You don’t need to be an insider to understand how the market breathes. Spoiler: it’s all about volume. Wonder why some coins soar while others plummet? The secret is to track crypto exchange trading volume. It’s like being at a party where you can hear which room buzzes with excitement. Now, I’ll show you how to listen in, decode the noise, and make it your biggest ally in the cryptoverse. Strap in – we’re about to unveil the market’s best-kept secrets.

Understanding the Fundamentals of Crypto Trading Volume

The Role of Volume in Crypto Price Movements

Ever wonder how crypto prices move? Volume is key. Think of it as how much a kid trades their cards in the playground. The more trades, the more demand for that shiny Charizard, and up goes its value. That’s how crypto works too. Loads of trading can push prices up. Really little can hold them still or even drop them. It’s like a heartbeat for coins. No beat, no life. Lots of beats, full of life!

Big jumps in volume often come before price changes. Prices can go up or down – it’s a coin toss. You see, when lots of coins change hands, the market gets excited. It’s like everyone suddenly wants that last piece of cake. So traders keep a close eye on volume. It gives a sneak peek at what may come.

Key Concepts in Volume-Driven Market Analysis

Now, let’s dig into the dirt. How do you watch the trading volume? There are tools for that. Using an API to get crypto volume data is like having X-ray glasses. It shows you the secret moves. Ever heard of real-time trade volume tracking? It’s watching the volume live as it happens.

Another thing is the 24-hour trading volume. This tells you how much was traded in a day. Kinda like counting how many times that Charizard was traded at school. This matters because it shows if the coin is hot or not.

Crypto market depth is how deep the trading pool is. If it’s deep, it means there’s a lot to trade. It’s like a big toy box full of different cards. If it’s shallow, your choices are slim.

Monitoring digital currency liquidity is like checking if there’s enough lemonade at the stand. If there is, great! Everyone can buy. If not, you might be out of luck. Liquidity means you can trade easily without big price changes.

Spotting volume spikes is a big deal. It’s like seeing a crowd run to a store – you know something’s up. Spikes can signal a price change. So stay alert!

All this volume chat matters because it can help you guess what the market will do. Will prices zoom up or dip down? Volume hints at the answer. It’s not foolproof, but it’s a good clue.

High volume cryptocurrency exchanges are the popular ones. They’re like busy malls. Lots are happening and that can mean good deals. But don’t ignore the quiet ones – low volume exchanges. Sometimes they have hidden gems, items not everyone has seen yet.

So, remembering all this gives you a good start. You can’t always tell where crypto prices will land. But volume is a great guide. It whispers secrets about what might happen next. And knowing that can be as good as gold – or coins!

Real-Time Analysis: Tracking Volume Fluctuations

Utilizing APIs for Live Crypto Volume Data

To truly grasp what’s going on under the surface of the crypto market, you must watch the trading volume closely. Think of it like tracking the heart rate of the market; changes can tell you so much about what’s happening now and what might come next. To keep an eye on this vital sign, we turn to technology – APIs, to be exact. APIs, or application programming interfaces, let us pull live data directly from exchanges. These data streams give us up-to-the-second insights into how much crypto is moving and where.

So, how does this actually work? APIs communicate with crypto exchanges and fetch us the latest numbers on trading activity. For example, when tracking Bitcoin or Ethereum, we can see how much is being bought and sold at any given moment. By tapping into APIs, we not only get raw numbers but also understand the intensity of trading – a tool crucial for my real-time trade volume tracking.

With these APIs, we can compare volumes across exchanges. We get to see which platforms see the most action (our high volume cryptocurrency exchanges) and which might be quieter. This lets us gauge cryptocurrency market depth and monitor digital currency liquidity – essentially, how easy it is to buy or sell without affecting the price too much.

Recognizing Patterns in Volume Spikes and Dips

Now, not all volume changes are created equal. Some are loud, demanding our attention, while others whisper subtle hints about market shifts. As a volume analyst, I’ve learned to pick up on these cues, and let me tell you, it’s like decoding a secret language. I look for volume spikes and dips, sudden increases or decreases in how much crypto is changing hands.

The big question: what do these changes mean? A sudden spike in trade volume could signal that big news hit the market. Maybe there’s a surge in interest, or perhaps big investors are moving in or out. On the other hand, if trading quiets down, with a sharp drop in volume, it could mean traders are uncertain or waiting for the next big thing to happen before they make their move.

But how exactly can you tell what’s a significant change? You look for the patterns. With volume analysis for crypto traders, we don’t just watch for one-time events. We watch how these spikes and dips form over time. For instance, if altcoin trade volume trends upward over several days, that could point to growing interest in alternative crypto investments.

When we see these patterns, it’s like we’re putting together pieces of a puzzle. As each piece falls into place, the market’s picture becomes clearer. By tracking these fluctuations in volume, and assessing exchange transaction activity, we get to understand how traders are feeling – bullish, bearish, or somewhere in between.

In the world of crypto, volume speaks volumes. It whispers the market’s secrets, tells tales of trader sentiment, and, if you listen closely, it can guide you through the chaos of price swings and trends. Now, as we dive deeper into the specifics, remember: executing successful volume-based trading strategies or navigating the crypto exchange volume leaderboard isn’t just about seeing the numbers. It’s about understanding the rhythms of the market and, more importantly, what they’re trying to tell us.

Comparing and Contrasting Crypto Exchange Volumes

High Volume vs. Low Volume Crypto Exchanges

Picture two markets. One bustles, brims with buyers and sellers—it’s loud, it’s lively. This is a high-volume exchange; lots of trades happen here. Now imagine a quiet street fair. Only a few folks browse the stalls. This is like a low-volume exchange. Fewer trades, less action.

In crypto, high volume means more liquidity. More liquidity lets you buy or sell without shifting the price too much. On the flip side, low volume can be risky. Prices can swing fast here. You might buy or sell at a price far from what you expected.

Now, why do high volumes matter? They show trust. More traders pick these exchanges, feeling safer with their money and trades. This doesn’t mean low volume spots are no good. Some might offer unique coins not found elsewhere. But remember, they come with higher risks.

Understanding these differences, you get why traders favor high-volume places. If you need to make big trades, you’ll want the high volume. It makes sure your trades don’t mess up the market price.

Let’s break it down even more. Say you’ve got a coin in a low-volume exchange. You want to sell. There might not be enough people wanting to buy. So you could end up waiting or dropping your price—a lot. High volume exchanges work fast. You sell; someone buys, easy.

Measuring the loudness, if you will, of these market places is key. It tells you where the party’s at: where the action unfolds each day. When you track where the money flows, you see the market’s true colors.

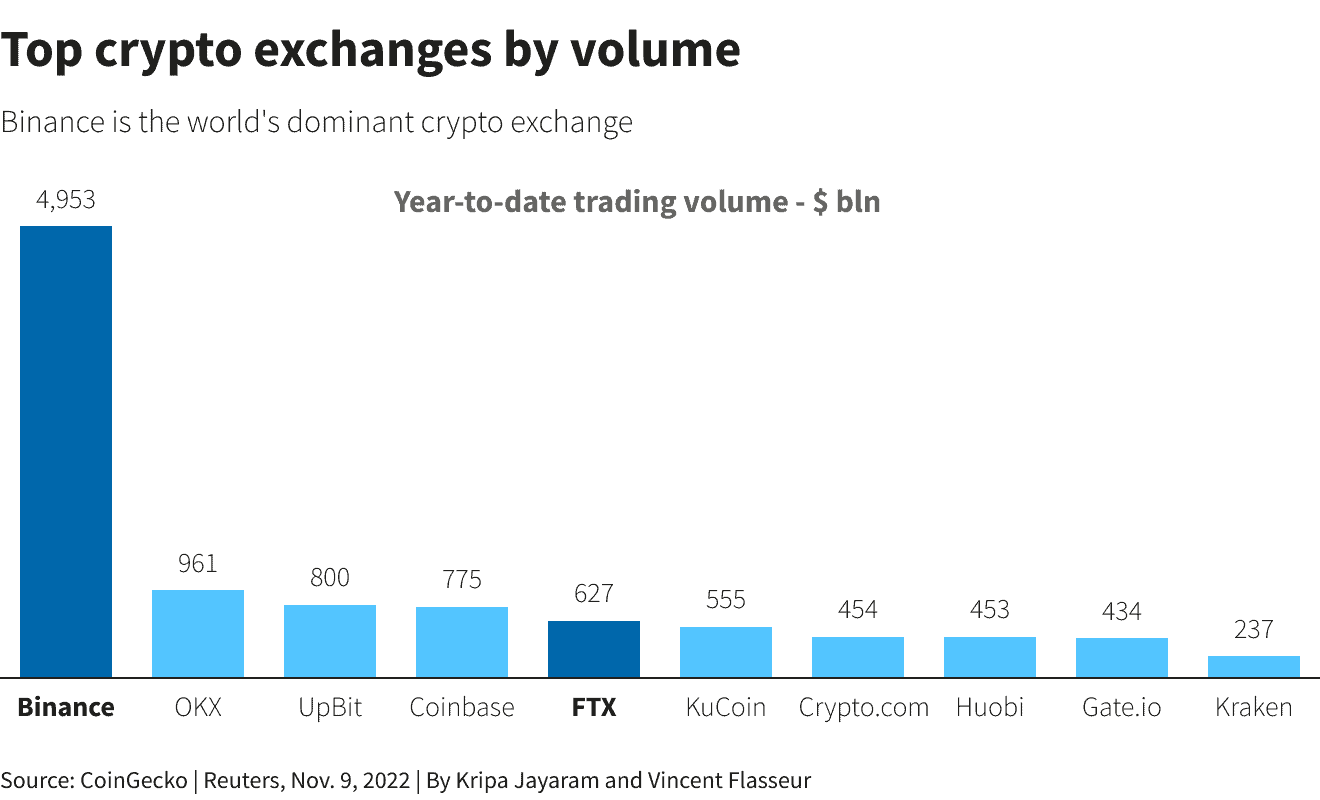

Identifying Market Leaders with Exchange Volume Leaderboards

Leaderboards are crucial. They’re like scoreboards that show who’s winning in volume. They list exchanges from most busy to least. They help see where the action is, day by day.

The top dogs, you’ll see, hold most of the trade. They draw in buyers and sellers non-stop. They’re the go-tos for active traders who want that instant buy or sell.

Lower on the list, you find niche places. They’re for those looking for something special. They have their use but don’t pulse with the same speed or security.

Now let’s get real. Why does this all count? When you spot which exchanges lead, you’re tapping into the market mood. High ranks hint at confidence. Drops in spots could warn you of trouble. This insight shapes your trade moves.

Leaderboards use real-time data. They change, they shift as the market breathes in and out. Keep an eye on them, and you’re keeping a finger on the market’s pulse.

So, diving into these volumes and ranks, you’re not just seeing which places buzz. You’re figuring out the market’s beat. You learn when to jump in and when to lay low. And that, my friends, is gold in the crypto world.

Leveraging Volume Data for Informed Trading

Developing Volume-Based Trading Strategies

Let’s dive right in. A smart trader knows numbers talk. Look at crypto trading volume closely, and you’ll hear its secrets. This number shows how much of a crypto traded in one day. Check it out right away. Trust me, it’s essential.

Ever seen when prices leap or drop? Volume’s often the whistle-blower. Here’s the deal. I check volume spikes for hints. A big sell-off might happen. Or maybe buyers storm in. You need to act fast. Big volume means big news. I’m telling you, it leads you to make informed trades.

It’s a no-brainer; high volume means lots of activity. You know others are trading like crazy. Maybe you should too? But do it wise. Use real-time trade volume tracking. This way, you keep up with the pros. You know straight up what’s hot and what’s not.

My advice? Use an API for crypto volume data. They’re like your eyes on the markets, 24/7. Computers do the heavy lifting, right? They sort through the sea of numbers. Then they hand you the treasures. Crystal clear, real-time data. Gets you ahead of others.

Getting it? Good. Let’s kick it up a notch. Why do solid trades often follow volume jumps? Big players move in. They bring cash, lots of it. Market moves, you see it. You can ride the waves they make. Want to play it smart? Learn from the volume. It whispers where the money flows.

Translating Volume Signals into Market Sentiment Analysis

Next up. Feel the markets, don’t just see them. Volume can be a mood ring for crypto. See, high trading volume doesn’t always mean a happy market. Watch out, it might signal trouble sometimes. Low volume? Could mean people are waiting. Maybe plotting their next move.

Get this – volume talks two ways. It doesn’t just show how many coins traded. It shows belief or fear. How? Well, when lots of people buy, demand pops. Price likely goes up. It says, folks are confident. On the flip side, a big sell-off? It could be panic or doubt.

Monitoring crypto market depth is like having X-ray vision. It lets you peek behind the curtain. See who’s really calling the shots. Big orders, small trades, all matter. Hold on to the best insights. They guide you, like a map. They point where the cash could go next.

And when it comes to crypto? Liquidity is the name of the game. Liquidity means you can buy or sell without much price change. More liquidity, smoother trading. I look for liquidity indicators for crypto assets. They tell me when a coin’s easy to trade. Issues selling? Big problem.

So, we size up the exchange too. A volume-based trading strategy looks for strong markets. I want somewhere busy. Like a high volume cryptocurrency exchange. They’re the powerhouses. Often more reliable. Less slippage, fair prices.

Wrap your head around trading volume signals. They’re your guide in this wild crypto jungle. They help us sense market sentiment. Like a pro. Got the signals? Then, you nail the trade timing. It’s critical.

Cracking the code of volume data isn’t wizardry. It’s your edge. Decode it right, and you could be on your way to smarter, sharper trading.

We’ve dived deep into crypto trading volume and its key role in the market. From grasping how volume moves prices to using live data for sharp analysis, we’ve covered it all. We also compared exchange volumes and explored how to leverage this info for smarter trading.

Now, armed with these insights, you’re set to navigate the crypto market’s waves like a pro. Remember, high-volume exchanges often lead the pack, and volume spikes can signal big moves. Keep these tips in mind, and you may find yourself making trades with newfound confidence. Let’s use this knowledge to trade smarter, not harder. Happy trading!

Q&A :

How do I track trading volume on crypto exchanges?

Tracking trading volume on crypto exchanges can be done by visiting the exchange’s market data section, using financial news websites, or employing a cryptocurrency market tracking application. These platforms often provide real-time data for each cryptocurrency, including its trading volume over different time frames.

What is the importance of trading volume in cryptocurrency exchanges?

Trading volume in cryptocurrency exchanges is crucial because it indicates the liquidity and interest levels for a specific coin or token. High trading volumes often reflect a healthy market with active traders, while low volumes might suggest decreased interest or potential price manipulation. Traders analyze trading volume to make informed decisions on when to enter or exit positions.

Can you compare trading volumes across different crypto exchanges?

Yes, you can compare trading volumes across different crypto exchanges by utilizing aggregator websites or market analysis tools that compile data from various sources. These platforms often rank exchanges by volume and allow users to see how much each exchange contributes to the trading volume of a particular crypto asset.

What are the best tools for monitoring crypto exchange trading volume?

Some of the best tools for monitoring crypto exchange trading volume include CoinMarketCap, CoinGecko, and CryptoCompare. These platforms offer comprehensive data on trading volumes, prices, market cap, and exchange rankings, updated in real-time.

Does high trading volume on a crypto exchange mean more reliability?

High trading volume on a crypto exchange does not necessarily mean more reliability, but it does suggest a higher level of trader engagement and liquidity. However, traders should also consider other factors, such as the exchange’s security features, user reviews, and regulatory compliance, when evaluating its reliability.