What is LSDFi in crypto? It’s the breakthrough that has the DeFi world buzzing. I dive deep to show you how it changes the game in liquidity. These aren’t mere tweaks to existing systems; LSDFi rewrites the rules. Imagine tapping into smarter, more efficient ways of providing liquidity. That’s LSDFi for you – a powerhouse in decentralized finance. Stick around as I unpack how it’s reshaping our grasp on DeFi technology.

Demystifying LSDFi: The Foundations of Liquidity Solutions in DeFi

Understanding LSDFi and Its Role in Decentralized Finance

When we talk about LSDFi, we tackle a fresh concept in crypto. Decentralized Finance, or DeFi, changes how we handle money. It lets us do financial stuff without banks or middlemen. Now, let’s add LSDFi to the mix. LSDFi stands for Liquidity Solutions in DeFi. It makes it easier to trade and invest in DeFi spaces.

So, what’s the big deal about LSDFi? It’s like adding a turbo boost to DeFi’s engine. With LSDFi, we can trade quicker and not worry much about finding someone to take the other side of the trade. Plus, it opens doors for folks to earn more on their crypto piles.

When you put your money into LSDFi’s pot, you let others use it for their trades. In return, you earn fees from those trades. This is yield farming. It’s like planting your digital coins and growing more coins from them.

But remember, knowledge is power, especially in crypto. So before investing, we should learn the ropes. DeFi projects can be complex, and LSDFi is not any different. There are risks to balance against rewards. By grapping LSDFi, you get ready to make smarter decisions in the DeFi world.

How LSDFi is Redefining Liquidity Provision through Technology

Now, let’s dive into the tech behind all this – LSDFi technology. This is where things get exciting! Blockchain is the foundation here. It keeps our digital money safe and sound through complex math and computers spread worldwide.

Smart contracts are crucial to LSDFi. They are like robot helpers living in the blockchain. They make sure everything happens like it should, following the set rules, without anyone cheating. When you invest in LSDFi, these smart contracts handle your money.

Not all superheroes wear capes – some come as smart contracts in the crypto space! They make sure liquidity is always there when you want to trade. No more waiting for someone to match your trade order. LSDFi applications do this by pooling together everyone’s funds. Then, anyone can trade anytime, which is quite the game-changer.

Think of LSDFi as the glue holding DeFi’s moving parts together. It provides the oils that keep the gears running smoothly. Without it, trading would be slower, costlier, and less fun. With LSDFi, investing in DeFi feels more like a sleek sports car, less like a clunky old truck.

In short, LSDFi is shaking things up. It’s priming DeFi protocols for more growth and making sure we have the tools for better crypto adventures. Understanding crypto terminology may seem tough, but once you get it, you’re set to uncover many opportunities. Whether you’re in it to farm yields or just explore new crypto frontiers, LSDFi has something for you.

The Mechanics of LSDFi: How Smart Contracts Fuel the Ecosystem

The Role of Smart Contracts in LSDFi Applications

Let’s talk about how LSDFi works. It’s like a super smart recipe. A smart contract is a set of rules. It tells digital money where to go and what to do. Smart contracts in LSDFi make sure everyone plays fair. They track everything without needing a middle person.

Say you want to save your digital money in LSDFi. Smart contracts act like vaults. They keep your money safe. But they do more. They let you loan your money to others. Then, you earn more coins as a ‘thank you’. You earn without doing much at all!

Smart contracts in LSDFi are really clever. They can see how much money is there. They always know the right number of coins to give out. This makes sure no one takes too much. It helps everyone get what they should.

Think of LSDFi like a big game. Smart contracts are like the rules. They keep the game going smoothly. When the rules work well, more people want to play. This means more money moves around. When more money moves, the game gets bigger and better!

With smart contracts, you don’t need to wait. They work all day and night. This way, your money never sleeps. It’s always earning more money.

From Tokens to Transactions: LSDFi’s Influence on Yield Farming

Okay, now let’s see how LSDFi changes yield farming. Yield farming is when you make more of a coin by using the coin you have. You do this by lending coins or being a part of a coin pool.

In yield farming with LSDFi, smart contracts help a lot. Think of a pool of coins. Each coin is like a little worker. More workers mean more work gets done. When you add your coins to the pool, it’s like you’re adding more workers.

With LSDFi, pools grow bigger. This is because the rules are clear and fair. Everyone knows what they’ll earn. So, they’re happy to jump in. This way, pools get very busy! They offer better deals to people coming in. This means you can get more coins for lending.

Smart contracts make sure everyone knows what’s going on. They share the same info with everyone. And that’s good for trust. People feel safe to lend their coins. And when people trust the system, they use it more.

LSDFi also talks to other DeFi programs. It’s like they’re friends. They work together to make everything better. LSDFi helps these friends share coins easily. This way, you get more choices for earning.

In the end, LSDFi means more money moving, better rules, and happy farmers. It’s a game-changer for sure. It’s not just new. It’s smart, and it lets you do more with your digital money. It’s like giving superpowers to your coins! With LSDFi, your money grows while you chill.

LSDFi Use Cases and Investment Strategies

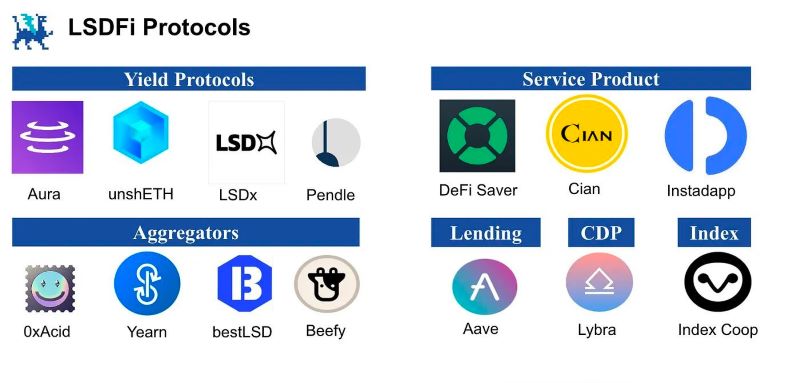

Diving into LSDFi Use Cases: Beyond the Basics

You’ve maybe heard about LSDFi. But what is it? In simple terms, LSDFi, or Liquidity and Stake Decentralized Finance, makes DeFi better. It adds more safety and ways to do business in DeFi. You know DeFi—finance without banks or middlemen. It’s all about using blockchain tech. People deal with each other directly here. This is where LSDFi shines.

Now, what can you really do with LSDFi? Well, it’s good for many things. For example, LSDFi helps folks earn more from their crypto. How? By letting them join in yield farming. That’s when you use your crypto to make more. With LSDFi, you can farm smarter, not harder. It uses smart contracts to find you good deals. This is where getting your feet wet in LSDFi can start to pay off.

LSDFi also steps in for lending and borrowing. Think of it as a superhero. It swoops in and helps move things around, so users get deals. Like, better rates for loans. Or, safer swaps of digital cash. It’s all to help both sides win.

Another cool thing LSDFi does is help trade without a fuss. It cuts out delays and high costs. So, you can trade crypto tokens quick and easy. That’s a big deal in the crypto world.

LSDFi’s got your back in crypto markets, too. It helps keep prices steady. This means you can trust your trades more. Less worry about prices going wild. That’s a breath of fresh air, right?

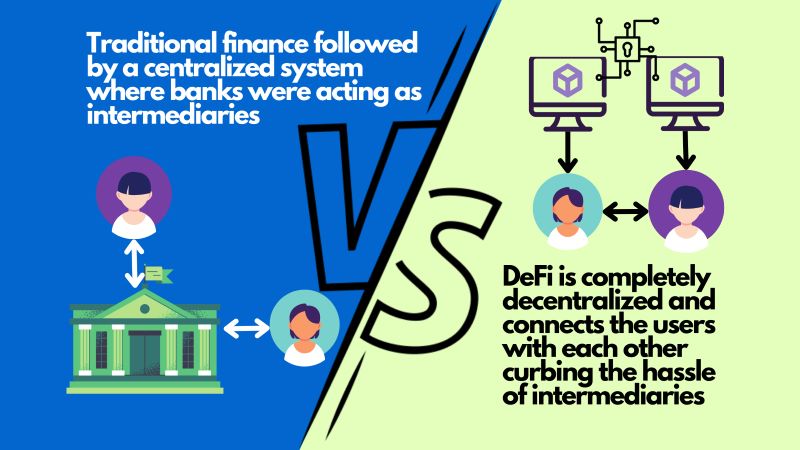

Now, let’s clear up the LSDFi vs traditional finance thing. It’s like comparing scooters to cars. Both get you places, but LSDFi is the future scooter. It’s fresh, sharp, and does the job with style. Old finance is the car. It worked for ages, but hello, we’re in the future now! Flexibility and speed matter more and more.

Crafting Investment Strategies Around LSDFi Platforms

Ready to dive into investing in LSDFi? Hold on to your hats, because it’s both fun and tricky. First up, you gotta know the risks and rewards. Yes, you can make bank with LSDFi. But, you can also hit snags. So, being smart is key.

Start with the basics. Spread your bets. Don’t toss all your cash into one spot. Spread it across different LSDFi platforms and DeFi projects. Mix it up with stablecoins, too. These are like digital dollars. Stable and steady.

Always check the setup of any LSDFi platform you eye. Look into their smart contracts. Are they safe? Have they been checked for bugs? You don’t want any nasty surprises.

Now, some LSDFi places let you own a piece of the action. That’s right, you can grab a slice of the pie through LSDFi tokens. If the platform does well, so do you. But remember, prices change fast in crypto. Keep your eyes peeled and think long-term.

Think about how LSDFi can grow, too. As blockchain tech gets better, so will LSDFi. We’re talking about reaching more people and making bigger waves in finance. Getting in early could set you up nicely for the ride.

What’s the take-home? LSDFi is cool, fresh, and opens doors in DeFi. It’s about earning interest, safe trades, and smart investing. Done right, it can boost your crypto gains. But remember to play it safe. Be smart with your picks, and you could enjoy the ride on the LSDFi rocket to the future.

LSDFi and the Future of Financial Decentralization

LSDFi vs. Traditional Finance: A Comparative Analysis

Let’s break down LSDFi and its game-changing role. When folks talk about DeFi, or decentralized finance, they mean managing money without a bank or official body in charge. LSDFi is a newer piece of this big DeFi puzzle. Simply put, LSDFi stands for Liquidity Solution DeFi. It’s a fancy way to say ‘making DeFi smoother and better for people to use’.

In traditional finance, banks call the shots. They hold your money, move it around, and lend it out. They also take a slice of the pie for themselves. But with LSDFi, it’s like we’re all playing a giant, trusty game of give and get. You stake your crypto tokens in smart contracts, which you can think of as robot bankers. They handle trades and loans without any boss overseeing them.

LSDFi offers lots of good stuff that regular banks don’t. For example, anyone with internet can join in, no fancy paperwork needed. Also, you often earn more money than what you’d get from a bank’s interest rate. You help make the market liquid—or easy to trade in and out of—by providing your own digital assets, and you get a thank-you in the form of fees from trades.

Still got questions about what is LSDFi? It’s cool – many do. Think of LSDFi as a helpful tool inside DeFi. It makes sure money flows easily without getting stuck, like oil in a car’s engine. Plus, keep in mind, we learn LSDFi by doing. Nobody becomes a pro overnight!

Embracing LSDFi’s Potential for Scalable DeFi Solutions

Now, you might wonder how big this LSDFi thing can get. Blockchain technology doesn’t have a closing time. It goes on 24/7, just like LSDFi. We’re talking about systems that can handle a bunch of money moves at once. That’s scalability. The more folks use LSDFi, the more it needs to handle lots of action without breaking a sweat.

With LSDFi, we have a secret sauce for DeFi to grow big and strong. It uses smart contracts to keep things running smooth. They’re like your personal assistant that never sleeps or makes mistakes. They keep your digital dough flowing to where it can do the most good, whether it’s lending it out or swapping it in trades.

The more we dig into LSDFi and DeFi projects, the clearer we see the vision. It’s all about cutting out the middleman. Or in this case, the giant, old-school banks. By trusting blockchain and smart contracts, we’re building a new kind of financial world where everyone gets a fair shot.

Investing in LSDFi could be a game-changer for your money. Imagine putting your cash in a place where it works for you day and night, earning interest, backing up loans, or joining the trading party. LSDFi platforms make that dream real by letting you jump into the DeFi space with confidence.

As we embrace LSDFi, we’re not just saying bye to big banks. We’re saying hello to a future where we’re in control of our money, risks, and rewards. LSDFi tech makes it possible. But remember, every new frontier has its risks. Being smart about where and how you join the LSDFi world is key. DeFi is exciting, sure, but stay sharp out there!

In this blog post, we’ve unlocked the secrets of LSDFi and its power in DeFi. We saw how LSDFi uses tech to shake up how we deal with cash flow. Smart contracts drive the system, making things like yield farming smoother and smarter.

As for your cash, LSDFi opens new doors for smart investing. It’s not just about saving money; it’s about making it grow. By knowing how to work with LSDFi, you can make moves that really pay off.

Looking ahead, LSDFi is changing the finance game. It challenges old-school banks and gives you control. Think bigger and dive into LSDFi—it’s not just the future; it’s now. Embrace it, and watch your DeFi impact soar. Remember, with LSDFi, you’re ahead of the curve in the finance revolution.

Q&A :

What Exactly is LSDFi in the Cryptocurrency Sphere?

LSDFi, in the context of cryptocurrency, might refer to a specialized financial instrument or platform within the blockchain ecosystem. However, it doesn’t correspond to a widely recognized term or acronym in the crypto industry. It could potentially be a typo or a less-known project or concept in this rapidly evolving space. For accurate information, it would be necessary to refer to specific sources or announcements related to this term.

How Does LSDFi Function Compared to Traditional Financial Instruments?

As LSDFi is not a standard term in the crypto world, its functionality comparison to traditional financial instruments cannot be established. Typically, legitimate financial instruments in crypto, such as DeFi (Decentralized Finance) protocols, operate on blockchain technology enabling peer-to-peer transactions without intermediaries, which is a key difference from traditional finance.

Are There Any Specific Benefits or Risks of Using LSDFi in Cryptocurrency Transactions?

Without a clear definition of LSDFi, pinpointing specific benefits or risks is challenging. Generally speaking, hypothetical benefits of a crypto financial instrument could include transparency, decentralization, and potentially high yields, while risks might involve high volatility, regulatory uncertainty, and technical vulnerabilities.

What Should I Consider Before Engaging with LSDFi?

If LSDFi were an identified product or service in the cryptocurrency market, due diligence would be crucial before engagement. This includes researching its legitimacy, the team behind it, community and investor feedback, security audits, and compliance with relevant regulations.

Where Can I Find Reliable Information About LSDFi to Make Informed Decisions?

For accurate and reliable information about any crypto-related term, including LSDFi, consult authoritative sources such as official project websites, whitepapers, crypto news platforms, and financial regulatory body advisories. Always exercise caution and consider obtaining advice from financial advisors with expertise in cryptocurrency.