Looking to ramp up your crypto exchange game? Get ready to dive into the tactics that could be a game-changer for your platform. Whether you’re starting fresh or aiming to scale up, knowing how to improve crypto exchange liquidity is key to success. I’ll walk you through the essentials, from leveraging market makers to making the most out of liquidity pools.

Plus, I’ve got some insider strategies up my sleeve. You’ll learn about bootstrapping pools that boost liquidity and how smart tech can shrink slippage woes. If that wasn’t enough, we’ll unravel how making friends with big-time investors can thicken your market. Stick with me, and let’s beef up your liquidity to make your exchange the place to trade.

Understanding the Fundamentals of Crypto Exchange Liquidity

The Role of Market Makers in Enhancing Liquidity

Market makers are like the wizards of crypto. They breathe life into markets by trading. A lot! This keeps everything moving smoothly. They buy and sell digital assets on exchanges around the clock. Their goal is to increase cryptocurrency market depth. This means more orders at different prices, ready to go. And when this depth grows, every trader has a buddy to trade with. No one gets left hanging with their crypto!

Here’s the deal: these market makers use high-frequency trading lots. It’s like having super-fast trading powers. They watch prices like hawks and swoop in at just the right moment. They also create market making strategies in crypto. This is a smart plan on when to buy or sell to make things even better. It means more folks can trade without wild price swings. That’s super important when you need a stable place to trade digital money.

So, let me ask you, how do market makers make trading better? They work hard to fill the order book with buy and sell orders. This helps reduce slippage in digital currency. Now, that’s just a fancy way of saying you get the price you expect, no surprise costs.

Importance of Liquidity Pools and Automated Market Makers (AMM)

Now, let’s dive into liquidity pools in crypto. They’re like big, shared piggy banks of money. People put in their crypto to help others trade it. And they get some rewards for helping out. It’s like playing on a team. Everyone chips in, and the game gets more fun.

Enter the super cool automated market makers, or AMM. They are like robot helpers on this team. They shuffle crypto around using a set of rules. These rules make trading fair and predictable. They don’t get tired or bored or greedy. This means whenever you want to trade, the AMM is there, ready to party.

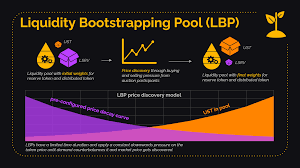

AMMs also work with something called liquidity bootstrapping pools, or LBP for short. These are like starter kits for new crypto. They help get things going when a new coin hits the market. They give traders a chance to try out new tokens. These pools help balance the price so it doesn’t go nuts when everyone’s trying to buy or sell at once.

So, how do liquidity pools and AMMs enhance crypto trading? By sharing their crypto, people keep trading active and exciting. And AMMs work non-stop to keep it fair for everyone. This way, more and more people want to dive in and trade too. It’s a win-win!

Remember, these two – market makers and AMMs – are key players on the liquidity team. They work their magic every day. They keep the markets running smooth and fun for traders like you and me.

How to Boost Your Crypto Exchange Liquidity: Implementing Effective Liquidity Strategies

Engaging with Liquidity Bootstrapping Pools (LBP)

To increase exchange liquidity, use Liquidity Bootstrapping Pools (LBP). LBPs are special liquidity pools. They help new tokens start well. You adjust prices in LBPs to keep them fair. Over time, prices in LBPs can drop gently. This drop pulls in buyers, protecting from big sell-offs. It’s like a smart sale. Drop prices slowly, and buyers come. LBPs make markets less wild. They help prices stay more steady. Better prices mean more folks trading.

Now, picture a seesaw balanced with sandbags. It’s steady because the weight is right. LBPs act like those sandbags for crypto. They keep your crypto from swinging wild. They add sandbags of money to both sides. This way, trading is smoother. Folks like smooth trading.

Designing Attractive Liquidity Provider Incentives

For bringing in providers, making good rewards is key. You give tokens to folks who help. That’s their reward for adding cash to your pool. You might say, “Help us, get tokens!” Think of it as a thank you gift. More money in the pool means it’s easier to trade. That’s better for everyone.

Try different rewards to see what fits. You can test, learn, and adapt. If you see people like one reward, use it more. You keep what works. You change what doesn’t. Be like a scientist. Experiment with rewards.

Crypto is exciting. But big jumps in price scare people off. Good rewards can calm the waters.

Always play fair and be clear about the rewards. Tell people what they earn and how. They like that. It builds trust. And crypto needs trust. You want a big crowd of traders. So, making friends with reward-givers is top-notch.

Let’s break it down more. Liquidity means it’s easy to trade. More easy trades mean more people come. Infrastructure is what holds it all together. Think roads for money. A road jam is bad. Empty roads are a waste. The perfect level keeps everyone happy.

With great liquidity, a healthy exchange thrives. It’s like a busy marketplace. Stalls full, people chatting, and goods changing hands. Your exchange can be that bustling place. With the right moves, like good LBPs and sweet rewards, you’re set for success.

Technologies Driving Liquidity in Modern Crypto Exchanges

Integrating API Trading to Attract Market Participants

Exchange bosses, hear this. Your platform needs powerful tools. API trading is one such hero. It calls traders and systems to action. Think of APIs like magnets. They pull market players in. And more players mean more trades. It’s that simple.

API stands for Application Programming Interface. It’s tech talk for a bridge. This bridge lets different software chat. For traders, this means they can use their favorite tools right on your exchange. And when their tools work with your market, they trade more. Each trade makes your market better.

But why do traders love APIs? Speed, for one. They can make fast moves, buying and selling in the blink of an eye. Control, for another. They set the rules. Their automations do the heavy lifting. With APIs, trading is smoother. It’s like going from a bumpy road to a smooth runway.

APIs draw in big fish, too. We’re talking about the institutions. They deal with big bucks. When they dive into your waters, they make big waves. This means more money moving and better liquidity for all.

Remember, APIs can also link exchanges. They can share information in real time. This makes sure traders find the best deals. And in turn, it can boost your volumes.

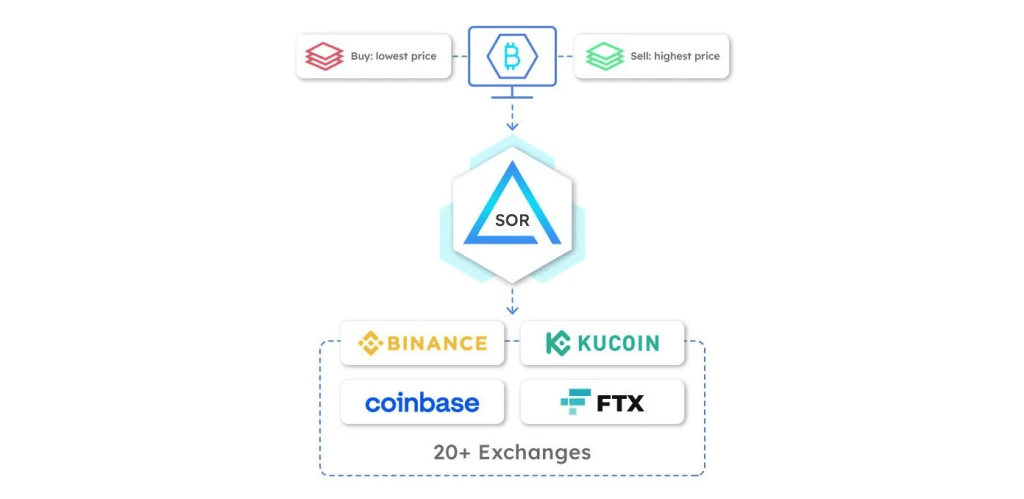

Deploying Smart Order Routing to Minimize Slippage

Now, let’s cut down on waste. Slippage is what we’re fighting. That’s when prices slip between trigger and trade. It’s a pest for us all. Trust me, you want your exchange to dodge this bullet.

Enter Smart Order Routing (SOR). SOR is strategy, not just tech. It finds the best path for every trade. It scans the crypto land for price tags. It picks the winning route. So traders get their deals sealed at prices they expect. Or BETTER.

What’s the magic behind it? It’s logic. SOR looks at all paths. It predicts the market’s moves. It spots the bottlenecks. And then, it shuns them. It takes your trades where they flow free. It’s a river of deals, no dams in sight.

With SOR, you give your traders trust. They know slippage won’t eat their profits. And here’s the kicker: they trade more often. Frequent trading means active markets. Active markets mean solid liquidity.

Both API trading and SOR aren’t just buzzwords. They’re the engine and wheels rolling your exchange forward. Use them right, and you’ll see the change. Your platform will hum with trades. And that’s the sign of good health in our crypto universe.

Expanding Market Reach and Regulatory Compliance

Partnering with Institutional Investors to Deepen Market Depth

Engaging with big-money players can work wonders. Think about institutional investors like hedge funds, asset managers, or pensions. Why? They hold a lot of cash and assets. And their involvement can massively boost market depth. That’s how we get closer to an ideal where every buy or sell has a matching order.

What does this mean for your exchange? More stability and better prices. Plus, it’s a circle of trust. Institutions bring more users, and that spike in activity attracts even more big players.

But hold on, how can we possibly attract these giants? By proving that your platform is up for their challenge. That boils down to showing off top-tier tech, airtight security, and, crucially, regulatory compliance. They won’t risk stepping into murky waters.

Establishing Transparency and Compliance Protocols

Let’s chat about transparency and rules. No yawning, promise – this is juicy stuff. See, the crypto world can feel like the Wild West. Some folks worry about diving in. Can they trust where they’re putting their money?

This is where you come in. By making transparency and compliance your best buddies, you create a safe space for money to flow in. It’s about clear, honest processes and following the book to the letter. Not just because you have to – but because it makes good business sense.

Set up crystal-clear guidelines. Make every transaction open for all to see – within privacy bounds, of course. And when the big regulators come knocking, welcome them with open arms. Prove that you’ve got nothing to hide.

Here’s the heavyweight tip: Get those checks and balances in place. Think regular audits, third-party reviews, and bulletproof customer protection. It’s like a giant neon sign that says “Your assets are safe here!”.

In this game, trust is the true currency. The more you have, the more folks will flock to you – from cautious retail investors to the big institutional whales. And as your trust swells, so does your liquidity – and the chance to carve out a hefty slice of the market for yourself.

In this post, we dug deep into the lifeblood of crypto exchanges: liquidity. We explored how market makers and liquidity pools keep the money flowing. We also covered ways to boost liquidity, like bootstrapping pools and rewards for those who chip in. The tech side is bustling, with APIs and smart routes making trades slick and quick. And let’s not forget the big fish—team-ups with heavy hitters and staying by the rules can really widen the net.

Knowing this stuff matters—you’re now set to swim strong in the fast-moving crypto waters. Whether you’re trading or running an exchange, these insights can help you make smart moves. Remember, a market is only as good as its liquidity. Keep these tips in hand, and you’re good to go. Stay fluid!

Q&A :

How can you boost liquidity in a cryptocurrency exchange?

Boosting liquidity on a cryptocurrency exchange can be achieved through implementing practices such as integrating with larger markets to share liquidity, utilizing liquidity providers or market makers, offering incentives to traders for providing liquidity, and ensuring a user-friendly platform to attract and retain a broad user base. Additionally, adding popular and stable cryptocurrencies may entice more users and improve liquidity.

What strategies can help increase user trading volume on crypto exchanges?

To increase trading volumes on crypto exchanges, strategies like lower trading fees, referral programs, high-quality customer support, hosting trading competitions, and ensuring high security standards can be effective. Moreover, providing a robust mobile app and keeping the exchange well-maintained with up-to-date technology can help in attracting more active traders.

Why is liquidity important for a crypto exchange?

Liquidity is crucial for a crypto exchange as it ensures smoother transactions, provides better price stability, and reduces the spread between buy and sell orders. High liquidity attracts more users by enabling the quick and efficient buying and selling of assets, which in turn can lead to narrower spreads and better price discovery.

What role do market makers play in cryptocurrency exchange liquidity?

Market makers play a pivotal role in cryptocurrency exchange liquidity as they constantly buy and sell cryptocurrencies to provide market depth. Their activity helps reduce volatility by mitigating large price fluctuations and ensures that orders can be filled quickly, which is essential for an exchange’s overall liquidity and user experience.

Can API integration improve crypto exchange liquidity?

Yes, API integration can significantly improve a crypto exchange’s liquidity. By integrating APIs from other exchanges or liquidity providers, an exchange can tap into a larger liquidity pool which helps in maintaining a constant supply of buy and sell orders, minimizing slippage, and ensuring competitive pricing for its users.