all trusted.

In public blockchains, like Bitcoin, no one’s in charge. It’s like a game where everyone’s moves count. But in private blockchains, there’s often a boss. They can say who can write in the ledger or even go back and erase something.

People say public is fairer since everyone gets a say. But private can be faster since there are fewer people to check things. So, picking between public and private depends on what’s important for you. Do you value openness or control?

Blockchains use a trick called “consensus mechanisms” to keep everyone honest. This is like a game rule that helps the group agree. There are different rules, like “proof of work,” where solving puzzles means you get to update the list. Or “proof of stake,” where the more you own, the more power you have to choose.

Keys also help to protect your spot in a blockchain. Your code locks your info. It’s like having a magic pen that only writes your story. No one can fake your writing ’cause it’s locked by your unique code.

All this helps folks trade clothes, game cards, or even houses without worry. With crypto ledgers, it’s like everyone’s singing the same song. It means no cheats, just fair play. And this could change how we all buy, sell, or even trust each other. It’s not just computer stuff, it’s a new way to make sure everyone plays nice.

Think of a blockchain as a super smart Lego set. Once you put the pieces together, they’re tough to pull apart. And that’s a good thing. It means we can all trust the toys—or the crypto—that we’re playing with.

The Security Protocol of Decentralized Systems

Blockchain security measures and cryptographic keys

In the world of crypto, security is a big deal. Why? Because you want to keep your digital money safe. Imagine your piggy bank, but it’s online, and it holds not just coins, but valuable digital tokens. Just like you need a sturdy lock for your piggy bank, blockchain technology uses special “locks” to keep your crypto safe. These locks are called cryptographic keys. They are like secret codes that protect your money.

Every person has two keys: one is public, which everyone can see, like your house number, and the other is private, which is a secret, like the key to your front door. To send crypto, you need someone’s public key, but to open your crypto piggy bank and use your money, you need your private key. Never share your private key, or others might take your crypto!

Ensuring ledger immutability in crypto through hash functions

Keeping your crypto records safe from changes is super important. That’s where hash functions come in. They turn all the information about crypto transactions into a jumble of numbers and letters. This jumble, or hash, is unique. Even a small change makes a totally different hash. Think of it like a special stamp on a letter that changes if anyone tries to open it.

This makes sure that once something is written in the ledger, or book of records, it can’t be changed without leaving a clear trace. It’s like writing with permanent marker in your notebook. Quick changes are easy to see, and that’s how we can trust the system. This is super important for keeping our digital money system honest and safe.

The Role of DLT in Enhancing Financial Services

Advantages of distributed ledgers in banking and payments

Banking and payments are changing fast thanks to blockchain technology. Before we had blockchain, all our banking info sat in one place. This made it an easy target for hackers. Now, with crypto ledgers, we break up this data. We spread it across many spots. This is what we call decentralized record-keeping.

Imagine a bank that’s open and clear about where your money goes. That’s what a public blockchain does. It lets everyone see transactions. A private blockchain is different. It’s like a club. Only a few have access to see all info.

These networks agree on what’s true without one boss. We call this ‘consensus mechanisms in crypto.’ Every day, folks trust DLT more to keep their money safe.

Let’s talk about cryptographic keys and crypto ledgers. They lock your info so only you can see it. Think of these keys like a secret code. They guard your digital cash.

Scalability is a big word for a simple idea. Can a system handle a lot of work without cracking? Scalability of distributed ledgers means more folks can use crypto without slow service.

Did you know? DLT can link different kinds of info. We call this interoperability in blockchain. With smart contracts and DLT, we can set rules for money to move on its own when a job is done. No more waiting.

Hash functions in crypto are cool ways to keep our data safe. They mix up info so bad folks can’t find it. It’s a big deal for safety.

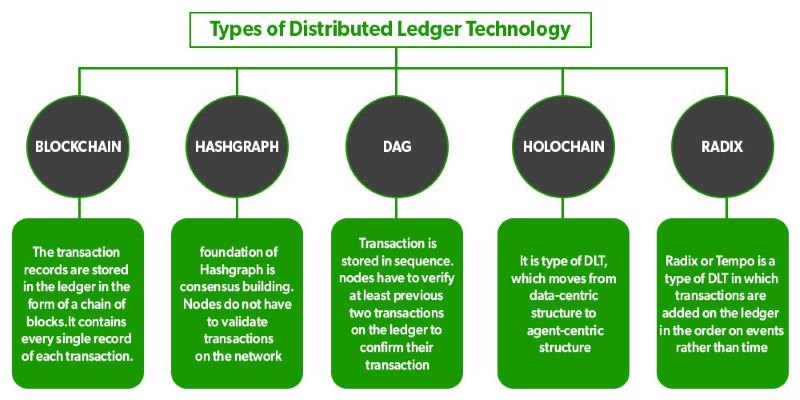

There are many types of distributed ledgers like books for different subjects in school. But all these books are for our digital money world. This is DLT in cryptocurrency.

Smart contracts and DLT: Revolutionizing agreement execution

Now let’s dive into smart contracts and DLT. In old days, if you made a deal, you shook hands. But can you trust just a handshake? Smart contracts are like making a pinky promise, but with the internet as your witness.

They let deals happen without a middle man. When you agree to do something, your deal goes live on the blockchain. It checks off steps as you do them. When all steps are done, the blockchain says, “deal’s complete”!

A permissioned blockchain network means you need a special invite to the club. Here, contracts are for folks inside the club. Permissionless means anyone can join. Deals here are more wild and free.

So, smart contracts on DLT? Big news. They save time and cut mess-ups. These contracts do what they say. No more, no less. That’s trust right there.

When you mix trust with fast and safe, that’s a win for everyone. DLT is making our money safe and our deals sharp. It’s a tool that’s changing our wallets and how we think about trust every single day.

Future-Proofing Finance with DLT Innovations

Scalability and interoperability: The path to widespread DLT adoption

Let’s dive right into the heart of what could change our financial world: distributed ledger technology, or DLT for short. DLT is like a shared record book. But, instead of one person holding the book and pen, everyone gets a copy and can write in it. The catch is, every change must follow strict rules and everyone must agree on it.

Now, imagine trying to use this book in every bank, store, and even between friends. We need to make sure it’s quick (scalability) and that it can work with different systems (interoperability). Imagine you’re at a fair, and all the games use different tickets. It’s much easier if all the games just accept the same tickets. That’s interoperability in a nutshell.

Consensus mechanisms in crypto: Proof of work vs proof of stake

To keep our shared record book safe, everyone needs to agree on new entries. This is where consensus mechanisms come in. In crypto, we mostly talk about two types: proof of work and proof of stake.

Proof of work is like a race where computers solve complex puzzles to add new pages to the book. The first to finish earns a prize and gets to add their page. Bitcoin uses this method, but it takes a lot of power – think of all the energy you would need to power those game booths at the fair.

Proof of stake is different. Here it’s not about the race but about trust and investment. Users lock away a chunk of their digital money to prove they’re honest. If they try something shady, they lose their money. So instead of using tons of power, it’s more about having skin in the game.

In short, DLT can really shake up finance as we know it, making it safer, faster, and more open. By solving the puzzles of scalability and interoperability and by picking the best consensus method, we’re building a financial funfair where everyone gets to play.

In this post, we untangled the complex web of distributed ledger technology. We started by explaining blockchain and the difference between public and private ledgers. Then, we dug into how these systems stay secure—think unbreakable codes and tamper-proof records. We also covered why your bank might start to use this tech, making money moves safer and faster. Finally, we looked ahead at how blockchain can grow and change, including new ways to agree on the truth without wasting energy. Decentralized ledgers aren’t just computer talk—they’re shaping up to be the backbone of future finance. Keep an eye on them; they’re changing our world, one block at a time.

Q&A :

What is distributed ledger technology and how does it relate to cryptocurrency?

Distributed ledger technology (DLT) is the architectural framework that underpins the existence of cryptocurrencies. It is a digital system for recording the transaction of assets where the details are recorded in multiple places at the same time. Unlike traditional databases, DLT has no central data store or administrative functionality. In cryptocurrency, this technology is implemented in the form of blockchain, which is the foundation of digital currencies like Bitcoin and Ethereum.

How does distributed ledger technology ensure security in cryptocurrency transactions?

Security in distributed ledger technology is maintained through a combination of cryptography, decentralization, and consensus algorithms. Each transaction is encrypted and linked to the previous transaction, forming a chain that is nearly impossible to alter without detection. Moreover, since the ledger is maintained across multiple nodes in the network, there is no single point of failure, making it inherently resistant to fraudulent activities and cyber-attacks.

What are the benefits of using distributed ledger technology in crypto?

The benefits of using distributed ledger technology in crypto include enhanced transparency, as all network participants share the same documentation as opposed to individual copies. This unified transaction history increases accuracy and provides a clear record of transactions. Additionally, DLT reduces transaction times and costs by eliminating the need for intermediaries, and it offers greater security and immutability, preventing tampering and revision of transaction histories.

Can distributed ledger technology be used beyond cryptocurrency applications?

Yes, distributed ledger technology has a wide range of applications beyond cryptocurrencies. Its potential uses extend to any domain where there is a need for secure, transparent, and tamper-proof record-keeping. This includes supply chain management, identity verification, voting systems, healthcare records, and much more. DLT provides a new paradigm for how information is collected and communicated, offering possibilities for innovation across various sectors.

Is there a difference between blockchain and distributed ledger technology?

Blockchain is a type of distributed ledger technology, but not all distributed ledgers are blockchains. Blockchain specifically refers to a ledger that is structured in blocks of data that are chained together. Distributed ledger technology, on the other hand, encompasses a broader category of ledger systems that distribute records across a network, which may not necessarily be formatted in a blockchain structure. Thus, while blockchain is the most recognized form of DLT due to the popularity of cryptocurrencies, DLT itself includes other types of ledgers too.