Diving into the world of digital currency? I’ve got you. Master how to set up a crypto wallet with no sweat. Let’s kick confusion to the curb and slice through the tech jargon. With my guidance, you’ll pick a wallet that fits like a glove, whether it’s hot and ready for action or cold for tight security. Ready to become a savvy saver in the crypto cosmos? Let’s unlock the secrets together!

Choosing the Right Crypto Wallet for Your Needs

Understanding Hot Wallet Versus Cold Wallet

Choosing a wallet starts with one question: hot or cold storage? Hot wallets connect to the web. They’re great for easy access to your coins. Use them if you trade or spend crypto often. Just know they’re less secure than cold wallets because hackers target them.

Cold wallets, on the other hand, are offline. They’re like super secure USB drives. They keep thieves out because they’re not connected to the web. Get a cold wallet if you have lots of crypto and need the best security. Remember, they’re less handy for quick trades.

Multi-Currency Wallet Support and Decentralized Finance Wallets

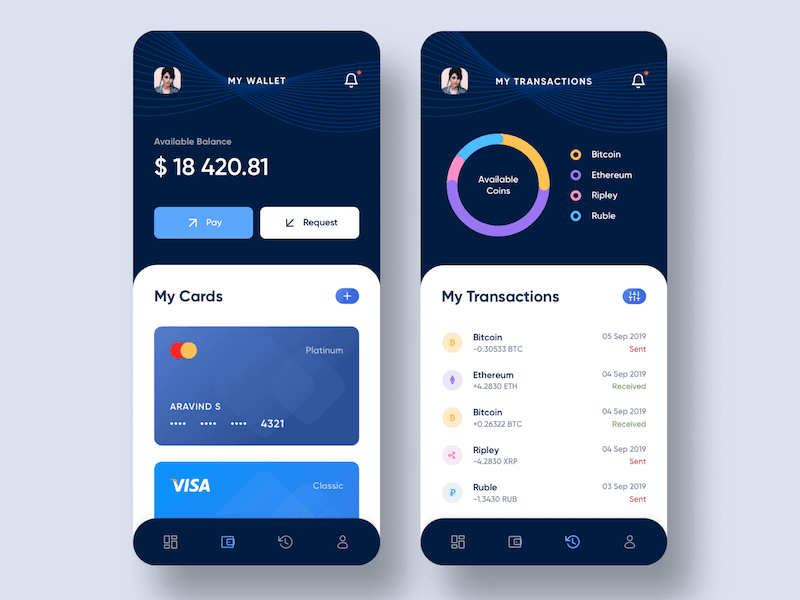

Now, think about what coins you want to hold. Some wallets hold many kinds of coins, called multi-currency support. It’s smart to choose one if you love collecting different cryptos. This way, you have all your coins in one place.

DeFi, or decentralized finance, wallets, are special. They let you play in the world of DeFi apps. If you want to lend, borrow, or earn interest on your crypto, look into DeFi wallets. They can do much more but can also be a bit tricky. Take your time learning about them.

When you pick out a wallet, look for one that fits your crypto life. Wallets are tools, so find the right one for you. Mix security, convenience, and support for your coins to get the best experience. Take care out there and choose wisely!

The Step-by-Step Process of Crypto Wallet Setup

Digital Wallet Setup Steps and Blockchain Wallet Creation

Setting up a digital wallet is like getting a new pet. You must be ready to care for it. First, pick a wallet type. Do you want it online or offline? Think of online as a hot wallet, like a quick snack, easy but can be risky. Offline, or cold storage, is like a safe in your house, tough to crack.

Next, find a wallet service. Look for one with a good rep and low fees. It should support many types of coins. If you love dogs and cats, wouldn’t you want a pet that could be both?

Once chosen, it’s setup time. For blockchain wallets, you’ll make a new account. Type in your info, and keep your password secret, like your best friend’s secret handshake.

Now, we face the key keeper task: your private key. Guard this like the last piece of candy in your stash. Lose it, and your coins could be gone forever. After securing it, you’ll see your public address. This is like your home address for getting mail, but for coins.

Remember to back up your wallet. It’s like having a spare key to your house. Write down your recovery phrase too. It’s a super-important secret code to fix things if your wallet gets lost.

Mobile Wallet Installation for Beginners and Desktop Wallet Configuration

Now, let’s talk moving wallets. Want one on your phone? That’s a mobile wallet. Easy peasy to use. Find it in your app store, download, and open it. Your phone is now a tiny bank!

For a desktop wallet, it’s kinda the same. Find the software online and download it to your computer. Follow the steps to get it running. It’s like building a model plane, piece by piece.

When it asks, set up two-factor authentication. This is like a guard dog for your wallet. It makes sure only you can get in.

For both wallet types, write down your secret keys and backup phrases. Put them in a spot where only you can find them. Think of it like a treasure map to your very own chest of gold.

Finally, test it with a small transaction. Send a little bit of coin to your new wallet. If it arrives, you’re golden. If not, don’t panic. Check every step you did, find the hiccup, and try again. It can be like learning to ride a bike – sometimes you wobble, but then you zoom!

Remember, keep your wallet updated. Don’t let it get old and slow, or you might miss out on new tricks and treats.

And there you go – your wallet is ready! Keep it secure and have fun watching your digital coin collection grow. It’s like growing your very own money tree!

Enhancing Security During and After Wallet Creation

Private Key Protection and Public Address Generation

When you make a wallet, your private key is like a secret code. You must keep this code safe. If someone else gets your code, they can take your money. So how do you set up and guard this private key? First, make sure your computer or phone is safe. Use good anti-virus software and keep it up to date. When your wallet makes a private key, write it down. Use a pen and paper. Do not store it on your computer or phone. It might get hacked.

After the key, you’ll get a public address. This is like your mail address, but for crypto. You share this with others to get crypto payments. Keeping your private key safe also keeps your public address safe. When you get this address, double-check it’s right. You don’t want to send money to the wrong place.

Now, let’s chat about backing up your wallet. This means you make a copy of your private key and public address. Use more than one place to keep these safe. Think about a safe or a locked drawer. Remember, if you lose your key, you lose your coins. So, always have a backup plan.

Recovery Phrase Importance and Wallet Security Features

Next up is your recovery phrase. This is a bunch of random words your wallet gives you. It acts like a backup key. If you lose your private key, you use this to get your wallet back. But just like the private key, keep it secret. Write it down in more than one place. Make sure these places are safe. Don’t ever share your recovery phrase or type it into a website or app, unless you’re 100% sure it’s safe.

Wallet security features are also necessary. Like the lock on your front door. They keep your crypto safe. Encryption is the main tool here. It scrambles your data so only you can read it. Two-factor authentication is another lock for your wallet. You’ll need your password and your phone, maybe, to open your wallet. This keeps others out even if they have your password.

When you’re doing a transaction, check everything is right before you send. The amount, the address, all the details. Then check it again. Crypto transactions can’t be undone. So, taking your time here is important.

Quick note: create a secure password for your wallet. Don’t reuse passwords and change them often. Security in your digital life starts with strong, unique passwords.

With these steps, you’re setting up your wallet for a safer future. Keep these tips in mind, and you’ll have a good foundation for crypto security. It’s not tough, but it’s vital. Treat it like the key to your house, and you’ll be on the right track.

Managing and Maintaining Your Crypto Wallet

Keeping Your Wallet in Sync with Blockchain Updates

To keep your crypto safe, your wallet must stay up-to-date. This means it needs the latest blockchain info. Each time a new block is made, your wallet should add it. This makes sure all your coin info is correct.

Why do you need to sync your wallet? If you don’t, you could see the wrong balance or have issues when sending coins. To avoid this, open your wallet often. It will update by itself if it’s a good one. If it hangs or stops, don’t worry. Check your internet, and give it time. If problems stay, reach out to wallet support for help.

Keeping your wallet synced is easy. Most wallets do it for you. But, don’t forget to do your part. Check on it, and keep your software up to date.

Avoiding Common Security Pitfalls and Updating Wallet Software

Always think of security. The crypto world can be risky. Bad folks are out there trying to steal your stuff. The first step is a strong password. Not your birthday. Not your pet’s name. Make it long and weird, so it’s tough to guess. And yes, write it down, but keep it safe – not on your phone or computer.

Two-factor authentication (2FA) is your friend. It asks for another code when you log in. This can be a text or from an app. Even if someone gets your password, they need this code too. It’s like having a big lock on your door.

You’ll hear about phishing a lot. It’s sneaky emails or messages that trick you. They look real but are fake. They want your info or to make you download bad stuff. Always double-check where messages are from. If unsure, don’t click anything!

Software updates can be a pain but are so important. Like a new coat of paint, they keep things fresh and tough against attacks. When your wallet says there’s an update, do it. It fixes holes that hackers use to break in.

And backups? Essential. If your phone takes a swim or your computer says goodbye, without a backup, your crypto waves goodbye too. Write down your recovery phrase. This is a bunch of words your wallet gives you. It’s a key back into your wallet if things go bad.

This is a lot, but you care about your money, right? Take these steps, and stay safe. Your future self will thank you for being smart about your crypto today.

In this post, we’ve covered important steps to pick and set up a crypto wallet. We looked at hot wallets, cold wallets, and how they differ. We also touched on wallets that hold many types of currency and the growing world of decentralized finance.

Next, we walked through setting up your wallet. I showed you how to install wallet apps on your phone and set up a desktop wallet too.

Then we dug into keeping your wallet secure. You learned to protect your private key and why you must keep your recovery phrase safe. I also shared top security features to look for in a wallet.

Finally, we talked about managing your wallet. You saw how to keep it updated and saw common security mistakes to avoid.

Remember, choosing and managing a crypto wallet can be simple. Just follow these steps and always stay alert to new tips and tricks. Stay safe and smart with your digital money! Follow Crypto Market Pulse to update more knowledge about Crypto.

Q&A :

What are the steps to set up a crypto wallet?

Starting a crypto wallet involves a few essential steps which you need to follow carefully to ensure the security of your digital assets. Firstly, choose whether you want a software wallet or a hardware wallet. Then, select a reputable provider or wallet application. Download and install the necessary software or purchase the hardware. Once installed, create your wallet by following the app’s setup instructions. This typically involves setting up security measures like a strong password, two-factor authentication, and backing up your private keys or recovery phrases. Always remember to keep your recovery phrases secure and never share your private keys with anyone.

Is it safe to use a cryptocurrency wallet?

Cryptocurrency wallets, when used correctly, can be safe for managing your digital currencies. Software wallets can be secure if they come from a reputable source and are kept updated. Hardware wallets are considered even safer as they store keys offline on a physical device. To maximize safety, use strong, unique passwords and enable additional security features where possible, such as two-factor authentication or multi-signature transactions, and avoid sharing your private keys or recovery phrases with others. Regular backups and staying informed about security best practices are also key to maintaining wallet safety.

Can I set up a crypto wallet for free?

Yes, setting up a crypto wallet can be free, especially if you opt for a software wallet. There are many reputable software wallets available to download at no cost, and they provide immediate access to a cryptocurrency’s network without any charge. However, hardware wallets, which provide offline storage for your crypto keys, typically come with a one-time purchase cost. Regardless of the type of wallet, always be mindful that while the setup might be free, there could be transaction fees or network fees when sending or receiving cryptocurrencies.

How do I choose the right cryptocurrency wallet?

Choosing the right cryptocurrency wallet depends on your individual needs and preferences. If convenience and quick access are your priorities, software wallets (like mobile or desktop apps) maybe your best bet. For heightened security, especially if you’re handling significant amounts of cryptocurrency, a hardware wallet might be appropriate. It’s essential to research and compare the features, such as user interface, supported coins, backup options, and security measures, of different wallets. Reading reviews and testimonies from other users can also guide you in making an informed decision.

What should I do if I lose access to my crypto wallet?

Losing access to your crypto wallet can be concerning, but there are steps you can take to attempt recovery. If it’s a software wallet and you’ve forgotten your password, look for a “forgot password” option and use your recovery phrase to regain access. For hardware wallets, you similarly can use the recovery phrase provided during the initial set-up to restore your wallet on another device. If you’ve lost your device or it has been stolen, secure a new device and use your recovery phrase to re-establish access. If all recovery methods fail, unfortunately, the contents of the wallet may be permanently inaccessible, emphasizing the importance of keeping backup information secure and accessible.