In the high-stakes game of crypto, daily trading volume by crypto exchange is a tell-all stat that insiders watch like hawks. It’s no tiny detail—it’s the pulse of the marketplace, clarifying who’s up, who’s down, and where the smart money moves. Stick with me, and we’ll tear into the juicy specifics of how the giants really fare when we stack their numbers side-by-side. We’re tackling Binance, Coinbase, and the rest of the big players to see who truly leads the pack in this digital arena. Get ready for a deep dive into the numbers that could shape your next big trade. This isn’t just data; it’s the crystal ball of cryptocurrency.

Understanding the Metrics Behind Crypto Trading Volume

Analyzing Daily Transaction Volume in Crypto

When it comes to sorting out the big players in crypto, daily transaction volume is key. This is the total value of all transactions for a cryptocurrency or an exchange in one day. To make wise crypto moves, you should know this number like the back of your hand.

Take note of how much Bitcoin or Ethereum is being traded each day. These giants set the tone for the market. When their trading volume goes up, it often means more action in the crypto world. Looking at these numbers, you soon spot trends. This helps you guess where things are heading.

Interpreting Volume Spikes and Market Liquidity

Now let’s chat about volume spikes and what they mean. A spike is when trading volume shoots up fast. This can make or break the game. It often signals big news or shifts in trader mood. It can be a new coin launch or some world news that shakes things up.

Seeing a spike makes me think, “What’s the buzz?” It can show a coin’s gaining heat or something’s up with the market. You want to keep a close eye on liquidity too. That’s how easy you can buy or sell without affecting the price too much. High liquidity means smooth sailing for trades. Low liquidity can mean trouble and price swings if you’re not careful.

Understanding these moves is no small task, but keys you into the crypto rhythm. It’s like knowing the best time to jump into a game of double Dutch. Catching on to these patterns puts you one step ahead in the crypto chase. So keep your eyes peeled and watch those volumes like a hawk. It’s a tool that sharp, savvy traders just can’t do without.

Comparing Top Exchanges: Liquidity and Volume Breakdown

Binance vs. Coinbase: A Volume Metrics Showdown

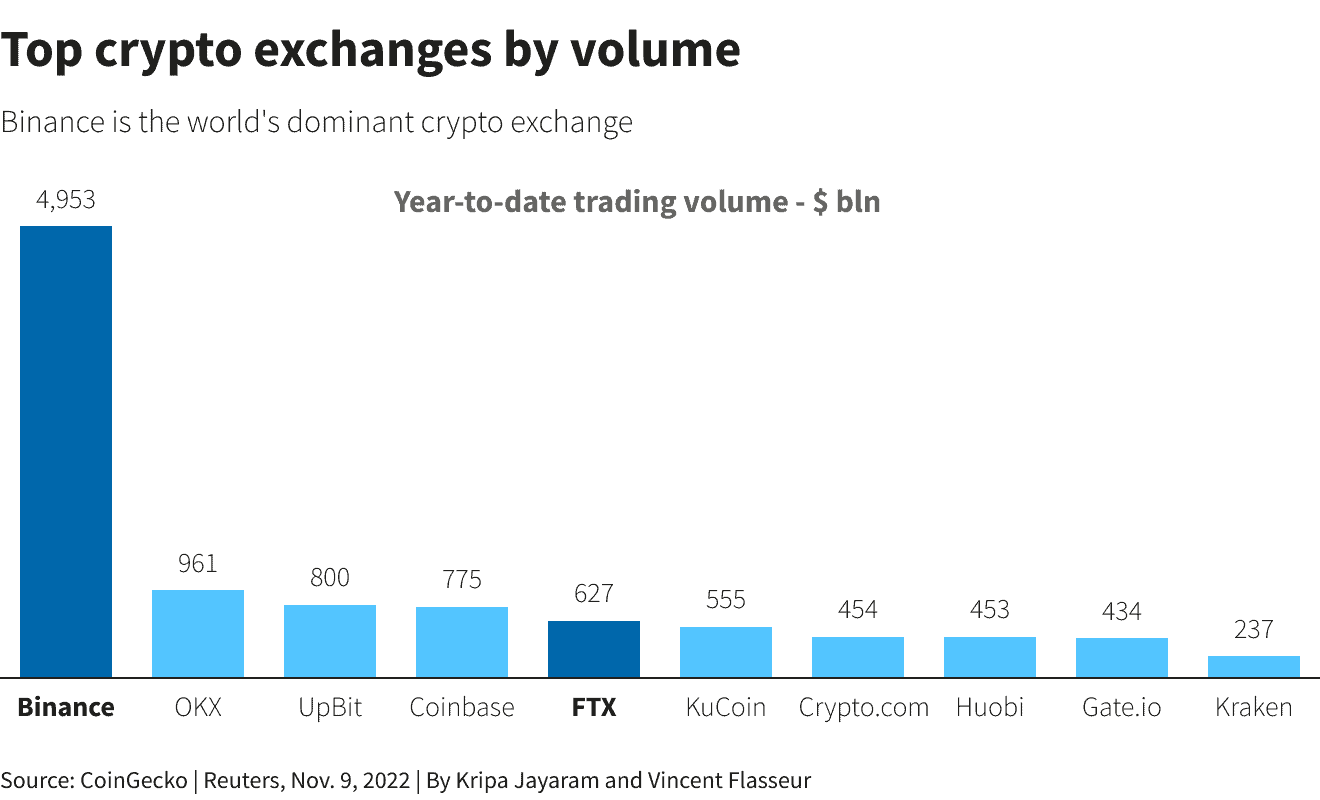

Let’s dive into a face-off between Binance and Coinbase. These heavy hitters vary a lot in daily transactions. Binance often leads in crypto trading volume analysis. It’s like a busy mall parking lot compared to Coinbase’s smaller, but still bustling, boutique shop. In this showdown, Coinbase’s volume metrics don’t hit Binance’s numbers, but what matters is not just size. It’s also about the feel when you trade. Binance’s trading activity feels like a speedway, cars zooming by. Coinbase, on the other hand, has a more relaxed vibe but with a sturdy flow.

So why care about these differences? Reliable liquidity matters in trading. It’s like having enough water in a pool to dive in. You want to make a splash in a market with enough action. That’s why checking out the Coinbase volume metrics and Binance trading activity is key. It tells you where the game is strong every day. And in crypto, the game changes fast.

Assessing Altcoin Market Activity Across Exchanges

Now, let’s talk altcoins. Bitcoin and Ethereum trading volume are like the ocean – vast and deep. But the altcoin market activity? It’s more like rivers that can run wild or dry up. Each exchange offers different altcoins. So volume and liquidity can swing like a seesaw. Pay attention to daily transaction volume for crypto beyond the big two. This is where Bitfinex market volume, Kraken volume report, and Huobi exchange data come in.

To buy or sell altcoins, you must peek at the altcoin market activity across these exchanges. Places like Uniswap even let us splash in the DeFi trading volumes pool. But remember, each altcoin acts in its way, and the trading volume indicators can tip you off to the next big wave or a calm sea. It’s like weather forecasts. Knowing when and where storms hit lets you sail smoothly or brace for choppy waters.

Looking closely at exchange volume comparisons reveals which harbors are safe for your trading ship. Let’s not forget, you might find treasure in lesser-known spots. Sometimes, low volume trading strategies in crypto can lead to hidden gems. But tread lightly, as calm waters can sometimes hide whirlpools. Always consider the importance of volume in trading before charting your course.

Staying in tune with the daily 24-hour trading volume in crypto keeps you ready. Top exchanges by volume are our lighthouses, guiding us through foggy markets. Remember, the sea of trading is vast, but with the right tools and a keen eye on volume analysis in crypto trading, you can navigate it like a seasoned captain. Keep an eye out for crypto exchange volume rankings and the flags they raise. The winds of volume-driven price movements can fill your sails or blow you off course, so steer wisely.

Trading Volume’s Influence on Cryptocurrency Valuation

Deciphering the Relationship Between Trading Volume and Crypto Prices

We need to talk about trading volumes and crypto prices. Bigger trading volumes often mean more interest. This can push crypto prices up or down. Let’s dig into this.

Crypto trading volume analysis gives us clues. High volume may signal a price jump is coming. It shows traders are busy buying or selling. The opposite is true for low volumes. They might hint that prices will drop soon as interest is low.

For example, if Bitcoin exchange transactions shoot up, the price might follow. Why? Because it shows lots of people want Bitcoin. The demand pushes prices up.

Ethereum trading volume can tell a similar story. More traders moving Ethereum can lead to price changes. If lots of Ethereum trades, the price may rise. Not much trading? The price might not move much.

Volume-Driven Price Movements: Case Studies in Crypto

Let’s say Binance trading activity spikes. This could change prices fast. Binance is a big exchange, so its trading activity really matters.

Coinbase volume metrics are also key. They show how much crypto is traded there. If Coinbase numbers jump, we might see prices change.

Take altcoin market activity, too. Altcoins aren’t as big as Bitcoin or Ethereum. But their prices can swing hard with volume changes.

Kraken and Bitfinex market volume also play their parts. Changes here can affect the whole crypto market.

And we can’t forget about crypto liquidity analysis. It tells us how easily we can buy or sell without affecting prices. Exchanges like Huobi give us this data.

Daily transaction volume crypto data is gold. It tells us so much about the market’s mood. A high trading volume in the past 24 hours for crypto might mean big news is stirring the pot.

Even Uniswap liquidity data has its stories. This Decentralized Finance (DeFi) exchange can teach us about newer crypto trends.

Look at the exchange volume comparison. It’s like a map of where the action is. See top cryptocurrency exchanges by volume going up? It’s like saying, “Hey, look here, something’s happening!”

And remember, it’s not just about high numbers. Low volume trading strategies in crypto are worth understanding, too. They can show good buy or sell opportunities if timed right.

So, volume analysis in crypto trading is a big deal. It helps us figure out moves before they happen. It’s part detective work, part smart guessing, and all about staying sharp.

Keep an eye on volume. It’s a powerful tool. It shows us the heartbeat of crypto markets. And that’s a secret worth knowing.

Strategic Insights: Leveraging Volume Data for Crypto Trading

Employing Trading Volume Indicators for Informed Decisions

Imagine you are a detective. But, in the world of crypto, your clues are sizes of trades and numbers. They can whisper secrets. They can hint at moves before they happen. Let’s dive in and see how using trading volume indicators can make you a better trade sleuth.

First up, know that volume tracks how much of a crypto trades in a day. When a lot of it trades, we call this high volume. High volume can mean big news, or many are buying and selling. Low volume can mean little interest or that few are trading.

Now think of Binance or Coinbase. People trade on these like they’re playing an arcade game. Lots of trades means lots of action. By looking at these numbers, you can guess how the game might go. Is Bitcoin hot today, or is it Ethereum’s turn to shine?

Using crypto trading volume analysis, you spot trends. A big sale on Binance? Could mean prices might drop. A quiet day on Coinbase? Maybe the market is waiting, holding its breath.

Implementing Volume-Driven Trading Strategies in the Crypto Market

Let’s get strategic. A key thing to remember: price moves where volume goes. If many buy, the price may climb. If they sell, it might fall. This is the dance of supply and demand.

With volume-driven trading strategies, you watch the rhythm of trading volume indicators. You see the spikes? That’s when a volume surge hits because of big news or a trend. These spikes might scare some, but a keen eye sees opportunity.

Here’s a golden nugget: not all volume is equal. Yes, Bitcoin exchange transactions pack a punch, but what about altcoin market activity? Different tunes for different coins.

Exchange volume comparison can show who’s top dog. Binance might lead today, but tomorrow? Could be Kraken or Huobi exchange data that guides you.

In Uniswap’s world of DeFi, trading volumes dance to a different beat. And those volume spikes in crypto trading? They might just show the way to the next big wave.

Be a market detective. Use trading volume indicators to crack the case. You’ll notice a high 24-hour trading volume crypto coin isn’t just noise. It’s a track playing on full blast, telling you there’s action ahead.

Look for patterns, and watch the crypto market depth. Deep markets are like big pools — they can take a lot of diving before you hit bottom. And that’s good news for traders.

Trading volume can light up the path in the dark forest of crypto trading. Use it to your advantage. Make informed choices. Because when it comes to crypto trading, volume isn’t just a number — it’s a story waiting to be read.

We just dug deep into the pulse of crypto trading – the volume game. We looked at how daily transactions paint a market’s picture and how spikes hint at liquidity. Don’t worry if big words like “liquidity” scare you; think of it as how easy you can sell your crypto without affecting its price.

We also tossed Binance and Coinbase into the ring to see who’s got the muscle in volume and liquidity. Turns out, this can vary a lot, and altcoins show some wild rides across the exchanges.

And hey, it’s not just noise; trading volume seriously sways crypto values. Ever notice how prices rocket when trading goes bonkers? That’s volume at play.

Lastly, we armed you with strategies to use volume to your advantage. Reading volume signs can be a big win for your trades, helping you make smarter moves.

So, remember, in the thunderous world of crypto, volume is your compass. It guides you to make trades that can stand strong in the wild market winds. Keep these insights close, and let the numbers lead the way to smarter, sharper trading.

Q&A :

What factors influence the daily trading volume on crypto exchanges?

Daily trading volume on crypto exchanges can be influenced by a number of factors such as market sentiment, news events, technological developments, trading competitions, and changes in regulations. Additionally, factors like the introduction of new coins, partnerships between exchanges and other financial platforms, and overall shifts in the economy can play a significant role. It’s important for traders to monitor these elements as they can impact liquidity and volatility within the crypto market.

How can you verify the accuracy of reported daily trading volumes by crypto exchanges?

To verify the accuracy of reported daily trading volumes by crypto exchanges, investors should look for platforms that have undergone independent audits and adhere to regulatory standards. Tools such as market surveillance technology, as well as reports from data aggregators that remove suspicious volumes, can also provide more reliable data. Transparency regarding order books and historical trade data can also be indicative of an exchange’s legitimacy.

Why do daily trading volumes vary so much between different crypto exchanges?

Daily trading volumes can vary greatly between crypto exchanges due to differences in user bases, geographic focus, available trading pairs, liquidity, fee structures, and exchange reputation. Additionally, some exchanges may artificially inflate their trading volumes through practices like wash trading to appear more attractive to traders. Market-specific news and regional demand can also cause fluctuations in trading volume on particular platforms.

What impact does high daily trading volume have on a crypto exchange?

High daily trading volume on a crypto exchange typically indicates a healthy level of liquidity, which allows traders to execute transactions quickly and with minimal slippage. This can attract more users, leading to increased revenue for the exchange. Additionally, high trading volume can enhance the exchange’s reputation and may lead to improved ranking on market cap analysis sites, potentially attracting further attention from investors.

How can investors use daily trading volume data to make informed decisions on crypto exchanges?

Investors can use daily trading volume data to assess the liquidity and stability of different crypto exchanges. High volumes can suggest that an exchange is more capable of handling large trades without significantly affecting the market price. Investors can also look for consistent volume as a sign of a stable trading environment. When fluctuations in volume are observed, investors might investigate to determine the cause, which could be tied to market news or changes within the exchange.