Ready to see how the big players stack up? Let’s talk shop and compare trading volume of different crypto exchanges. It’s a match-up worth watching – giants of the game showing off their muscle in trading volume. In this deep dive, we’ll spotlight who’s on top and why volume matters. You’ll get the lowdown on how these titans keep cash flowing and what it means for traders like you. Whether it’s centralized clout or the upswing of decentralized darlings, understand the volume game to trade smarter. Get the scoop on which platforms pump the most money and how this shapes your trading tactics. Dive in as we break down the numbers and strategies that make these exchanges the behemoths of the blockchain.

Unveiling the Titans: Centralized Exchanges Leading the Charge in Trading Volumes

Spotlight on the Top Performers: Analyzing 24-Hour Trading Volumes

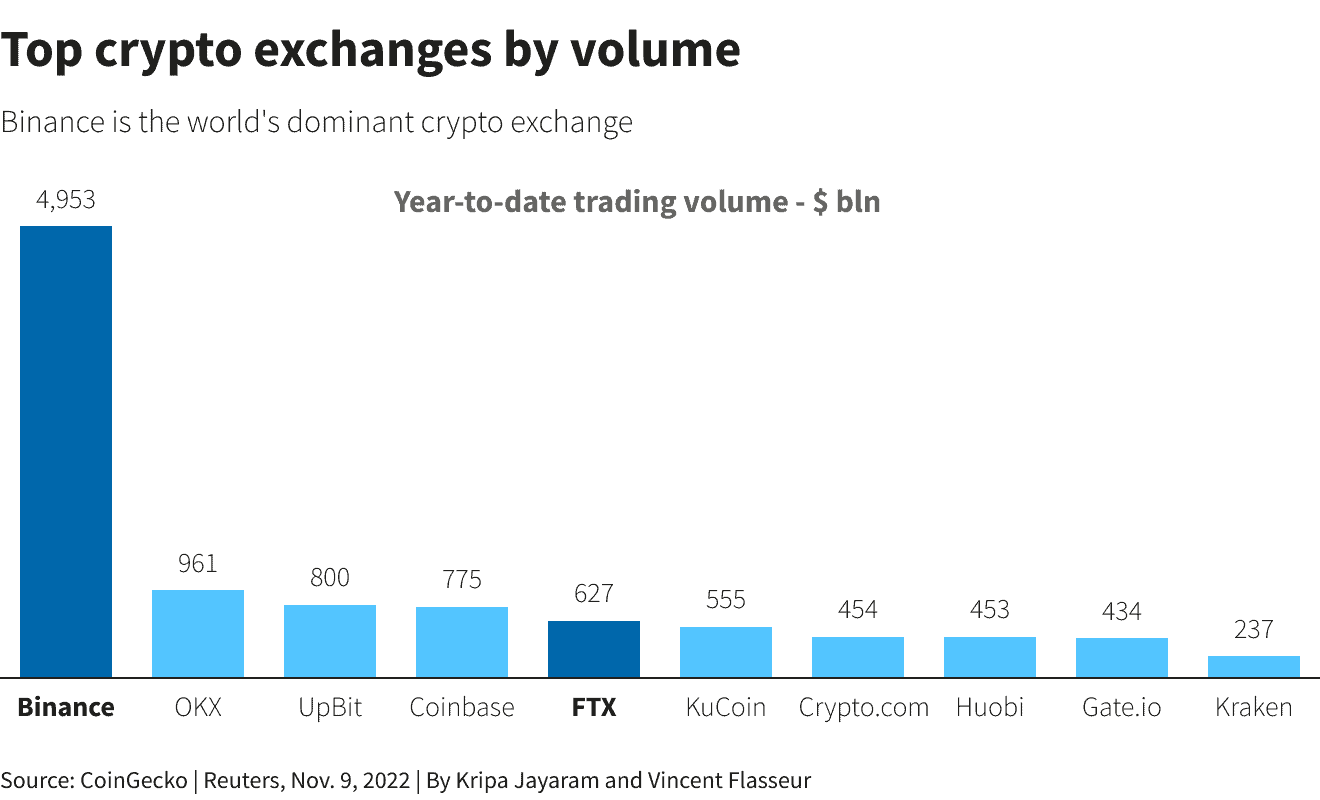

Ever wonder which crypto exchanges are the busiest? I’ve got you. The biggest players, like Binance and Coinbase, often see the most action. In the world of crypto, their 24-hour trading volumes are like beehives of activity. They buzz with transactions round the clock. Let’s dig into why.

High 24-hour trading volumes mean a lot. They show trust and popularity. With more folks buying and selling, you get a better sense of prices. These exchanges offer a big menu of trading pairs, too. Want to swap Bitcoin for Ether? Easy. Looking for less common coins? They’ve got those as well. This means you have more choices and opportunities as a trader.

Liquidity Showdown: Comparing Centralized Exchange Liquidity

Picture a huge water tank. Think of liquidity like how fast you can fill a cup from it. Centralized exchanges are like tanks with big pipes. They fill your cup quickly, no waiting. You want to buy or sell? There’s always someone at the other end ready to trade.

Comparing liquidity across these giants helps us see who’s on top. Some have deep liquidity, making big trades without much price change. That’s great for traders. It means they can move lots of coins with less worry about shifting prices. That’s a big plus if you’re trading serious cash.

For folks trading less popular coins, high liquidity means smoother trades. No one likes to wait or see prices move too much. That’s why strong liquidity matters. It gives everyone, big and small traders alike, the chance to jump in and trade with ease.

In crypto, markets never sleep, and liquidity keeps the wheels turning smoothly. It gives traders the confidence to trade when they want, not when the market lets them. These top exchanges understand this. They keep their liquidity high for us all.

Staying on top of these fast-moving markets is key. It means looking at real-time trading volumes and being ready to act. As a market analyst, I see the big picture. I help you see it too, so you can trade with the giants of the crypto world.

The Rise of Decentralized Platforms: A New Era of Trade Volume Growth

Trading Activity Transformation: The Impact of Decentralized Exchanges

Did you know that trade activity has changed a lot with decentralized exchanges? It’s true! They handle the trade of cryptos without a central guide. Unlike their big brother, centralized platforms, they let users trade directly with each other. This is cool, because it means people have more control over their own stuff. And yay, now we see more trading than before on these new kinds of places!

Now, let’s talk volume. I look at lots of data, and boy, decentralized exchanges saw their trade volume go way up. Why? Because people love them! They are safe and open for anyone, anywhere. More users mean more trades all day and night. We call this the 24-hour trading volume. It shows us how much trading happens on an exchange in a day.

So if someone asks, “Are decentralized exchanges getting big in trade volume?” we’d say, “Yes! They’re growing fast!” Now let’s dig deeper.

Liquidity Pools and Volume: How Decentralization is Reshaping Markets

Liquidity pools, folks. These are great. They let people put money together in a big pot. This lets trades happen anytime, quick and easy. When more people add money to the pool, it means there’s more volume on the exchange. And guess what? Higher volume means a better market, because you can trade a lot without the prices going crazy.

Decentralized platforms have something called crypto liquidity analysis. That’s just a big way to say we look at how easy it is to turn a crypto into cash. Good news is, with more liquidity pools, these platforms are catching up with big, centralized ones. They help us avoid price drops when we buy or sell big amounts.

Plus, everyone gets a chance to win. People who join liquidity pools can earn fees when others trade. So it’s like you’re part of the bank, getting a little “thank you” money each time someone makes a trade.

We talked about trade volume on different exchanges, right? Well, exchanges get ranked by how much trading they do – the more, the higher they rank. These days, some decentralized ones are climbing that ladder super quickly, thanks to their smart design.

Finally, are decentralized exchanges changing the market? Absolutely! They are making the crypto world bigger and better for everyone. By using things like liquidity pools, they’re making sure trading is always buzzing, day or night.

So there you have it, the lowdown on how these nifty decentralized spots are shaking up the world of crypto trade volume. Keep an eye on them – they’re going places, and taking us with them!

Trade Volume Dynamics: Understanding Exchange Volume Metrics and Their Impact

The Ripple Effects of Volume Fluctuations in Crypto Markets

Let’s get right into the heart of crypto markets. You’ve heard about price changes. But what about the waves made by trade volume? Imagine a pool. Each trade is like a splash. Some are small; others are huge. Big splashes, or high volume, often mean lots to see and catch on to.

What makes the splashes? News, sure. Big players, yes! They trade lots of coins, making waves. Small players can too, by all acting at once. When waves rise or fall, we feel it. Prices can shift with volume. They often do. This dance keeps traders on their toes.

Watch trade volume, and you catch market vibes. See a rush of action? Maybe it’s time to dive in. But be smart. High volume doesn’t always mean good news. It’s not just how big the volume is. It’s why it’s big.

Volume speaks to a coin’s health too. Active trading means a heartbeat. It means people want that coin. No trades? That’s a worry. Coins need movement to live. It’s like water for fish.

So, volume matters – a lot. Let’s dive deeper now.

Volume-Based Pricing Strategies Across Exchanges: A Comparative Study

Look across exchanges, and it’s a mix. Each has its own way to set prices. They base it on volume. More trades, often better prices. Some exchanges drop fees as you trade more. It’s their way to say “thanks” for trading a lot.

Why does this matter? Let’s pick apart the pricing plans. Say you’re a regular trader, often trading. Low fees help a ton. They keep more coin in your pocket. If you don’t trade much, high fees can hurt.

It’s not just fees, though. Some swaps offer better rates to big traders. Others keep it even. Knowing this helps you pick where to trade.

To sum it up, know this: Who trades and how much makes waves in the crypto pool. Watch the waves to know the game. And when picking a swap spot, find one that fits how you trade. This could mean more wins for you in the busy world of crypto trading.

Navigating the Exchange Landscape: Strategies for Volume-Based Trading and Investment

Crypto Trading Pairs by Volume: Identifying the Most Liquid Options

When we talk about liquid options in crypto, we are looking for trading pairs that can be bought or sold quickly without causing a big price change. High-volume trading pairs offer this speed. They let you trade without moving the price too much. But why does this matter? With liquid pairs, you can trade large amounts fast and at a good price.

Think of Bitcoin paired with the US dollar (BTC/USD). It’s often top of the list for volume. It means lots of people want to trade this pair. There’s always someone on the other side of your trade. You can jump in or out fast. If you’re trading crypto, looking at 24-hour trading volume will help you find these liquid pairs.

Now, some use only popular pairs while others explore less known ones. Each choice comes with its risks. Major pairs, like BTC/USD, are safer bets for steady trading. On the other hand, diving into low volume cryptocurrency exchanges might offer big wins. But it’s risky. You could face big price swings, making trades less predictable.

Fee Structures and Their Influence on Exchange Volume and Trader Decisions

Let’s talk fees. They matter a lot! An exchange’s fee structure can make or break your trading strategy. High fees can eat up your profits, especially if you trade a lot. Exchanges know this. So they set fees to attract traders. Lower fees mean more trades. More trades boost volume.

Look at volume-based exchange fees. They reward you for trading more. Trade a lot and you pay less per trade. This can lead to more trading on the platform, pushing up the volume even more. It’s a circle that benefits both the traders and the exchange.

But here’s the catch. Not all trade volume is real. Some exchanges show big numbers that don’t match reality. They do this to look more popular. So, trust is key. You need crypto market volume data you can rely on. Always check multiple sources before you believe the volume data you see.

This is where I come in. I dig deep into exchange trade volume ranking. I look at crypto exchange volume data over time. This shows us real growth – or lack of it. My aim? To help you see past the fluff to the real numbers.

Remember, more volume usually means a better trading experience. Less slippage, tight spreads, and quick trade times. For the best volume-based trading, always turn to the leading crypto exchanges by volume. They’re like the rock stars of the crypto world. They set the stage for a smooth trading show.

In summary, to trade well, keep an eye on trading activity by platform. Choose pairs with lots of action and mind those fees. And always question the numbers. Your trading success might just depend on it. Now, let’s bring these insights into action and pave the way for smart trading decisions based on solid exchange volume data.

We dove deep into the trading exchange world, from the big players to the fresh faces of decentralized markets. We looked at who’s leading in 24-hour trading volumes and how their liquidity stacks up. We saw how decentralized platforms are making their mark, changing how we trade with liquidity pools. Then, we examined how trade volume metrics affect the crypto market, including price strategies across different exchanges.

Lastly, we explored how you can make smart trades and investments by understanding volume and fees. Keep these insights in your strategy toolbox – they’ll help you navigate the exchange landscape like a pro. Stay sharp and keep learning; the world of crypto trading is always evolving!

Q&A :

How do I compare trading volumes across different cryptocurrency exchanges?

When comparing trading volumes of different crypto exchanges, it is crucial to look at their reported volumes on exchange ranking sites like CoinMarketCap or CoinGecko. Additionally, consider using analytical tools that aggregate trading data from multiple sources to provide a more comprehensive comparison. Always verify if the volumes are reflective of organic trading activity to avoid inflated or manipulated data.

What does trading volume tell me about a crypto exchange?

Trading volume provides insights into the liquidity and activity level of a cryptocurrency exchange. A higher volume indicates more users are actively trading, which often leads to better price discovery and less price slippage. It also suggests the exchange is trusted and has a stable user base. Keep in mind, however, that volume alone doesn’t guarantee the exchange’s security or reliability.

Can I trust the trading volume reported by crypto exchanges?

Skepticism about the accuracy of self-reported trading volumes from crypto exchanges is warranted. Some exchanges have been known to engage in “wash trading” to artificially inflate their volume figures. To get a more accurate picture, look for reports from independent researchers or use analytic platforms that apply volume filtration methods to screen for suspicious activity.

Why is it important to consider trading volume when choosing a cryptocurrency exchange?

Considering trading volume is important when choosing an exchange because it relates directly to market liquidity. High liquidity means easier execution of trades without significantly affecting the asset’s price. It also provides a measure for the robustness of the market on that exchange, potentially leading to a safer trading environment.

What tools can help me analyze the trading volume of crypto exchanges?

Several online tools and platforms can assist in analyzing crypto exchanges’ trading volumes. Resources like CoinMarketCap, CoinGecko, and CryptoCompare provide comprehensive data and charts comparing the volumes of various exchanges. For an in-depth analysis, consider using APIs that pull trading data from multiple exchanges, or blockchain analysis tools that offer volume tracking and verification.